Silver forecast: Bullish structure holds as prices eye all-time higs

- Silver remains structurally bullish, holding higher highs and higher lows on the Daily timeframe as buyers continue to absorb pullbacks.

- Fundamental tailwinds from supply deficits, industrial demand, and risk-off sentiment keep silver well-supported relative to gold.

- Technically, silver favors continuation, with upside targets intact above resistance while support zones define invalidation.

Silver narrative — Why Silver remains strong

Silver has continued to outperform across the precious metals complex, maintaining strong bullish momentum into early 2026. While gold often dominates safe-haven headlines, silver’s unique dual role as both a monetary metal and an industrial commodity has positioned it favorably amid global uncertainty and tightening physical supply.

Over recent sessions, Silver (XAG/USD) has held near multi-year highs, with price action showing resilience despite brief consolidation phases. Buyers have consistently defended pullbacks, indicating strong underlying demand rather than speculative excess.

This resilience reflects a market that is no longer driven by short-term hype, but by structural forces — from constrained mine supply and exchange inventories to persistent industrial consumption tied to renewable energy, electronics, and electrification.

Fundamental drivers supporting Silver prices

Supply tightness and structural deficit

Silver markets remain under pressure from ongoing supply deficits, with mine production struggling to keep pace with demand. Unlike gold, silver’s above-ground inventories are far smaller relative to annual usage, making price more sensitive to demand shocks and inventory drawdowns.

This tightness has been amplified by:

Reduced new mining projects

Rising extraction costs

Declining ore grades in major producing regions

As a result, silver has increasingly behaved like a scarcity asset during periods of heightened demand.

Industrial demand remains a core tailwind

Unlike gold, silver benefits directly from economic and technological shifts. Demand from:

Solar panel manufacturing

Electric vehicles

Semiconductor and electronics production

continues to grow structurally, creating a non-speculative demand floor beneath price. This makes silver uniquely positioned during periods where inflation concerns and energy transitions overlap.

Macro and risk sentiment support

Silver has also benefited from:

Ongoing geopolitical tensions

Fragile global growth expectations

Anticipation of more accommodative monetary conditions

As investors rotate into hard assets, silver often acts as a high-beta alternative to gold, attracting flows when risk sentiment deteriorates or real yields soften.

