Silver to follow gold higher

The problem of silver's oversupply solved by gold's price

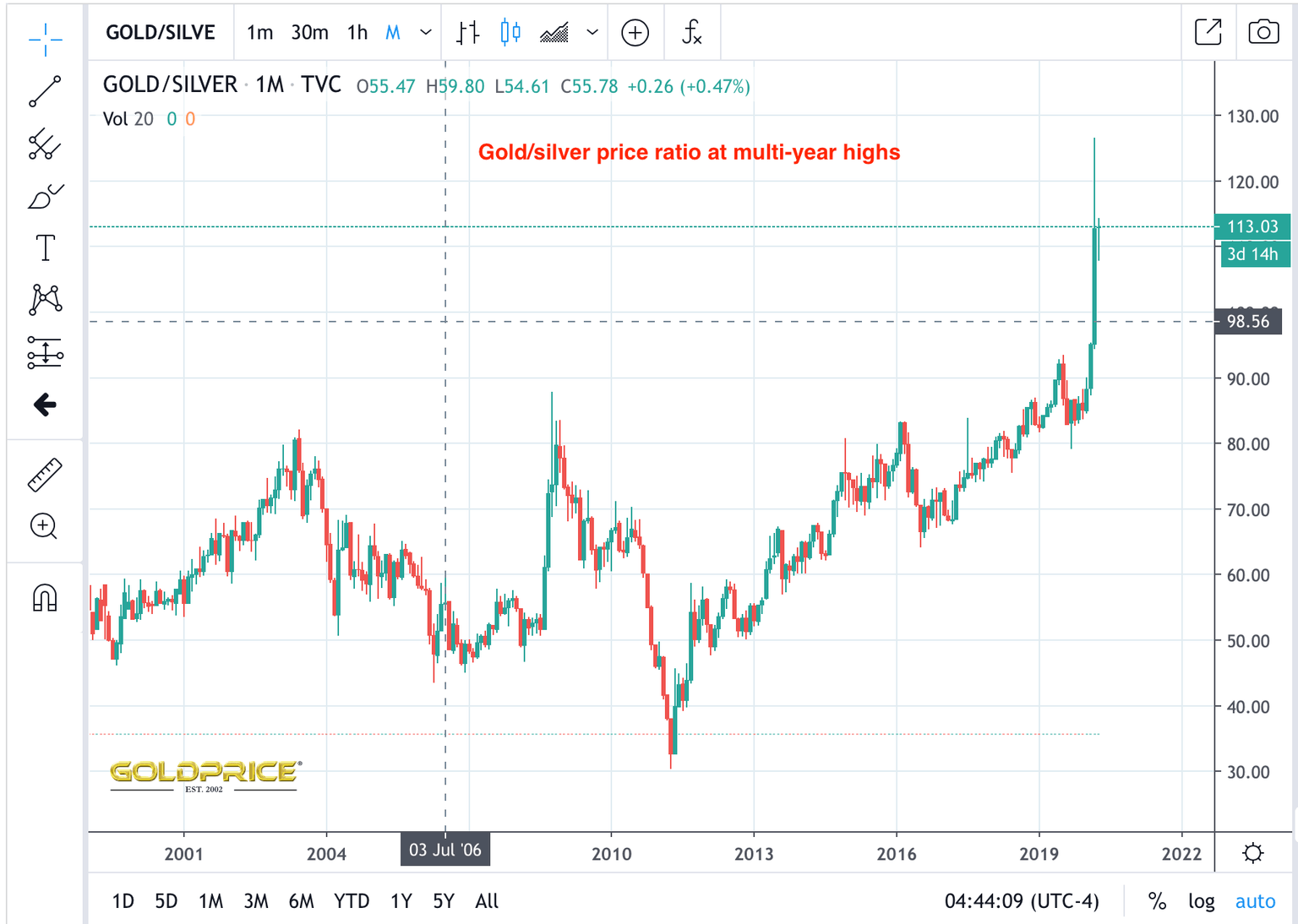

I was reading a Bloomberg article yesterday which explained that this year is the 8th year of oversupply for silver. These large stockpiles of silver are part of the reason that silver prices have remained relatively subdued due to gold prices. Take a look at the gold/silver price ratio and you can see that gold is trading at a very high price in relation to silver. The implication is that silver prices are due a correction higher based on the ratio.

