The benefit of habits

S2N spotlight

As I am one of those guys for whom gamification works, I thought I would share some Stoic philosophy that I subscribe to and try and apply to my life.

The Stoics believed that who we become is shaped by the habits we practise every day. They didn’t see self-control or wisdom as one-off decisions but as the result of training yourself to think clearly and act steadily. Good habits, repeated daily, make it easier to stay level-headed when life gets messy.

This way of thinking is especially useful in trading and investing. Markets move up and down in ways no one can fully predict, and those swings can easily push people into acting on fear or greed. I know I am speaking from personal experience. By building habits like sticking to a trading plan, managing risk carefully, or reviewing trades consistently, you create a buffer against emotional decisions. Epictetus taught that we should focus only on what we can control—and in markets, we can’t control the outcome of any single trade, but we can control how we prepare and how we respond.

I want to extend this to my newsletter writing as well. I take it really seriously to stick to a routine. It is very tempting to say nobody cares if you miss a letter or your streak of consecutive weeks of writing ends. But they are mistaken because I care. Nobody gains more from writing these letters more than I do, so why would I sacrifice that growth?

It is wonderful for my wife and me to be spending quality time with our son overseas. When your children leave home and start to build their own lives far away from yours, there is a tremendous amount of sadness but also joy as you witness their independence and resilience. A parent’s job is never done, but it changes, and I am slowly learning to accept my new role.

S2N observations

I am only looking at the markets from afar and detaching myself from my daily avalanche of news reports and articles, which I am finding healthy and refreshing. I am spending a lot of time on the AI front and developing my thoughts by talking to different people in the industry and in the general economy and understanding how they see AI impacting their companies.

The one observation that keeps coming up is that job losses are happening at the margin at the moment but are likely to gain momentum into a landslide in the near future. It is obvious to me that the markets are completely ignoring this and believe that with the newfound productivity, new high-paying jobs will emerge. I am less sanguine.

It doesn’t take a genius to observe that we are living through a period of populism that has already spilt over into violent protesting with anarchy knocking on the door. We have “strong men” leaders dictators flexing, with far-reaching geopolitical tensions bubbling up all over the globe.

Despite the above, the markets only want to go up. As an active student of crowd psychology for decades, this highlights how society under an archetypal spell will suspend reality to live out the collective energy of the crowd. This is where we are forced to accept that while reality always will play out in the end as it should, it also has a remarkable ability to “bend the truth” for frustratingly long periods of time.

