Silver set for buyers on industrial demand?

Around the start of the year, Crescat Capital thought that silver was a great commodity to invest in. Crescat finished strong in 2020 to capture the top three spots in the Bloomberg News US hedge fund performance table for December. All three Crescat funds made it into Bloomberg’s top 10 for the full year with the Crescat Precious Metals Fund taking the #1 spot. So, worth a look for sure!

They point back to the last blue sweep in Congress, early in 2009, where Silver rose by over 300% and consider that silver has the same potential again.

The US economy has a twin problem of increasing debt and a falling currency account deficit.

The main way that the Fed is funding the US economy is through the monetisation of debt. Spend now, pay later. According to Crescat the US Gov’t now have an inbuilt bias to keep interest rates low in order to allow institutions to service their debt and to keep some risky valuations afloat. In truth, this is a toxic mix where today’s problems are really stored up for another day.

A few points to note

-

Cryptocurrencies are seeing inflows. Whatever you think about the view that Bitcoin is stealing gold’s rise – they are a new player on the block and are taking a share of the market capitalisation.

-

USD strength is a risk that may grow. Yes, the Fed need to keep rates low to service debt Yes, the Democrats will spend and use debt to do it. However, the Fed wants to see inflation over 2.5%. It also won’t want to see debt further increase. At some point, cooler heads will prevail and it will become political issues. There is a risk for USD strength.

-

Silver has further appeal from its solar panel usage, so that is another demand factor.

Technically where to enter

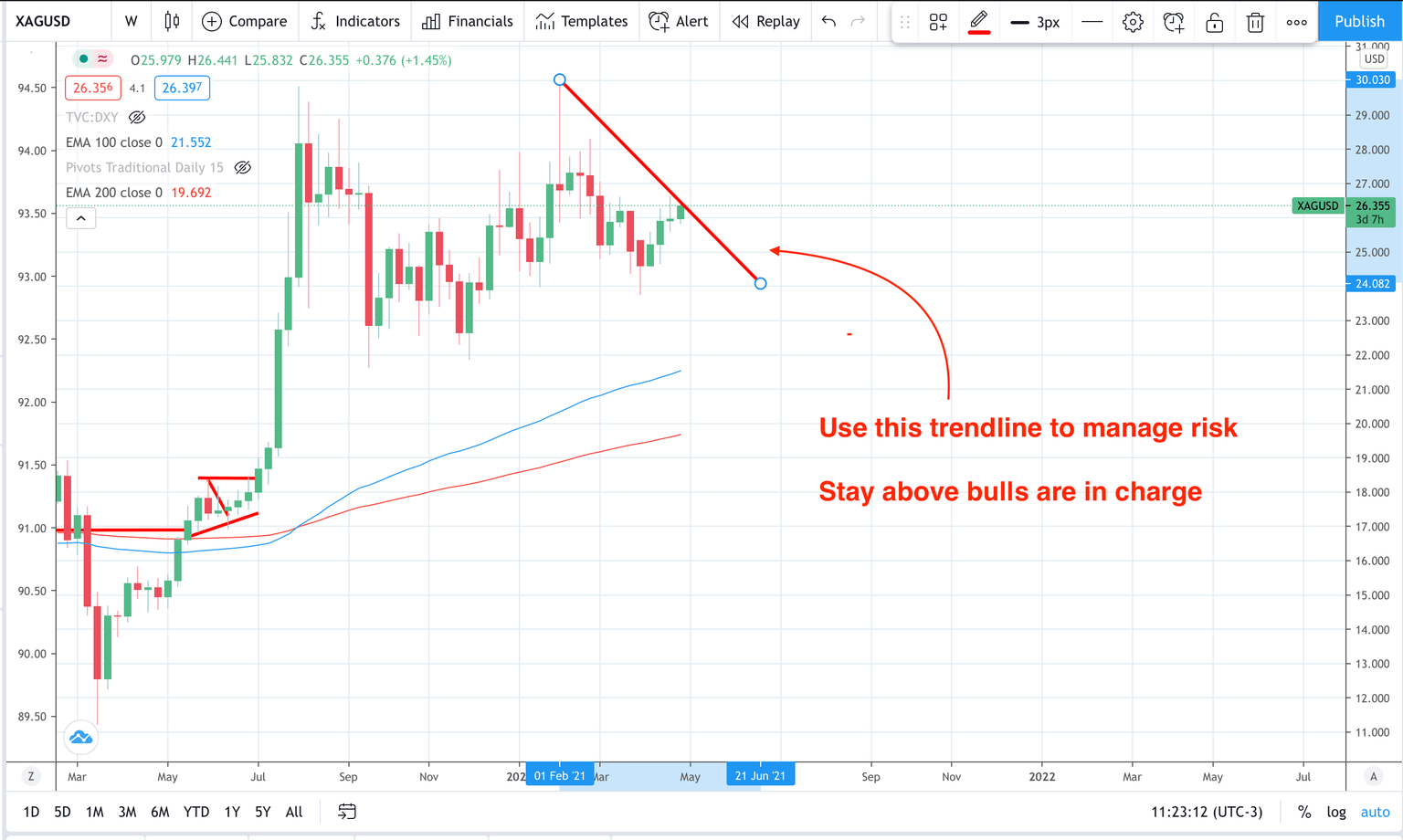

A low-risk high reward entry for silver would be by using the trend line marked on the chart below. Stay above and the bullish case remains open. Stay below and sellers are in charge.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.