S&P 500: First resistance at 4100/4110

Emini SP 500, Nasdaq, Emini Dow Jones

Emini S&P JUNE we wrote: negative bearish engulfing candle was a warning to bulls – coupled with a diverging stochastic, this could signal an over due correction to the downside.

Nice call yesterday as we broke first support at 4120/10 to target 4083/80 & 4050/40. We bottomed exactly here.

Nasdaq JUNE we wrote: now holding 13350/380 perfectly on the bounce to target 12970/930.

A perfect call. These levels were the high & low for the day offering an easy 400 ticks profit.

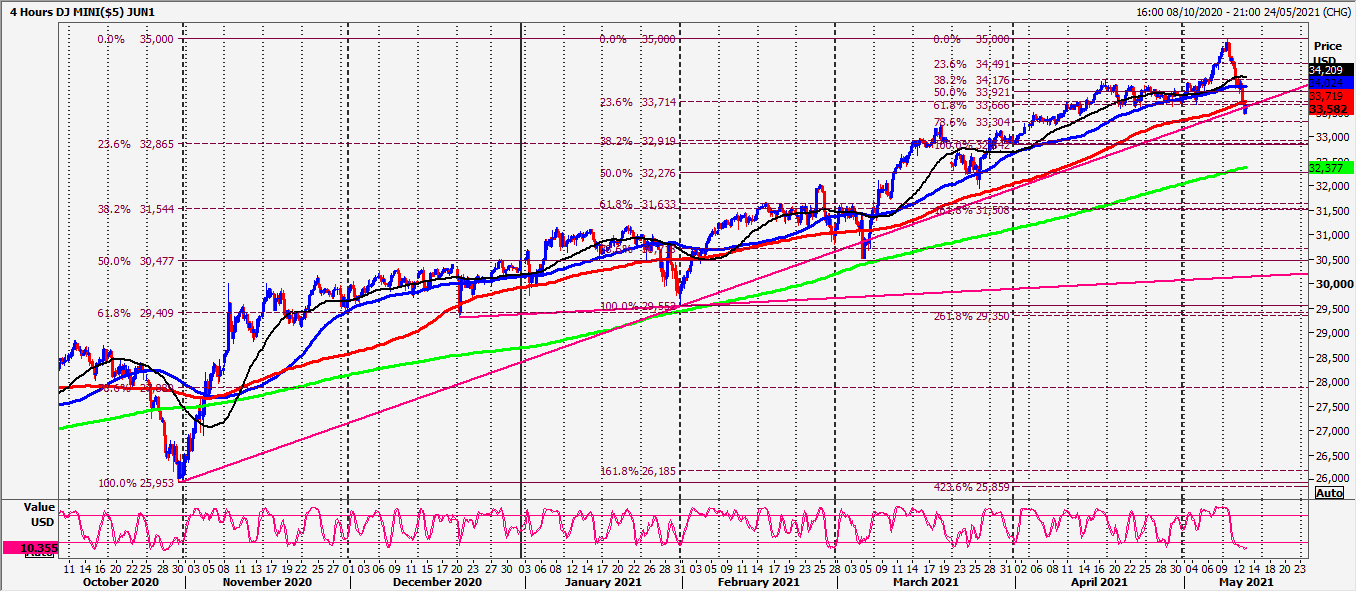

Emini Dow Jones unexpectedly broke very strong support at 33730/660.

Daily analysis

Emini S&P bottomed exactly at our lower target of 4050/40. Below 4035 tests 7 month trend line support at 4020/15. Longs need stops below 4005. A break lower targets 3985/80.

First resistance at 4100/4110. Above 4120 allows a recovery to 4145, perhaps as far as strong resistance at 4160/70. Shorts need stops above 4180.

Nasdaq bottomed exactly at the 12970/930 target. This is the best support for today. However below 12900 risks a slide to 12650/600, perhaps as far as the 200 day moving average at 12500/480.

Minor resistance at 13200/200. Strong resistance at 13360/390. Above 13410 is more positive for initially targeting 13550 then strong resistance at 13630/670.

Emini Dow Jones unexpectedly broke very strong support at 33730/660. Holding below here targets 33330/300, perhaps as far as important 8 month trend line support at 32150/110. Below 32000 look for very important 14 month trend line support at 32800/750.

First resistance at 33800/850. Strong resistance at 34000/100. Shorts need stops above 34200. A break higher targets 34440/450.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk