Risk on again as stocks extend rally

-

Risk on again as stocks extend rally.

-

GME sinks 60% as shine comes off the ‘memestocks’ trade.

-

Italian banks rally as country taps Mario Draghi for PM.

So, while the EU drags its feet, points blame, raises threats of vaccine export controls and criticises the Oxford University vaccine for being ineffective and suggests the British were taking risks with rushing approvals, the UK is quietly getting on with it. 10m vaccinated and counting. And new research suggests the AstraZeneca vaccine is not only is very effective but slows the spread of the virus. The impact on transmission matters a lot to making things normal quicker as it means you don’t need to vaccinate as many.

Super Mario to the rescue: Former European Central Bank Governor Mario Draghi has been asked to form a government of national unity in Italy. He’s a highly skilled operator, a consummate politician and we know he’ll do ‘whatever it takes’ to steer Italy out of its worst economic and health crisis since the war. As far as technocrats go, you won’t find a better one. Italian banks like the idea of Draghi as PM – shares rose 6% in the major names. His expertise in this area is clearly a positive. Italian 10-year bond yields sank 7 bps to 0.585. The FTSE MIB rallied 2% as banks rose and investors discounted the political risk. I think many of us who watched every ECB presser for the last decade will think Italy has secured a top operator. If you need a technocrat, you won’t do better.

So, the Reddit /wallstreetbets traders got burned. Hardly a surprise - as consistently warned in this column, however you dressed it up, it was a greater fool speculative bubble, which would only end one way. The party for so-called memestocks was always going to be wild but ultimately rather short-lived. Sooner or later the music stops. Cheerleader Dave Portnoy sold down all his ‘memestocks’ for a $700,000k loss. The losses were bruising – GameStop –60%, AMC Entertainment declined –41%, BlackBerry fell –21%. GME and AMC both trade about 8-10% lower in pre-mkt. Silver is back under $27 after touching $30 briefly amid the frenzy, with COMEX raising margin requirements. Other metals also slipped, with gold testing the 38.2% Fib support around $1,830.

More importantly, at least for the broader market and economic outlook, rates are climbing, Wall Street futures are up 5% from their Sunday night lows and the US dollar has broken higher (thought that might not last). European stocks extended the week’s rally in early trade, rising for a third straight day following a strong lead from Wall Street. The S&P 500 rose 1.4% whilst small caps rose 1.2%.

Reflation back on? US 10-year yields have marched back up to 1.12% as the Treasury market appears to be loading up for reflation again, whilst 30-year yields are back to 3-week highs. Moves seem to be associated with progress on Joe Biden’s $1.9tn stimulus programme whilst, as flagged yesterday, we are seeing inflationary pressures feed through into the latest US and UK PMI surveys. Indeed, even Europe could be getting on the act – the final composite PMI for the bloc this morning said inflationary pressures – especially in manufacturing – intensified during January. Input cost inflation accelerated to the highest in two years.

Alphabet and Amazon smashed expectations, but the news that Jeff Bezos will step down as CEO of the latter took the shine of a record-breaking quarter. Amazon Web Services boss Andy Jassy will replace Bezos, overshadowing a stunning quarterly update in which the company posted $125.56 billion in sales. Earnings per share smashed expectations at more than $14 vs $7 expected. Guidance for the next quarter suggests a slowdown but still operating at +33%-40% year-on-year. Cloud revenues rose 28% but this was a little short of forecasts. Bezos will still be pulling strings - I don’t think this is material concern for the stock as it continues to deliver numbers that continue to exceed even the most bullish estimates.

For Alphabet, it was another exceptionally strong quarter. Shares surged over 7% after-hours following its quarterly update delivered EPS of $22.30 vs $15.90 expected on revenues of $56.9bn vs $53bn expected. Core advertising +23% remains strong and shows pandemic trends supportive of digital advertising remains positive, whilst YouTube ad revenue rose 46% and underlined the increasing part this division plays in driving sales.

Crude gains: Positive sentiment around vaccines, stimulus and a big draw on US stocks helped lift oil prices to fresh highs. WTI trades above $55 this morning, around a year high, after the American Petroleum Institute (API) said US crude oil inventories fell by 4.3m barrels in the week to Jan 29th, vs expectations for a build of 446k barrels. Gasoline stocks fell by 240k barrels, vs an expected draw of 1.1m barrels, while distillates fell by 1.6m barrels, which was also larger than expected. EIA data today expected to show a draw of just –0.6m after last week’s -9.9m draw. We also look ahead to the OPEC Joint Ministerial Monitoring Committee (JMMC) meeting scheduled for today.

