SOFR: Critical financial transition shrouded in ambiguity

We can include yet another item to the long list of unprecedented phenomena in 2020. The few who have written on the subject are calling it the “big bang,” or “derivative reset” for financial institutions. This is the process of switching a colossal pile of derivative contracts to an entirely new benchmark interest rate. The gross notional value is not truly measurable, as derivative assets are largely owned and traded in the shadow banking system. However, regulators and experts estimate the sum to be at least 200 trillion US dollars!

The interbank benchmark rate being replaced is LIBOR or the London Interbank Offered Rate. LIBOR has been around since the 1980s and has been the most commonly used global interbank benchmark rate mechanism, publishing benchmark rates daily in five currencies. The most integral LIBOR rate published is of course US dollar LIBOR, as it is the most widely used currency for banking transactions. The replacement for US dollar LIBOR is “SOFR,” the Secured Overnight Financing Rate.The timeline of the transition was originally outlined in the “Paced Transition Plan,” detailed on the New York Fed’s website. Upon completion of the transition by the end of 2021, LIBOR will no longer be published or used as a benchmark rate for any financial contracts. Foreign currency LIBOR, including Yen, Euros, Francs, and British Pounds, will be replaced by their nations’ own alternatives which will function similarly to SOFR in the US. The lengthy transition timeline allows LIBOR to temporarily coexist with SOFR (and other nations’ LIBOR alternatives) in case any problems emerge.

Back in April of 2018, the New York Fed began publishing the SOFR rate daily. One of the final steps in the transition to SOFR was just recently completed, with the first $80 trillion in US dollar LIBOR contracts officially switching to the SOFR benchmark as of Friday, October 16th, 2020. The remaining trillions or more in financial contracts will be moved by the end of 2021, thus completing the transition. SOFR is set to change the relationship between central planners, the banking system, and the financial markets broadly.

Basic elements of the reset:

Planning for the “big bang” LIBOR reset has been ongoing for years, though largely ignored due to the financial jargon circling the matter. The burden of rolling out the unprecedented monetary policy experiment has fallen on the shoulders of the Federal Reserve, and specifically the New York branch of the Fed. The other major party teaming up with the NY Fed is the “ARRC,” Alternative Reference Rate Committee. The US Congress’ Financial Stability Oversight Council (FSOC) has conducted its oversight as well. It is noteworthy that the ARRC’s membership includes private firms and large banks that hold the derivative contracts switching to SOFR. The full list of ARRC members can be found on the New York Fed’s website, which includes non-bank entities such as clearinghouses and the US Treasury. Elected officials on the FSOC and non-elected Fed members have cited the switch to SOFR as a financial stability risk on multiple occasions, raising concerns worthy of examination for any investor and business operating with counterparty risks in the financial markets.

The contracts being reset are mostly interest rate swaps of varying maturities. I suggest consulting resources such as “Investopedia” if a general refresher is needed on the function of swap contracts or financial derivatives. There are a few key characteristics to note. First, banks trade the “OTC,” over the counter - making them products of the shadow banking system. Contractual agreements can vary based on both the currency used and also the counterparties transacting. These securities don’t pass through a public exchange, and their notional values are determined by the interest rate benchmark underlying a transaction. This makes it possible for their notional values to change if a new benchmark rate is applied! Hence, the switch to SOFR carries derivative price volatility risks.

We are talking about non-transparent financial instruments, the size of at least 10 US economies. What could possibly go wrong as banks reset their benchmarks! In relation to the underlying collateral, derivatives are analogous to an elephant balancing on a baseball. This is why Warren Buffet famously called derivatives “financial weapons of mass destruction.”

LIBOR? - a brief review.

LIBOR simply communicates the average interest rate at which large banks can borrow from each other. It can be used as a benchmark rate for a variety of debt instruments, from OTC derivatives to everyday home and auto loans. LIBOR splitting into multiple alternatives, like TONAR (Tokyo Overnight Average Rate) in Japan, represents an important decay in the infrastructure supporting the US dollar’s status as a world reserve currency.