Technical outlook — Silver price action analysis

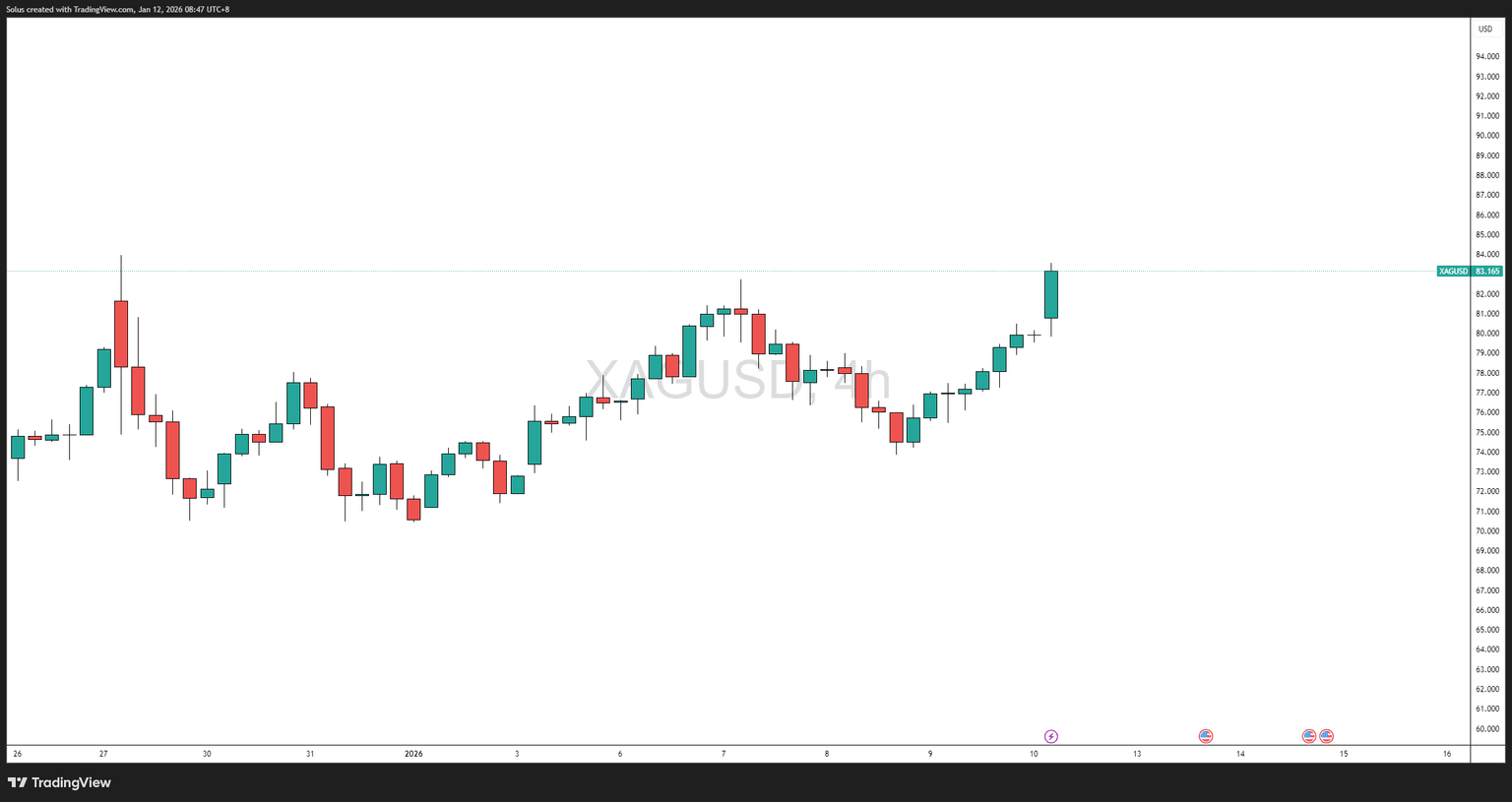

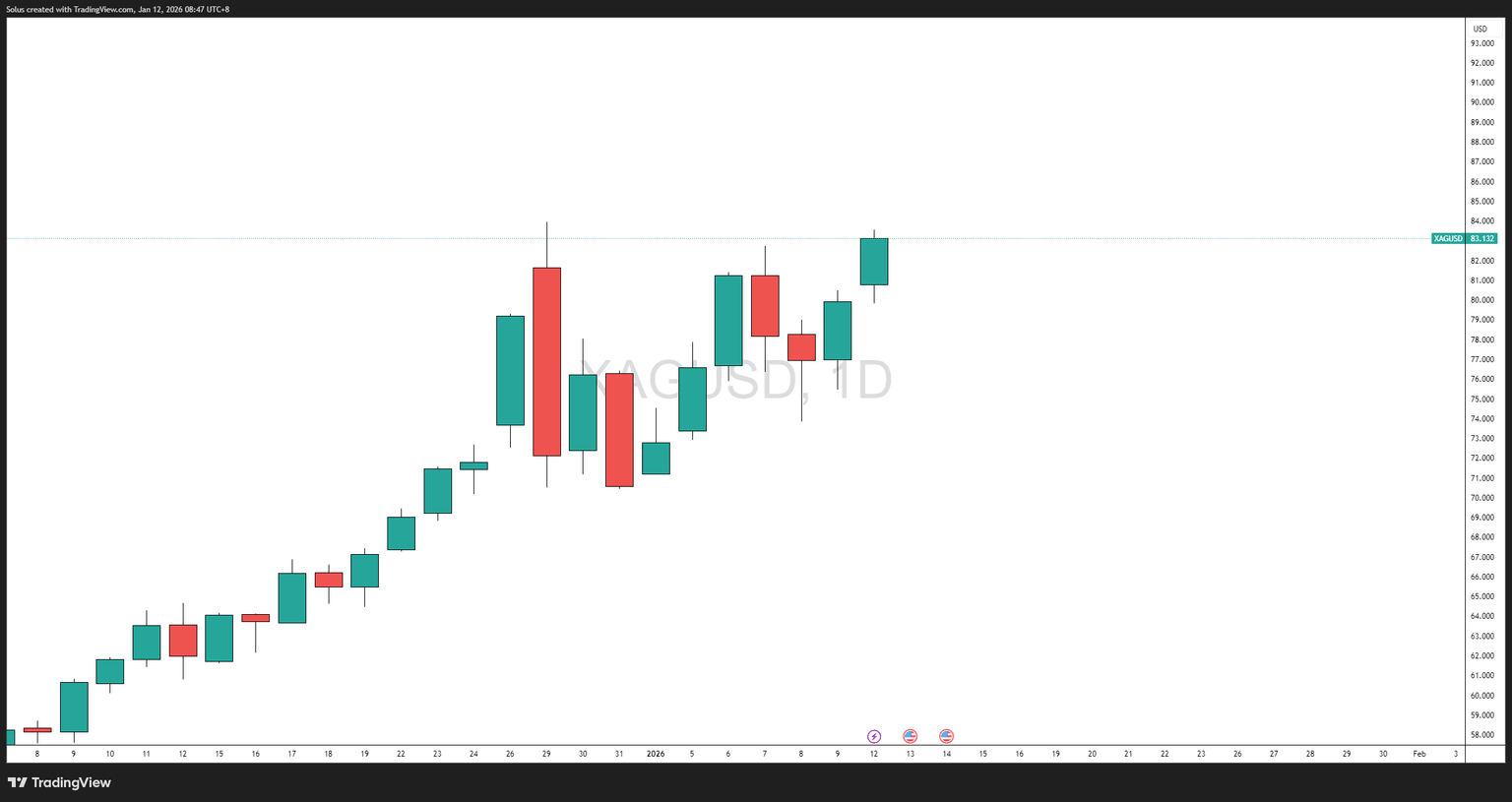

Daily timeframe narrative

On the Daily chart, silver remains in a clear bullish market structure, defined by higher highs and higher lows. Recent candles show strong bodies with limited downside wicks, signaling sustained buying interest rather than distribution.

Importantly, prior resistance zones have been reclaimed and respected as support — a classic sign of trend continuation rather than exhaustion.

There are currently no confirmed bearish reversal patterns on the Daily timeframe.

