Strategy Recommendation, sell HE put spreads.

*There is a substantial risk of loss in trading futures and options.

* Past performance is not indicative of future results

On the radar:

Hog prices are low and Chinese demand could start to pick up. We like selling put spreads.

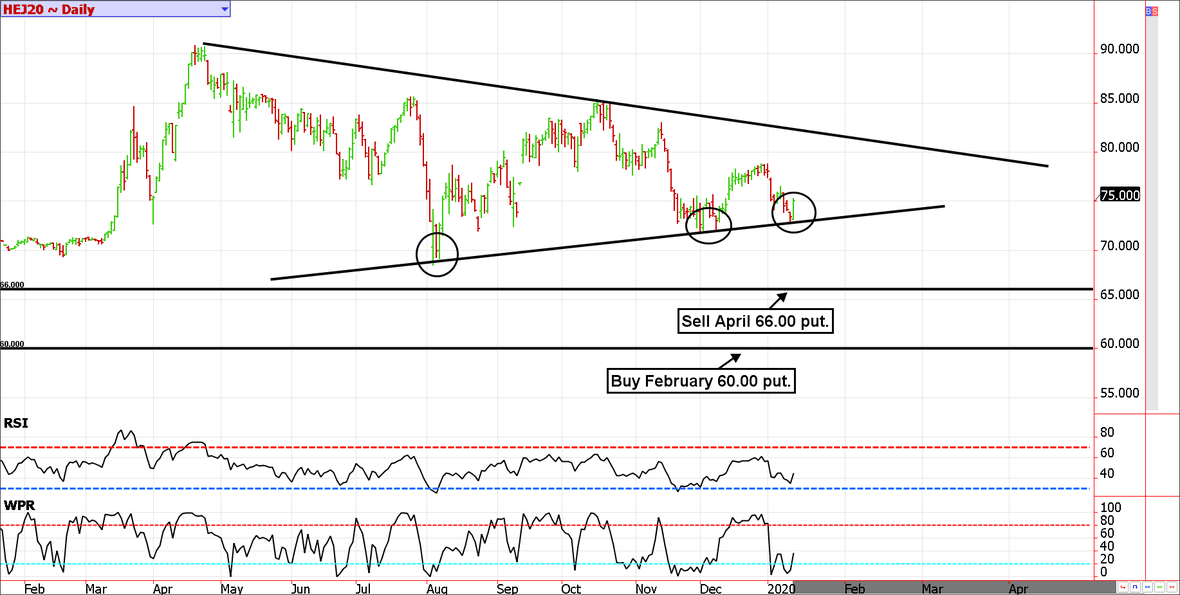

SELL DIAGONAL PUT SPREADS IN LEAN HOGS.

The seasonal low in hogs is due in the coming weeks and with the US/China trade deal set to be signed today, we could start seeing Chinese demand for US pork normalize. Even if it doesn't the US market has probably priced in a near worst-case demand scenario. Thus, we like playing the upside in a well-hedged manner using diagonal put spreads.

Specifically, selling the April lean hog 66.00 put and buying the February 60.00 put creates a strategy that stands to profit whether hogs trade higher, lower or sideways but will lose it prices decline dramatically. The spread can be sold for roughly $700 before considering transaction costs and comes with a margin requirement of just $495.

The risk and reward calculations are complicated by the fact that this trade involves options with two expiration dates. The short April 66.00 put expires in about 60 days while the protective long February 60.00 put expires in about 30 days. If both options were held to expiration, the max profit would be in the ballpark of $700 but that would require holding a naked short put for 60 days beyond the expiration of the February options. This isn't something we would recommend. However, if everything goes as planned we suspect we can buy the spread back in the coming weeks at a much lower price than the spread is being sold today. Our initial profit target for the spread will be $400. On the flip side, due to the difference in futures pricing the intrinsic risk on this spread is less than the 6.00 points between strike prices. In fact, because the April future is about 8.00 higher than February, there really isn't any intrinsic risk but we estimate that if things go wrong the risk could climb into the several hundred to one thousand dollar range.

Margin: $495

Delta: 0.11

Zaner360 symbols: OHEJ20 P66 and OHEG20 P60

*There is unlimited risk in naked option selling and futures!

Due to time constraints and our fiduciary duty to put clients first, the charts provided in this newsletter may not reflect the current session data.

Seasonality is already factored into current prices, any references to such does not indicate future market action.

There is a substantial risk of loss in trading futures and options.

** These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 or more years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in similar directional manner during a certain calendar year. While seasonal trends may potentially impact supply and demand in certain commodities, seasonal aspects of supply and demand have been factored into futures & options market pricing. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.

Author

Carley Garner

DeCarley Trading

Carley Garner is an experienced commodity broker with DeCarley Trading, a division of Zaner, in Las Vegas, Nevada. She is also the author of multiple books including, “Higher Probability Commodity Trading” and “A Trader's First Book on Commodities”.