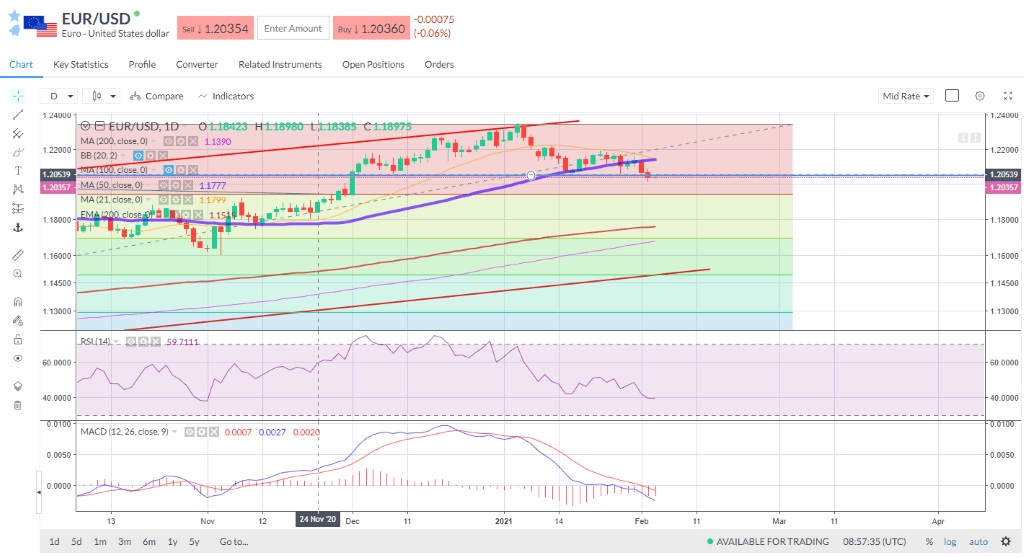

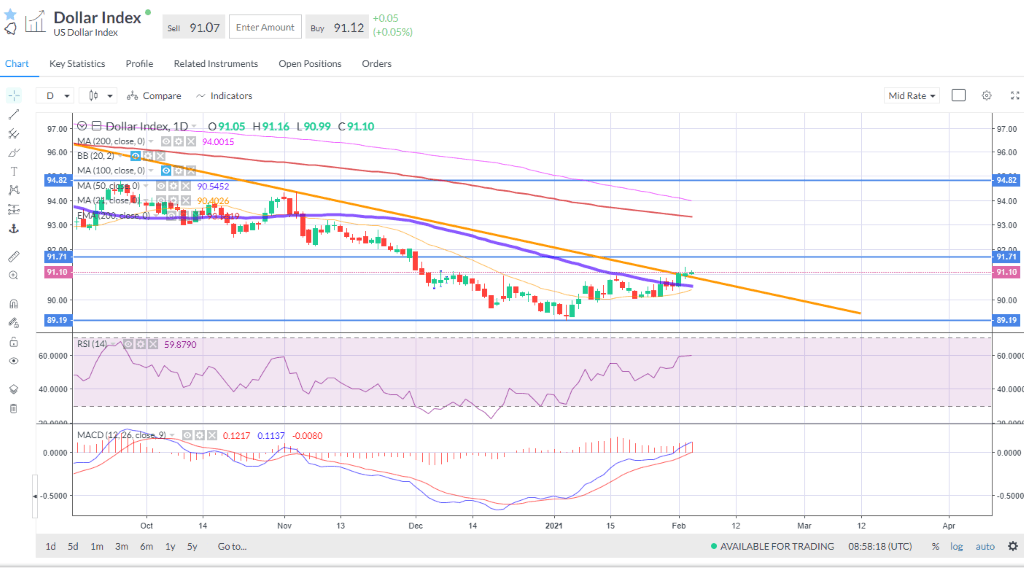

In FX, the dollar just held gains as previous resistance now acts as support. But I fear this apparent short squeeze on crowded short dollar positioning could be a dollar bull trap and EURUSD will recover to 1.25 before the year is out despite the tardy vaccine rollout and underperformance vs the US economically meaning short-term pain for euro bulls. Short-term look for the 91 level on DXY to provide support. Final PMI data out of the Eurozone this morning point to a mixed picture. Manufacturing production rose for a seventh successive month, though at the lowest rate in that period. Only Germany saw a rise in private sector output last month, whilst “solid falls" were seen in France and Italy.

EURUSD holds losses after breaking key support at 1.2050

Author

Neil Wilson

Markets.com

Neil is the chief market analyst for Markets.com, covering a broad range of topics across FX, equities and commodities. He joined in 2018 after two years working as senior market analyst for ETX Capital.