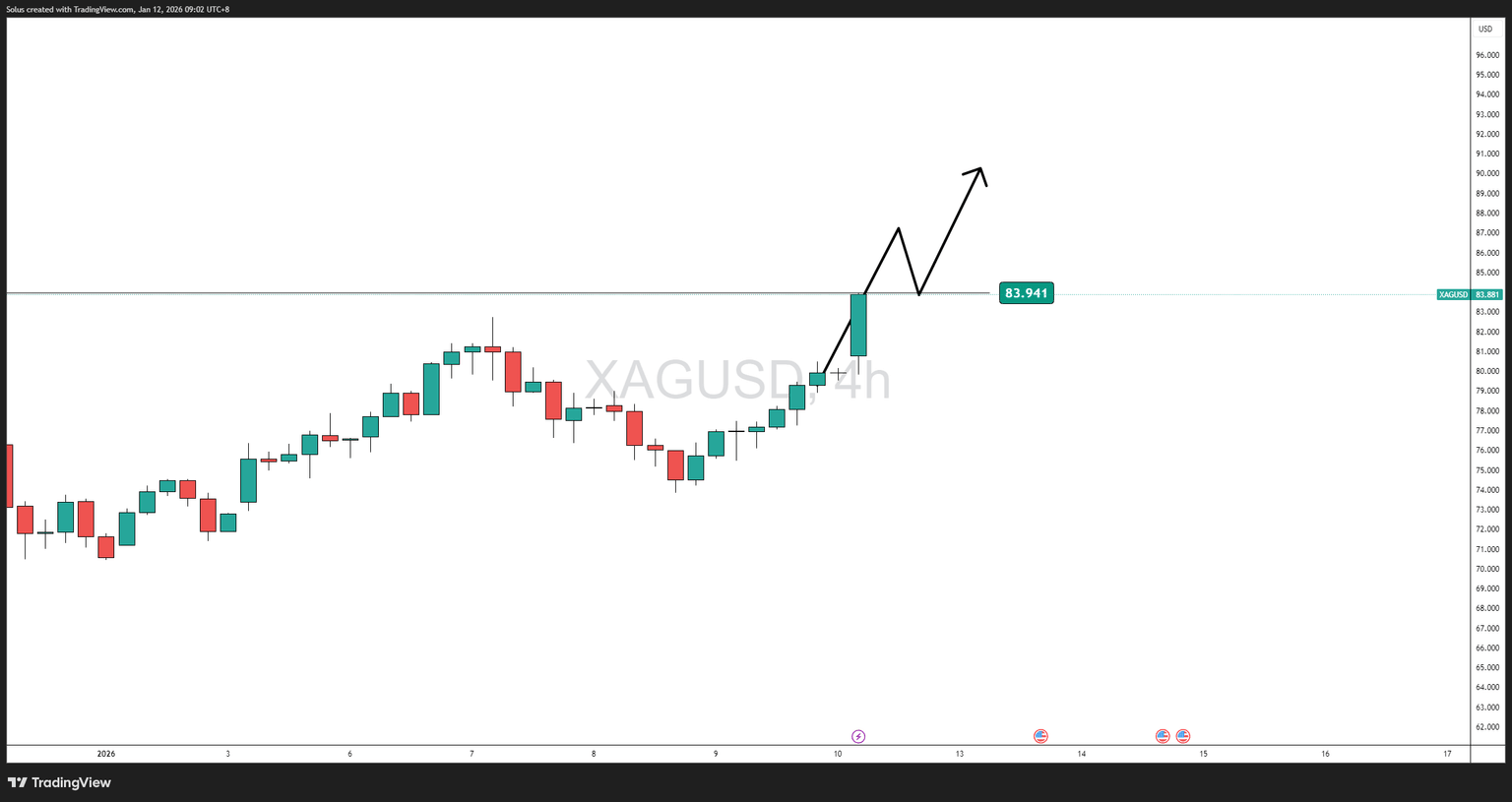

Bullish scenario — Trend continuation

Silver maintains a bullish bias as long as price holds above key structural support zones.

Bullish continuation is favored if:

- Price holds above prior breakout levels

- Pullbacks remain shallow and corrective

- Momentum resumes above recent highs

Upside targets:

- $88 – $92: Near-term continuation zone

- $95+: Extension toward major psychological resistance

Bullish narrative:

As long as silver remains supported above structure, dips are likely to be corrective rather than impulsive. A sustained break above recent highs could trigger momentum-driven expansion as sidelined buyers re-enter.

