Stocks will open lower, but bulls may regain the ground

Stocks remained above their previous low on Friday, and today they are expected to open much lower. Will the downtrend continue?

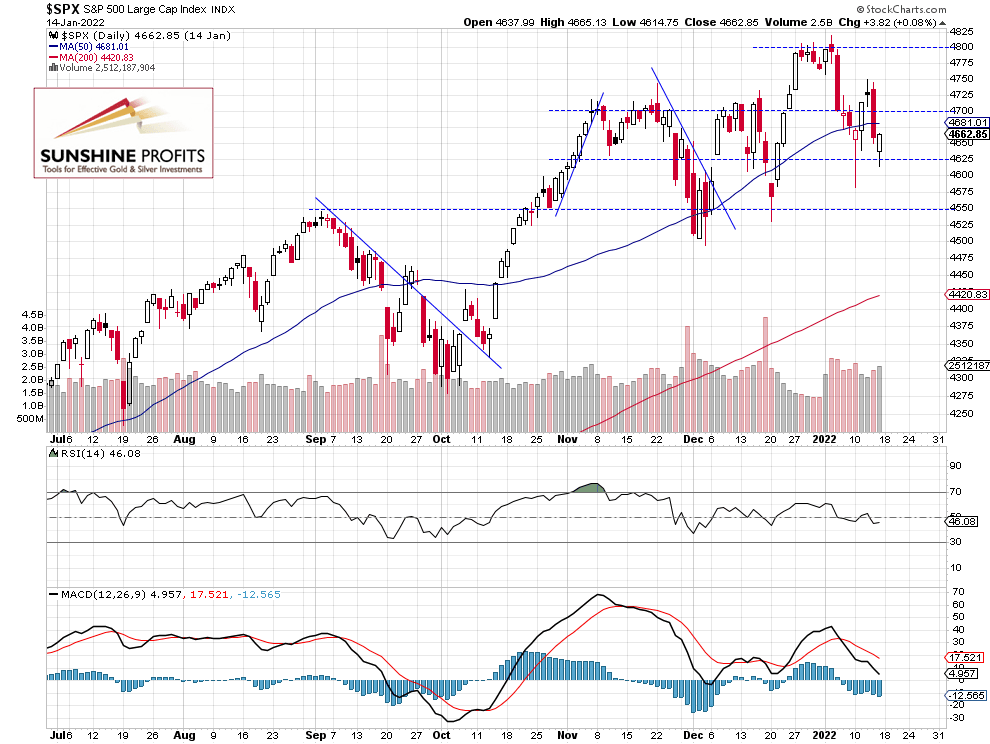

The S&P 500 index gained 0.08% and it closed at 4,662.85 on Friday after bouncing from the daily low of 4,614.75. The broad stock market’s gauge remained above its Jan. 10 local low of 4,582.24. It continues to trade within an over two-month long consolidation. Late December – early January consolidation along the 4,800 level was a topping pattern and the index fell to its previous trading range. This morning the market is expected to open 0.9% lower so we may see an attempt at breaking below the 4,600 level.

The nearest important resistance level is at around 4,680-4,700. On the other hand, the support level is at 4,580-4,600, marked by the recent local low. The S&P 500 is still trading within a medium-term consolidation, as we can see on the daily chart:

Nasdaq 100 bounced from 16,000 resistance level

The technology Nasdaq 100 index remains relatively weaker than the broad stock market. On Jan. 10 it fell to the local low of 15,165.53. The Nasdaq 100 was almost 1600 points or 9.5% below the Nov. 22 record high of 16,764.85. Last week it bounced from the 16,000 level and it went closer to the local low again. It still trades along the September’s local high, as we can see on the daily chart:

Apple extends its consolidation

Recently, Apple stock broke below its two-month long upward trend line after reaching the new record high of $182.94. So far, it looks like a downward correction and the nearest important support level is at $165-170, marked by the previous highs and lows. The stock trades within an over month-long consolidation of around $170-180.

Is this a medium-term topping pattern? It’s getting very hard to fundamentally justify the Apple’s current market capitalization of around $3 trillion.

Conclusion

The S&P 500 index is expected to open 0.9% lower this morning following global stock markets’ weakness amid Russia-Ukraine tensions and worse-than-expected economic data releases. So the market will get close to the recent local lows and the support level of around 4,580-4,600 again. There have been no confirmed short-term positive signals so far. However, we may see another intraday rebound later in the day. The quarterly earnings releases remain a bullish factor for stocks.

Here’s the breakdown:

-

The S&P 500 will likely get back to the 4,600 level this morning; later we may see another intraday rebound.

-

In our opinion no positions are currently justified from the risk/reward point of view.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.