The best Trump trades now

All three major indices did great in the risk-on continuation – two opening selling attempts didn‘t reach far enough as the money on the sidelines overpowered those waiting for the sizable gap being closed. But that‘s not how it works when a major macro shift occurs, and the rising odds of a sweep is such a cherry on top.

The only major risk for today remains the FOMC (conference delivery), and I wrote already Sunday that:

(…) rates are rising while a rate cut is being expected. The current odds of 1% that there is no cut, is wildly underappreciated, inaccurate – that‘s what the bond market is telling us, regardless of the steepening and term premium rising. At the same time, I don‘t think the Fed would like to risk disappointing the market demands.

Diving into the many (altogether six and a snapshot from our channel) charts presented, I‘ll start with the risk-on strength positioning view, status of the dollar, and why I didn‘t expect a great S&P 500 surge after yesterday‘s closing bell (judging from intraday traders‘ point of view in our channel).

S&P 500 and Nasdaq

The volume and overlaid price chart with sectoral comparisons tells the full story – major downside surprises are unlikely, and dips are to be bought. XLRE, XLP and XLU declining together with select XLV stocks (see how my bearish pick LLY presented Monday, fell? These intraday reversals, such closings of bullish gaps, were the most telling features, together with Russell 2000 keeping its mojo and doing great). That‘s where your outperformance and underperformance is in equities.

Gold, Silver and Miners

This is a chart with bearish momentum that must be respected as the dollar‘s ascent isn‘t merely a function of yields, but of geopolitics as well. Yesterday, we have seen strong day two in the red out of the path all the way to the top and then down, as called for clients.

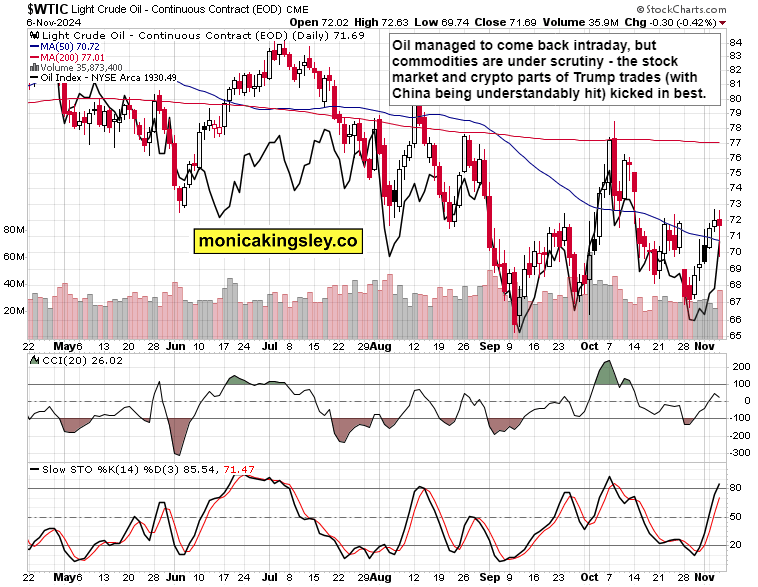

Crude Oil

Neither oil nor copper have recovered much, and it doesn‘t look to be getting fast on the table really. As money will flow into the US, it‘ll be (growth and select other) equities, crypto and the dollar that will steal the spotlight.

It‘s a very valid question – why cut if there is no recession ahead, but the expectations pressure on the Fed is high today.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.