One of the most important impacts of LIBOR on everyday investors is its signal of interbank liquidity. For instance, if LIBOR rates were to suddenly shoot up from 3% to 10%, it would be a sign that liquidity is lacking in the interbank lending market. Moreover, it would be a signal that counterparty risks are extremely elevated. This could have been used to anticipate major volatility events in the past.

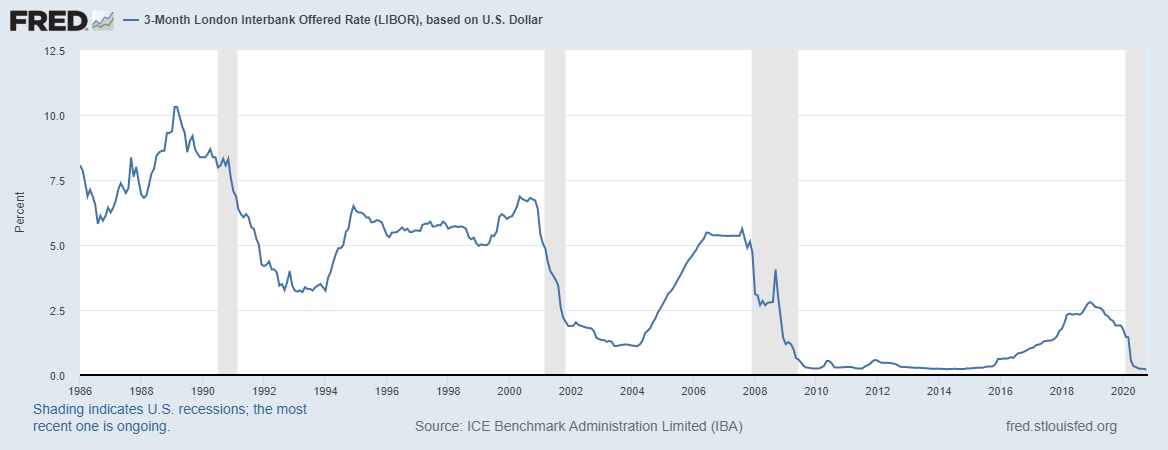

The chart below from the St. Louis Fed’s website shows how the 3-month LIBOR rates have risen leading up to major recession periods (grey areas = recession). As we can see, the banking system can only handle climbing rates for so long before liquidity becomes tight, forcing banks to cut back on lending. LIBOR can be seen falling after the onset of the recessions (grey) because governments and central banks intervene to boost liquidity. LIBOR rates falling would suggest any central bank and government interventions are working by alleviating pressure on the banking system and economy.

The second LIBOR chart (below) shows the LIBOR rate spike at the height of the 2008 housing crisis. At the time, the world was worried large banks were going to fall like dominoes. The chart also shows how the Federal Reserve and government policy interventions heading into 2009 (bailouts and quantitative easing) allowed LIBOR to stabilize, falling below 1% as the Federal Reserve dropped the Fed Funds rate to zero.

Another variation of the liquidity signal discussed is known as the TED Spread. This is the difference between the interest rate on short-term (three-month) LIBOR and the interest rate on 3-month US Treasuries. This is an important note for later in this report, when discussing how SOFR eliminates this tool from public view.

Why Replace LIBOR With SOFR?

The desire to replace USD LIBOR stems from it being a “stated rate.” This means LIBOR is not determined by real transactional data, but by bankers simply stating the rate at which they believe they can borrow from counterparties. As you might imagine, this can allow banks to misrepresent their LIBOR data, which is exactly what happened in the period surrounding the great financial crisis of 2008. Misrepresenting their LIBOR submissions created an illusion of solvency in the banking system.

By the time regulators began calling for an alternative to LIBOR, the fraudulent rigging of the LIBOR rates had already been rewarded in many ways. Massive bank bailouts funded by the public made private bank balance sheets swell. More banking sector leverage was encouraged, adding to the existing debts that caused the GFC in 2008. SOFR will serve to encourage the same practices while covering up the fragility of the banking system.

