Technical analysis – EUR/USD’s positive traction disappoints, negative bias holds

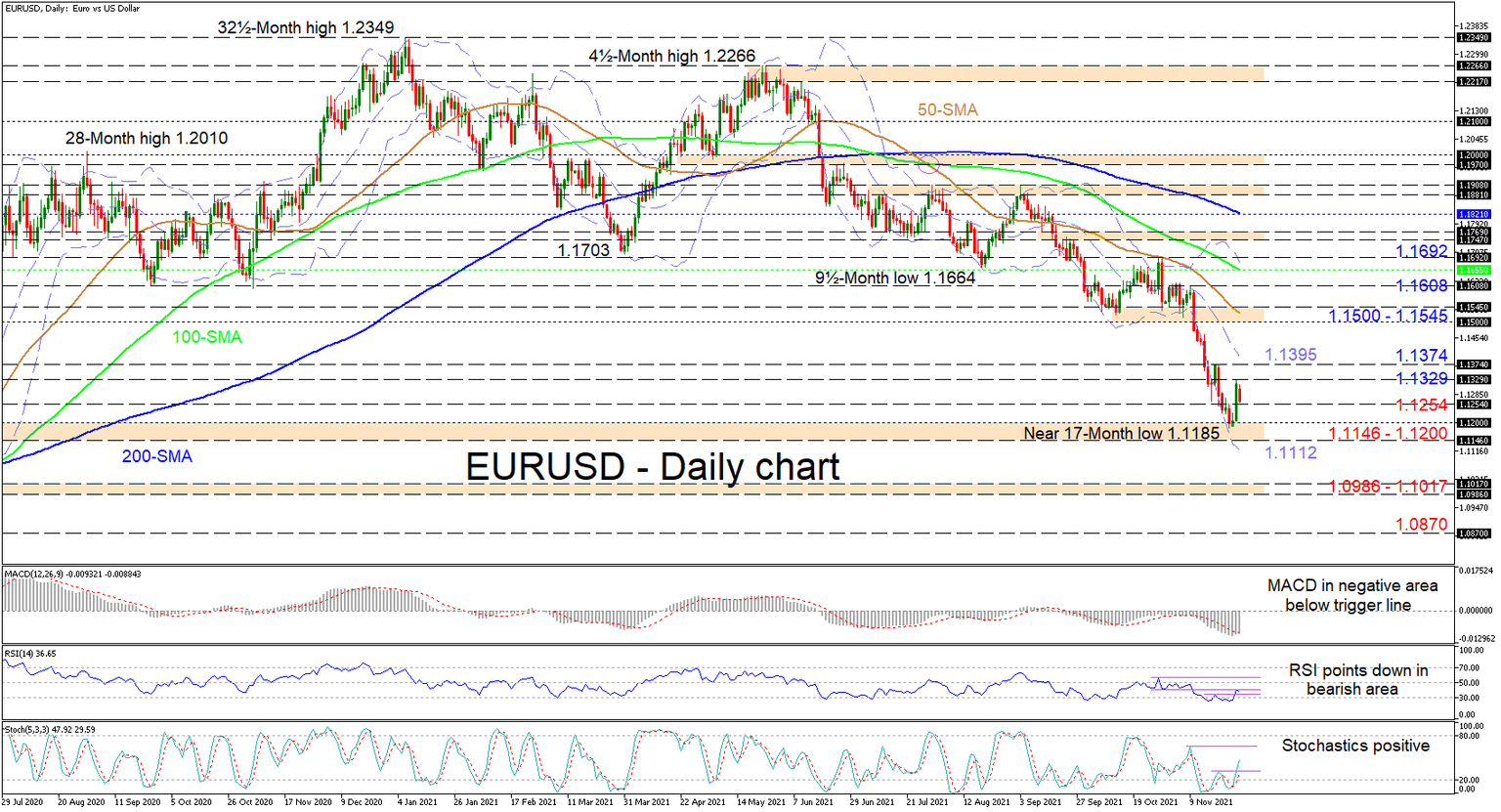

EURUSD’s negative bearing prevails despite the bounce off the near 17-month low of 1.1185. The falling simple moving averages (SMAs) are endorsing the bearish outlook in the pair.

The short-term oscillators are transmitting mixed signals in directional momentum. The MACD is far beneath the zero mark and is holding below its red trigger line. The RSI is dipping in bearish territory signalling that positive impetus is feeble, whereas the rising stochastic lines continue to sponsor gains in the pair.

If sellers manage to stay in control, initial support could emanate from the 1.1254 level ahead of the 1.1146-1.1200 support boundary. Resuscitating the descent, sellers may snag at the 1.0986-1.1017 border, linked to the inside swing highs over the mid-April until mid-May period of 2020. Sinking beneath the 1.1000 vicinity, traders’ attention could then turn to the 1.0870 trough, achieved in the later part of May 2020.

If buyers re-emerge, preliminary resistance could transpire from the 1.1329 and 1.1374 nearby highs, where the mid-Bollinger band is converging. Climbing higher, the critical 1.1500-1.1545 resistance border coupled with the 50-day SMA, may impede additional gains from materialising. However, should buyers conquer this barrier, they could jump towards the 1.1608 neighbouring high before challenging a fortified region of resistance, existing between the 100-day SMA and the 1.1692 mark.

Summarizing, EURUSD is struggling to recoup previously lost ground. The pair is sustaining a bearish bias below the SMAs and the 1.1500-1.1545 obstacle.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.