S&P 500 maintains its upward momentum

Fundamental Analysis

Traders are unsure about the market direction. The increase in COVID-19 cases and more restrictive measures are creating more uncertainty about the global economic growth. There are hopes that after Joe Biden’s inauguration ceremony, we will see more fiscal help from the U.S. lawmakers which will help the US economic growth to shift into a better gear.

Technical Analysis

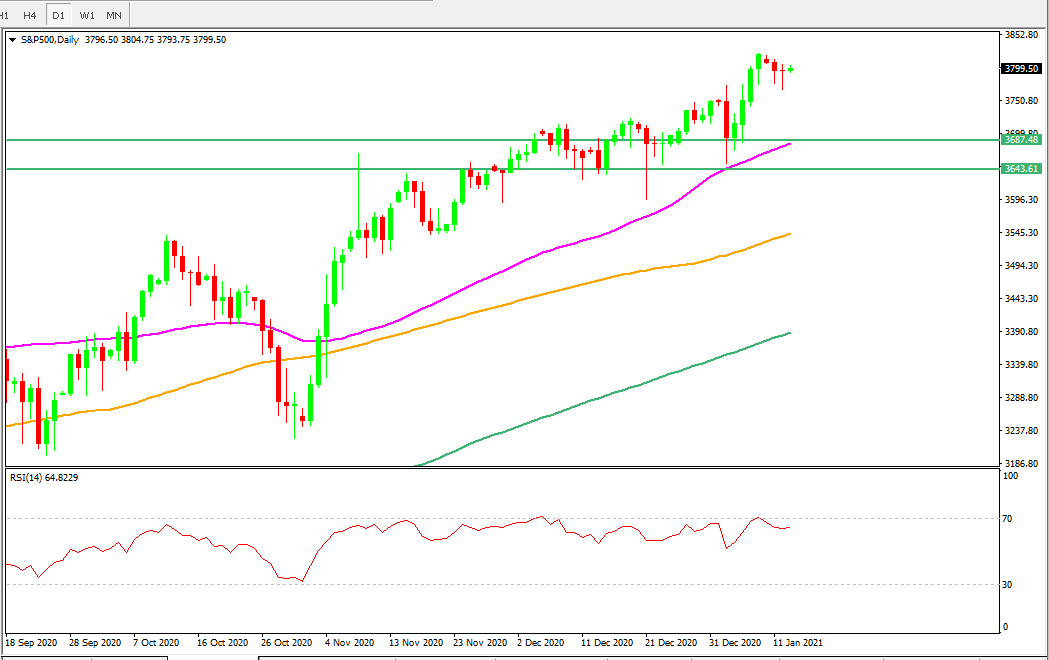

From a technical analysis perspective, the S&P 500’s price is trying to break its three consecutive days of losses. The S&P 500’s price is still trading above the50-day SMA on the daily time frame. As long as the index continues to trade above the 50, 100 and 200-day SMA on the daily time frame, which it is, bulls have little to no reason to lose their hope. However, traders may want to take some caution with any new upside trade as the RSI is trading near the overbought part, a reading near or above 70 represents overbought and any number which is near or below 30 shows oversold.

The near term support is 3693 while the resistance is at 3900.

Author

Naeem Aslam

Zaye Capital Markets

Based in London, Naeem Aslam is the co-founder of CompareBroker.io and is well-known on financial TV with regular contributions on Bloomberg, CNBC, BBC, Fox Business, France24, Sky News, Al Jazeera and many other tier-one media across the globe.