Retail Sales and construction point to signs of recovery in Poland

Retail sales showed the first signs of annual growth since January, rising by 2.3% YoY. Construction output also expanded by 9.8% YoY, pointing to a solid start to the fourth quarter for the Polish economy. This recovery should continue on the back of reviving private and public consumption, and in 2024, GDP could grow by around 3%.

A solid start to the fourth quarter for retail sets the stage for consumption bounce back

Retail sales of goods rose by 2.8% year-on-year in October (versus our expectations of 2.3% and the consensus view of 1.4%) after shrinking by 0.3% YoY a month earlier. This was the first increase in goods sales in real terms since the turn of 2022/23. The seasonally adjusted data showed the fifth consecutive month of sales growth. The highest double-digit increases were recorded in fuel sales (16.7% YoY) and car sales (12.3% YoY). Weakness persisted in sales of durable goods other than auto. Double-digit declines were recorded in the furniture, consumer electronics, and household appliances category (-10.9% YoY) and in the group comprising newspapers, books and other sales in non-specialised shops (-11.1% YoY).

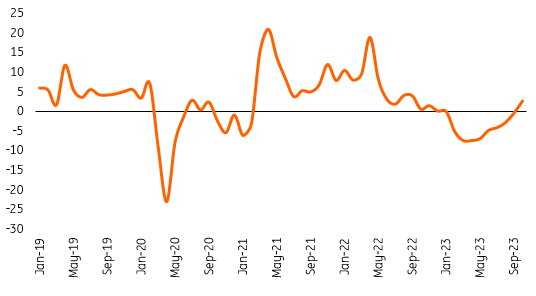

Retail Sales turned positive again after months of declines

Retail Sales of goods, %YoY

Source: CSO data.

The start of the fourth quarter of this year is encouraging for the retail trade. The recovery of real household disposable income is continuing. In October, real wages in the corporate sector increased by nearly 6% YoY. Consumer sentiment – including willingness to make major purchases – has been steadily improving since the beginning of the year. We expect the fourth quarter to see a year-on-year increase in household consumption, with a further rebound continuing into 2024.

Next year, economic growth should reach 3%, driven mainly by private and public consumption growth. Private consumption would be supported by an increase in real disposable income due to lower inflation, while public consumption would benefit from high valorisation of social benefits (with more than 800 pensions) and planned salary increases in public services and administration.

Construction output growth still close to double-digits

Construction output jumped up by 9.8% YoY in October after 11.5% in September, slightly below the market consensus of 10.5%. The annual growth was supported by a higher number of working days (22 vs. 21 a year earlier) and favourable weather conditions for construction activity (the average air temperature was 10.9˚C, 2.1 ˚C higher than the multi-year average for that month). On a monthly basis, output rose by 2.5% MoM after 11.4% in September, although on a seasonally adjusted basis, it fell by 1.1% MoM.

Almost double-digit growth in construction

Construction output, %YoY

Source: CSO data.

In regards to composition, output in the area of building construction slowed in October (1.1% YoY after 3.9% in September), while civil engineering construction remained strong (+17.6% YoY after +17.9% in September), and specialised works growth slowed slightly (7.1% YoY in October after 10.0% a month earlier).

We associate the continued strong growth in civil engineering construction with public investments co-financed by European funds. This December marks the end of access to funds from the 2014-20 financial perspective, and the end of the budget perspective usually brings an accumulation of spending.

Growth in building construction output was supported by easier access to mortgages, linked to the high popularity of the government's programme subsidising mortgages (launched in July), the fall in lending rates following rate cuts from the National Bank of Poland (by 75bp in September and 25bp in October) and the easing of the regulatory buffer. These factors have boosted borrowers' credit eligibility and underpinned demand for mortgages.

The construction industry is adding its share to the recovery scenario in the Polish economy. In the coming months, we assume a continuation of the improvement in the construction of buildings. The situation in civil engineering will be supported by good prospects for the rapid unlocking of EU funds, including from the Recovery and Resilience Fund, in early 2024. Without this inflow, we would see a decline in the inflow of European funds relative to 2023.

The prospect of an economic rebound accompanied by CPI inflation running well above the target means that the MPC may refrain from further interest rate cuts. Our baseline scenario assumes that NBP rates will remain unchanged until the end of 2024 (with the main rate still at 5.75%).

Read the original analysis: Retail Sales and construction point to signs of recovery in Poland

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.