Seven fundamentals for the week: Iran-Israel war, Fed to fire up tariff-troubled markets

- Geopolitics and trade tensions remain in the spotlight ahead of several deadlines.

- The Fed is set to signal its next moves after confusing data.

- US retail sales and interest rate decisions in Japan and the UK keep things lively as well.

When will the Federal Reserve (Fed) cut interest rates? That question competes with the Israel-Iran war and the fate of the tariffs America slaps on its peers. And there's more in store.

1) Middle East tensions simmer

Will the war between Israel and Iran choke Oil supplies out of the region? The two Middle Eastern countries have been exchanging significant blows since early Friday, and there seems to be no end in sight.

Among the scenarios are a collapse of the Iranian regime, and also an expansion of the war, dragging the United States (US) and other countries.

Oil prices have substantially risen, but that would considerably extend if the Straits of Hormuz close and carriers of Crude are unable to pass out of the Persian Gulf.

Gold has also been a beneficiary, and the US Dollar (USD) has returned to vogue as a safe-haven asset. Will this continue? If the conflict continues without an escalation, the Greenback could lose some ground, in line with the trend so far this year.

2) Trade talks focus on EU, China

Will Europe and the US get closer? As leaders head for the North Atlantic Treaty Organization (NATO) summit, there are growing hopes that trans-Atlantic trade will find a better footing. The stronger EUR/USD may help in alleviating tensions.

These talks come after the US and China reached an accord on implementing what they had already agreed upon, and as relations remain fragile.

US President Donald Trump has set various deadlines for slapping new levies: late June for sending letters on unilateral duties and early July for implementing the "reciprocal tariffs" announced in April. He is emboldened by a court ruling leaving the current policy intact until a new hearing on July 31.

Any progress on trade deals would boost Stocks and the US Dollar, while clashes boost the Euro and Gold.

3) BoJ likely to lower rate hike expectations

Tuesday, early in the Asian session. The Bank of Japan (BoJ) has been touting further interest rate hikes for long months, but there is less justification for such moves now. While rising rice prices have grabbed headlines, other costs have remained tame in recent months.

The BoJ has raised rates three times in the current cycle, lifting them from a negative -0.10% to capping them at 0.50% in its latest hike in January.

BoJ Governor Kazuo Ueda and his colleagues are likely to leave interest rates unchanged at this juncture, and could signal that another hike is unlikely anytime soon. The Japanese Yen (JPY) is off the highs it reached in April and could succumb to further pressure.

4) US retail sales may show cracks in consumption

Tuesday, 12:30 GMT. The US consumer seems to have no limits – but tariffs may eventually hit expenditure. Softer-than-expected inflation figures last month imply less buying in response to higher costs.

More importantly, increased buying earlier in the year may have front-run tariffs and could now result in lower spending.

Headline Retail Sales rose by 0.1% in April and may now edge lower. The Retail Sales Control Group slid by 0.2% back then after two months of strong rises, and it may extend its fall.

5) Jobless claims may have a last-minute impact on the Fed

Wednesday, 12:30 GMT. For a change, weekly unemployment claims are published on Wednesday due to the Juneteenth holiday in the US. That puts this high-frequency release just ahead of the Fed decision, potentially triggering some nervous trading.

A figure above 250K would weigh on the US Dollar while boosting Gold, while a decline toward 200K would do the opposite.

6) Fed decision hinges on all-important dot plot

Wednesday, 18:00 GMT, press conference at 18:30 GMT. Is the Fed about to resume its rate-cutting cycle? Not this time, but there are signs of weakness in the US economy.

First, the most recent inflation figures were surprisingly low, with the core Consumer Price Index (CPI) rising by only 0.1% in May. Tariffs have yet to be passed to the consumer, so the Fed might be cautious.

On the central bank's second mandate, employment, the data has been mixed: better-than-expected job gains of 139K in the latest Nonfarm Payrolls (NFP) report, but the trend is down.