How Does SOFR Change Things?

As one might have expected, the LIBOR fiasco forced the ARRC and Federal Reserve Bank of New York to commit to producing the SOFR rate from real lending data. It may appear to bolster SOFR’s reliability and security, but we must first answer: “which data is used to produce SOFR rates?”

The answer can be found on the New York Fed and ARRC’s websites, where we learn that the new benchmark rate is calculated using the transaction data in the Treasury repo market! For an avid Fed watcher, red flags should immediately be raised by this observation.

Now the reality of SOFR begins to diverge from the language used by the Fed and ARRC to describe it. The following quote is taken from the New York Fed’s Website, one of several statements referring to the supposed advantages of using repo market data to create the SOFR rate. Any keywords relating to the broad analysis of SOFR are underlined. Writing in parenthesis is my own, not the Fed’s.

“This makes it (the new SOFR benchmark rate) a transparent rate that is representative of the market across a broad range of market participants and protects it from attempts at manipulation. Also, the fact that it’s derived from the U.S. Treasury repo market (the overnight repo market operated out of the New York Fed) means that, unlike LIBOR, it’s not at risk of disappearing.”

Source: https://www.newyorkfed.org/arrc/sofr-transition

This is a startling statement for many reasons. First, the Fed’s own “fed funds” rate is used as the benchmark for the US Treasury repo market. To remain within the context of this SOFR analysis, we can simply assert that the fed funds rate is blatantly manipulated by the Federal Reserve through its monetization of trillions in US government debt since 2008. If SOFR’s rate is based on the fed funds rate, then we must understand that SOFR will be a rate manipulated lower by the Fed. This is an overt attempt by the Fed to drop rates in the banking system.

Recall that during the March 2020 liquidity crisis, the Fed openly committed to providing up to one trillion dollars a night in Treasury repo market liquidity to ease concerns that the lending markets would be illiquid! We can imagine the Fed would need to offer even more liquidity in the future, knowing the entire derivative market and SOFR depend on fed funds as well. The Fed’s actions in March are an overt example of market manipulation, but it gets worse when we recall the fact that the FEd completely lost control of repo market rates in September of 2019, causing stress in lending markets and forcing them to commit to more QE. The ARRC and Federal Reserve may want to amend their statement that SOFR will be free of any “attempts at manipulation.” Instead, it seems the Fed wants to maintain the illusion that its power is indeed almighty.

Recall the “TED Spread” mentioned earlier. This is the difference between short term US dollar LIBOR rates and short term US Treasury interest rates (3-month). It has served for decades as one of the best indicators of interbank lending health. The chart below will cease to exist after 2021 as the Ted Spread vanishes along with LIBOR. This means there will no longer be an efficient way for investors to compare interbank liquidity with US Treasury financing conditions. Note the spikes in the chart below and how they coincide with what we know to be impactful market events.

The Fed is essentially asking markets to turn a blind eye to the interbank financing markets. Instead, we are to trust the Fed will keep things liquid, but behind the scenes! With the TED Spread gone in 2021, the shadow banking system will be able to expand recklessly and with less public transparency.

To see if SOFR is indeed more stable as the Fed suggests, we can simply compare SOFR (blue) with both one-month and three-month LIBOR rates below. Notice how SOFR is always choppier, and even spiked during the now infamous repo market malfunction that the Fed tried to cover up in September of 2019. If the Fed lost control of the repo market again like this, SOFR and all the derivatives benchmarked to it would feel the pain as well.

Another important difference between the unsecured LIBOR and new SOFR rates is that Treasury repo market transactions are secured using collateral (Treasuries). As you might imagine, this all but guarantees SOFR will produce lower rates in the banking system than LIBOR did. The Fed is therefore encouraging banks to engage in riskier transactions with lower rates, in return, the Fed accomplishes a long-term goal of its own - generating more Treasury demand. As the preferred collateral asset to transact with the NY Fed, Treasuries will remain integral to the banking system’s interest rate benchmark. This may incentivize banks to own Treasuries, even in the even their yields turn negative. It also keeps government financing rates from rising. Those are some of the Fed’s intended consequences.