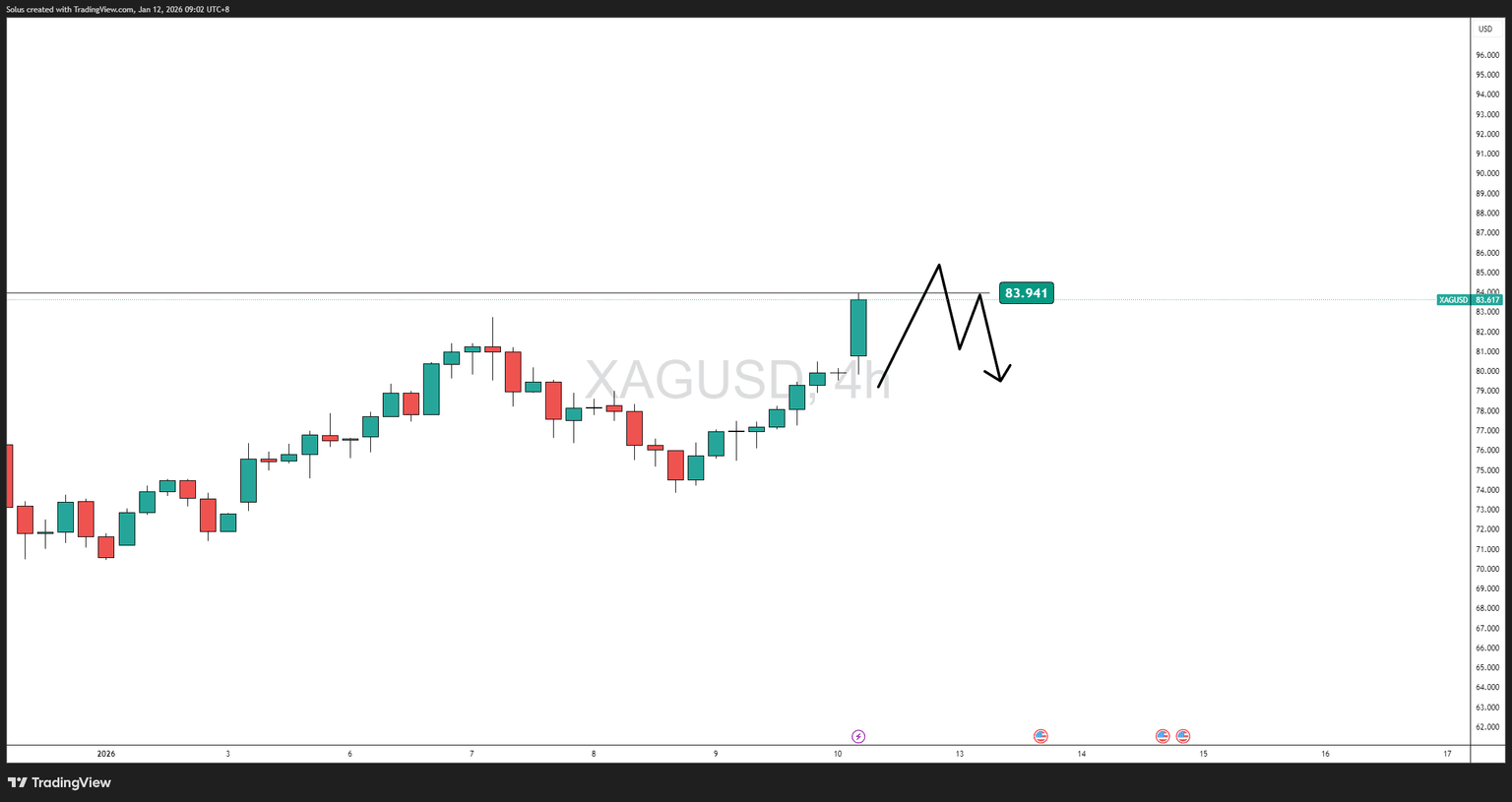

Bearish scenario — Corrective pullback

While the broader trend remains bullish, silver is not immune to volatility.

Bearish risk increases if:

- Price fails to sustain above recent highs

- A clear bearish Daily reversal forms

- Key support zones are decisively broken

Key support zones:

- $80.00 – $78.00: First major demand zone

- $75.00 – $72.00: Deeper corrective support

Bearish narrative:

A move into these zones would likely represent healthy trend correction, not trend failure, unless accompanied by a broader shift in macro sentiment.

Silver market outlook summary

Silver continues to trade in a technically strong and fundamentally supported environment. Structural supply deficits, expanding industrial demand, and persistent macro uncertainty keep silver well-positioned into 2026.

While volatility remains elevated, the broader trend favors continuation rather than reversal, with pullbacks offering potential re-entry opportunities rather than signaling distribution.

Bias: Bullish

Risk: Volatility-driven pullbacks

Opportunity: Trend continuation above structure

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.