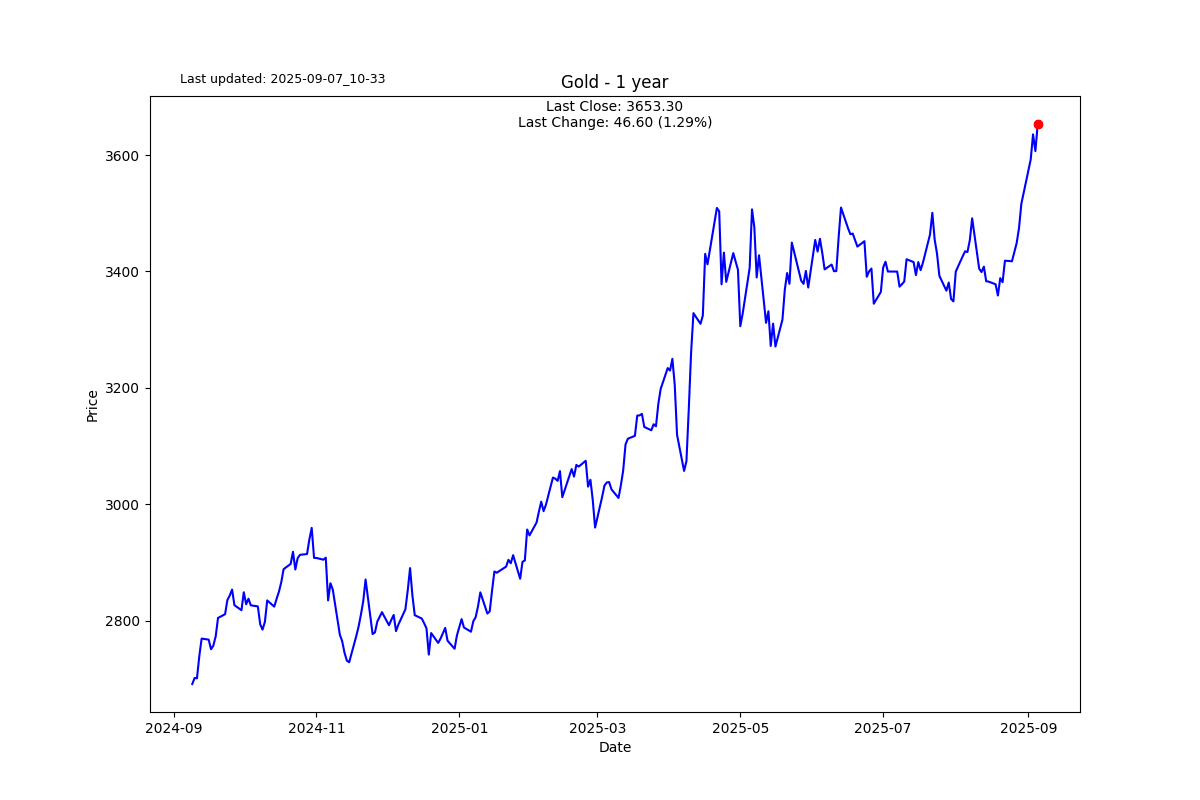

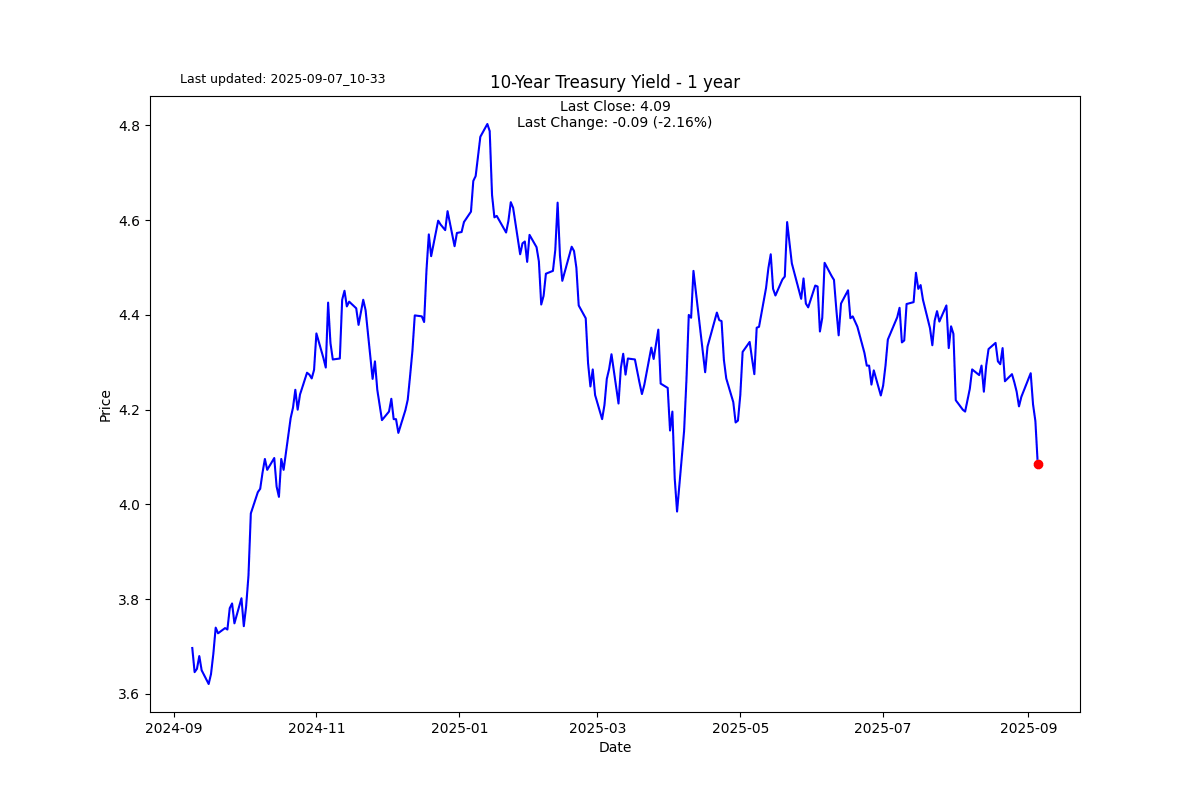

The above chart helps put 2025 and the performance of some of the main asset classes into context. I always like looking at performance through a time dimension; a two-dimensional table misses the nuance of the journey through time. I call these charts on my site Price Journey’s.

S2N screener alert

The Brazilian Bovespa Index made a new ATH.

The Mexican stock market joined the fun as well.

The Singapore Straits Times Index also

Gold made a new ATH.

Interestingly, wheat futures made a new ATL. I have no knowledge why; I haven’t followed the news around wheat.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.

-638928711083342172.jpg&w=1536&q=95)

-638928711167164606.png&w=1536&q=95)

-638928711284214989.png&w=1536&q=95)

-638928711410450455.png&w=1536&q=95)

-638928711526920268.png&w=1536&q=95)

-638928711638392183.png&w=1536&q=95)

-638928713168432276.png&w=1536&q=95)