Why is silver so over-supplied?

Well, this is because silver is always the bridesmaid, but never the bride. Silver is often mined as a byproduct of copper and gold mines. Wanted gold, but found silver. Ok, put it in the silver pile. The silver pile has grown and it is still dug up even as demand falls as it is a byproduct.

Why will silver still probably rise?

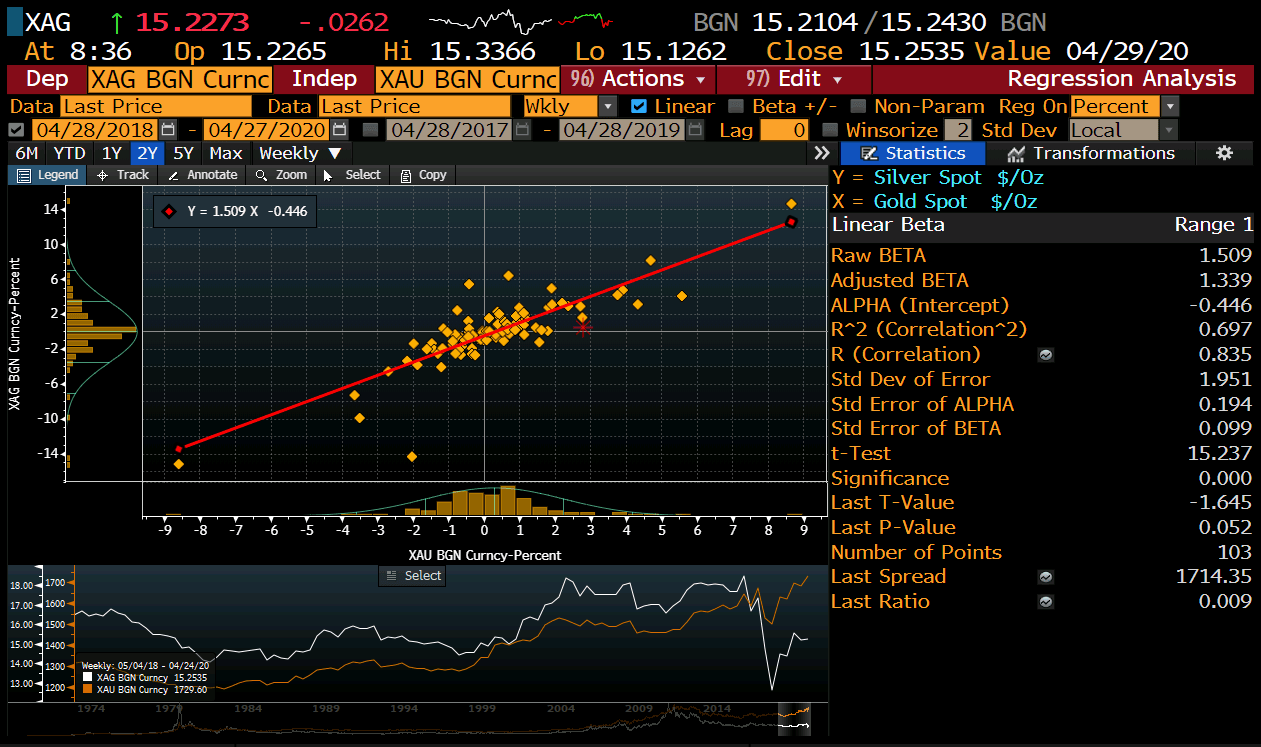

Silver may be only be the bridesmaid, but when gold is the real bride silver wins too. Silver has a very close relationship with gold. It has a daily correlation of 0.8 and a beta of over 1.3 from the last 5 years.

Therefore, expect gold's ascendancy to drag silver higher along with it as long as the market situation remains the same.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.