We can identify some serious unintended consequences as well. We have previously identified that the SOFR and repo market rates are essentially the same. If we follow the Fed’s monetary policy actions since the GFC, we can identify a reinforcing cycle which I will call the SOFR liquidity trap. This could be extremely problematic:

First, we know that the Fed only has one method to address a hypothetical spike in the repo/SOFR rate, or upward pressure on rates. This is the expansion of its balance sheet. The expansion may come from either purchasing private-sector assets, like commercial paper, or buying Treasuries and in return creating new bank reserves (digital money printing as Jerome Powell famously called it). However, the Fed’s quantitative easing measures also reduce the amount of Treasury collateral in the banking system. This is crucial to understand how the Fed’s methods may eventually backfire. The Fed cannot “digitally print” currency units to grow the primary dealer banks’ reserves without first taking away collateral from the banking system.

The Fed has to rely on the banking sector’s willingness to take new reserves from the Fed and find new entities to extend loans to. If the banks refuse, it will increase the likelihood that rates will spike in the repo market at a future date, and also make the banking system more fragile in the case of such a spike. A dangerous cycle is created. If say, there is a global pandemic, banks are less likely to lend. The Fed’s natural response in this case becomes detrimental to financial stability. The Fed will try to replace the banks’ duties and end up starving the system of collateral assets to transact in the repo market. Eventually, we are likely to build up too much stress on the financial system for this cycle to continue without some type of cataclysmic event.

The Fed’s “cure” for an illiquid banking system could in the worst case end up being the downfall of the entire derivatives market. When we account for this SOFR liquidity trap phenomenon, it’s clear how it can help guide investment decisions. This flow will depend largely on the banks’ willingness to lend to new borrowers and will largely dictate the Fed’s ability or inability to create inflation in the future. If there are not enough loans extended due to a lack of credit worthy borrowers in the economy, the Fed will likely be unable to create inflation without more creative policy tools.

If things go as planned, enough new loans will be extended by the big banks to keep financial markets liquid. This would likely result in a loss in purchasing power for the US dollar at a more rapid rate. This scenario is what markets have been betting on since the lows in March 2020, up to September’s stock market highs which remain the highs heading into November. Now, we are about to see whether the US government’s lack of new Treasury issuance and deficit spending will ultimately create a liquidity trap, leading to deflationary forces.

Indeed, it remains the logical tendency for overly indebted markets to go through a deleveraging. It would only take a slight miscalculation from the Fed, banks, or not enough new Treasury supply from Congres. The self-promulgating nature of the SOFR liquidity trap is more likely the more the Fed expands its balance sheet and reduces the amount of Treasury collateral in the banking system.

CONCLUSIONS & KEY IMPACTS

It’s difficult to agree with the logic behind the regulator’s new SOFR benchmark. The Fed’s attempt to remain in full control of financial stability is becoming more of an illusion as the markets become further disconnected from any fundamentals. Moving forward, the Fed seems prepared to keep encouraging a debt binge. We will likely learn the hard way that the shadow banking system is outside of the Fed’s control. The next repo/SOFR benchmark spike seems likely to either tilt the momentum in favour of either extreme deflation (price collapse) or extreme inflation, and it will all depend on the banking sector’s reaction. We can already count on what the Fed’s reaction will be.

It seems more than fair to ask: is the Fed the one playing the music, or is it the banking sector? The Fed’s new choppy, and yet still dishonest interbank benchmark could expose the realities behind the great central planning facade. When it comes to policing the massive banking system they have helped create, it’s a whole new ball game for Jerome Powell and the FOMC. “Don’t fight the Fed” seems to ignore the very real lessons history teaches us - human excesses and indulgence will always reach a limit. Perhaps it is high time for investors to instead show a healthy skepticism of the Fed’s powers.

Author

Miles Ruttan

Bytown Capital

Miles' focus at the firm is to oversee our macro analysis, with the emphasis being placed on global credit and liquidity flows.