Fed Chair Jerome Powell and his colleagues are set to hold interest rates unchanged at this point – they do not like to surprise markets. However, intentions to move faster than previously expected could be manifested in the "Dot plot" – forecasts officials publish every three months.

Back in March, the dots pointed to two rate cuts in 2025. There were many who preferred only one move. This time, the balance could tilt toward those favoring two cuts.

The statement could also be more dovish. In its latest decision in May, Powell stated that tariffs raise inflation and unemployment risks at an equal distance. That might change this time, with the statement leaning toward risks to its employment mandate.

Last but not least, Powell will take the stage to answer reporters' questions. Apart from trying to pin him down on the next Fed moves and current concerns, they may ask him about his potential successor. Speculation that Trump could nominate a more pliant and dovish Chair has been swirling in recent days.

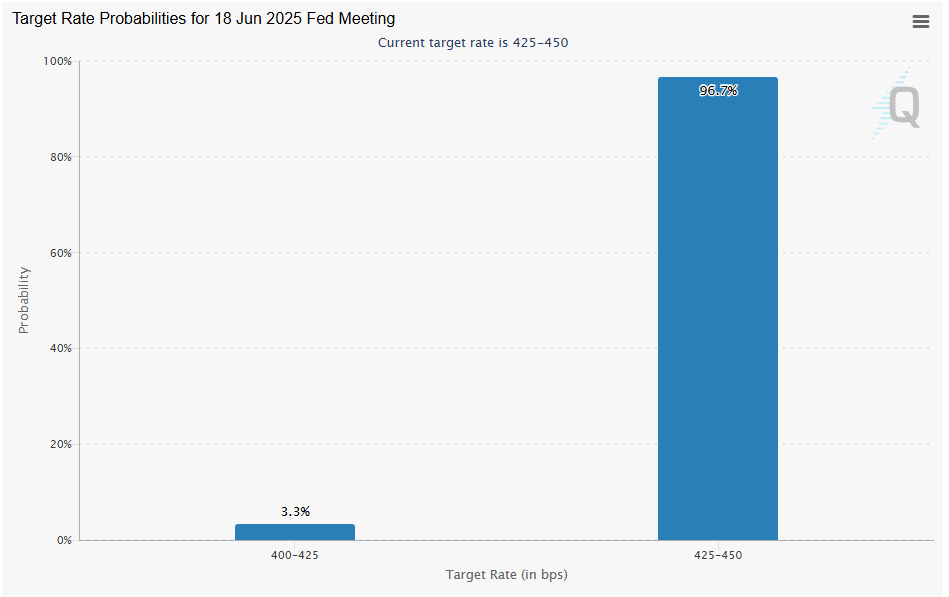

A no-change in interest rates decision is fully priced, according to the CME Fedwatch:

Source: CMEGroup.

7) Britain heads toward a back-to-back rate cut

Thursday, 11:00 GMT. The Bank of England (BoE) has been cautious in its approach to cutting interest rates, as core inflation remained high and the economy continued to grow. That may have changed recently, as unemployment rose to 4.6% in April, and the economy shrank by 0.3% in April as well.

That may push Bank of England Governor Andrew Bailey and his colleagues to cut interest rates for the second time in a row, the first back-to-back slashes since early 2020. Expectations stand on a no-change move, but a cut cannot be ruled out.

Apart from the decision, investors will also be watching the voting pattern within the Monetary Policy Committee (MPC). Back in May, there was a three-way split between those back leaving borrowing costs unchanged, the majority supporting a 25 basis point (bps) cut and those opting for a double-dose 50 bps move.

If many lean toward a rate cut, the Pound Sterling (GBP) would suffer more than in the case of a larger consensus.

Final thoughts

A week consisting of a Fed decision is always interesting – and even more so when Trump is the president. The bank holiday in America on Thursday adds even more spice. Trade with care.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.