Technical analysis: Gold consolidates as merged MAs curb advances

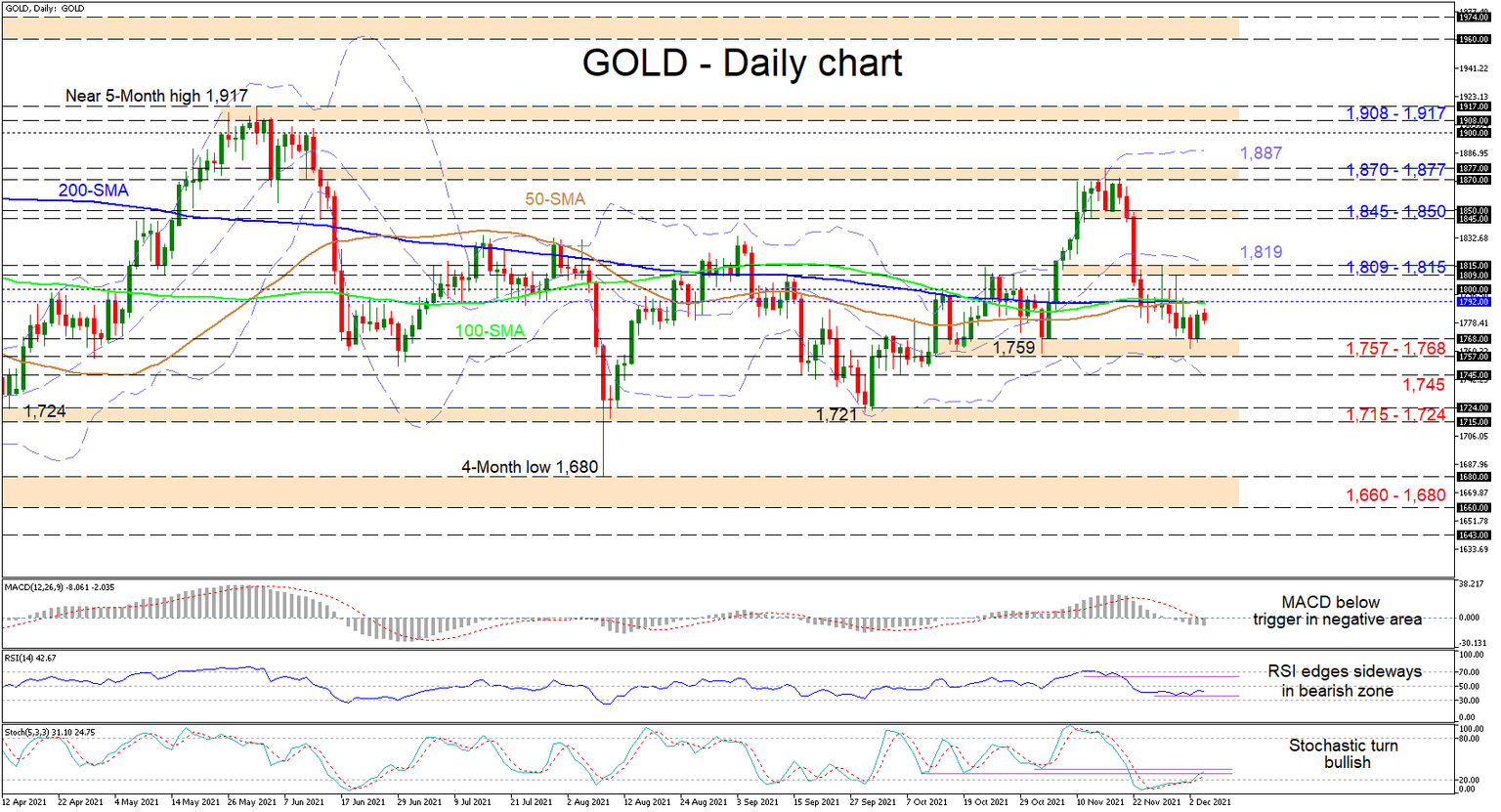

Gold is currently edging sideways not too far below the 1,800 mark after managing to find its feet around the 1,757-1,768 support base, following the latest plunge in the commodity from the 1,877 high. The flattened simple moving averages (SMAs) have joined together and are sponsoring a clear price trend.

The short-term oscillators are suggesting mixed messages in directional momentum. The MACD is slightly underneath the zero level and below its red trigger line, while the positively charged stochastic oscillator is promoting positive price action in the commodity. The RSI is aiming a tad lower in the bearish territory, indicating that the commodity’s scale may be tilting slightly negative.

In the negative scenario, limitations could originate from the key 1,757-1,768 support zone. Breaching this barrier, sellers may aim for the lower Bollinger band, currently lying at the 1,745 low before seeking out the 1,715-1,724 critical foundation. If selling interest endures, the price could then dive for the 1,660-1,680 boundary that has managed to hold as an upside defence, which took shape over the April until June 2020 period.

If upside forces increase, initial tough resistance could transpire from the converged SMAs at 1,792 and the 1,800 handle overhead. The neighbouring resistance band of 1,809-1,815 and the mid-Bollinger band at 1,819 could hinder further developments in the price towards the 1,845-1,850 obstacle. From here, should upside impetus surpass the 1,870-1,877 border and upper Bollinger band at 1,887, the bulls may seek out the 1,900 hurdles and the zone of the near 5-month high of 1,917.

Summarizing, gold is currently stuck in a horizontal trajectory between the 1,757-1,768 lower limit and the 1,792-1,800 upper limit. That said, surpassing the mid-Bollinger band at 1,819 could bolster bullish forces, while a dip below the lower Bollinger band at 1,745 could feed negative pressures.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.