The Aussie Tanks on Weak Employment Report | AUD/USD

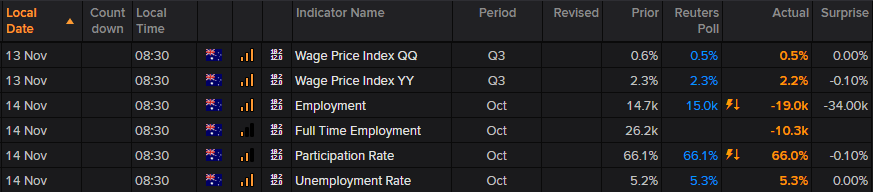

- Unemployment rose back to 5.3% (after a 1-month hiatus at 5.2%)

- Headline employment contracted by -19k (+15k expected) – its first contraction since September 2016

- Full-time employment fell -10.3k (+26.2k prior)

- Participation rate at a 4-month low of 66% (record high of 66.2% reached in August)

Another day, another bout of volatility in Asia sparked by incoming data and expectations diverging. Whilst unemployment was forecast at 5.3% - it’s a step in the wrong direction where RBA policy is concerned. Yet to see employment for the first time in over 3 years, full-time employment contract and the participation rate fall further from its record highs took its toll on the Aussie which has broken key levels across the board.

As it stands, RBA expect unemployment to sit around 5.25% through to 2021 before it falls to 5%. Yet if the inverted correlation with capacity utilisation is to hold true we could still see unemployment fall over the coming months. As always, the correlation is imperfect, but the basic trend is apparent; a rising capacity utilisation (falling on the chart) leads to lower unemployment, and visa-versa.

Still, after today’s data set, expectations for a rate cut are on the rise again, with April to May next year suggesting around a 60% chance. A cut in December is just 25%. We’ll have to wait until December 19th to see if this month’s data set is merely a blip, but for now the Aussie remains under pressure and could face further headwinds if trade talk optimism continues to fade.

AUD/USD: The bearish channel and 200-day eMA capped as resistance ahead of its recent pullback, although today’s weak employment data saw prices break the corrective channel and now testing support just above 0.8600. Given its established downtrend and momentum has now realigned with it, the bias is for it to push to new lows.

- Bearing in mind that prices are now resting on support having reached 95% of its ATR, then it plausible to expect a pause or mild rebound from current levels at the very least.

- Daily trend remains bearish beneath the 0.6930 highs, although bears can fade into minor rallies beneath 0.6850 (momentum doesn’t favour a rebound that high though).

- A clear break of 0.6800 brings 0.6750 and 0.6723 low into focus.

AUD/NZD: Given RBNZ may well keep rates at 1% over the foreseeable future (and above RBA’s 0.75%) then AUD/NZD could extend its downside. Today’s weak employment print and rising expectations for RBA to cut only adds to the diverging theme whilst prices remain elevated.

- A cluster of support around 1.0620 continues to hold (200-day eMA, 38.2% Fibonacci retracement and structural levels) so we could see a minor rebound before losses resume.

- A break below 1.0600/20 signals bearish resumption and brings the 1.0450 / 1.5000 zone into focus.

Author

Matt Simpson, CFTe, MSTA

CityIndex

Matt Simpson is a certified technical analyst who combines charts and fundamentals to generate trading themes.