The Australian Dollar rapidly depreciates

The AUD/USD pair has fallen rapidly in the final week, reaching 0.6592. This decline is primarily driven by the US dollar's robust performance, following stronger-than-expected US economic data. Investors now speculate that the Federal Reserve may postpone any interest rate cuts.

The minutes from the Fed's recent meeting have revealed concerns among policymakers about the possibility of high and persistent inflation. This has led some monetary committee members to express a readiness to tighten policy further if inflation continues to rise.

Similarly, the minutes from the Reserve Bank of Australia's (RBA) recent meeting revealed doubts among local policymakers. Although the RBA considered raising interest rates in May, it ultimately decided to maintain the current policy stance. Meanwhile, domestic statistics showed that inflation expectations in Australia fell to 4.1% in May, the lowest level since October 2021.

Technical analysis of AUD/USD

On the H4 chart of AUD/USD, a decline to 0.6663 was followed by a correction to 0.6780. Subsequently, a new wave of decline to 0.6580 has formed, serving as the local target. Upon reaching this target, a correction to 0.6630 (testing from below) is possible, followed by another decline to 0.6548. This target represents the initial objective of the downward trend wave. Technically, this scenario is confirmed by the MACD indicator, with its signal line above zero and pointing strictly downwards.

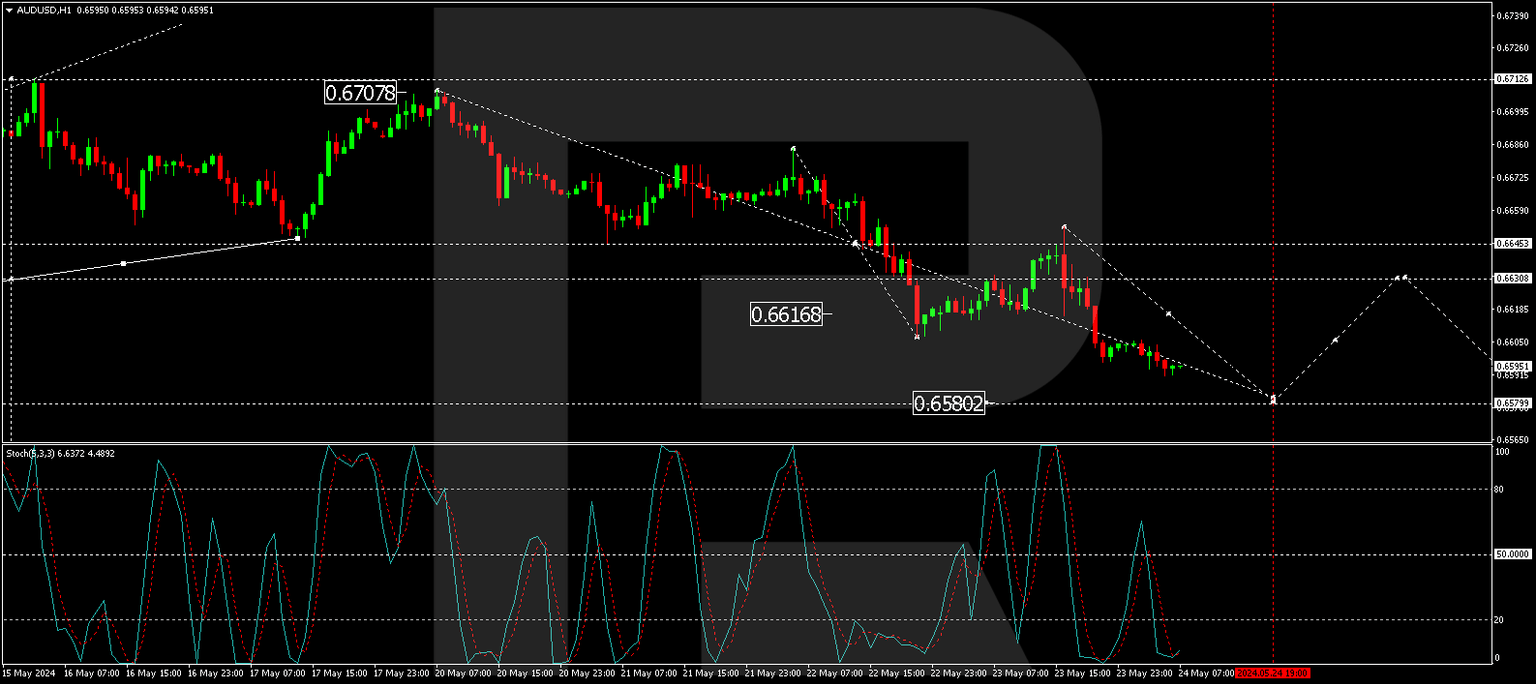

On the H1 chart, a consolidation range has formed around 0.6645. The downward exit from this range achieved the local target of 0.6607. The market has since corrected to 0.6646 (testing from below). Today, the decline wave to 0.6580 continues. After reaching this level, a consolidation range is expected to form around it. An upward exit from this range could lead to a correction to 0.6630. Conversely, a downward exit would open the potential for a further decline to 0.6540. This scenario is technically confirmed by the Stochastic oscillator, with its signal line below 20, indicating a potential beginning of a growth link to 50.

Summary

The Australian dollar's depreciation is largely influenced by the strong US dollar and the cautious outlook of the Federal Reserve and the Reserve Bank of Australia. Technical indicators suggest further potential declines with possible corrective rebounds. Market participants should closely monitor these levels as economic conditions and policy expectations evolve.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.