Results of the UK’s televised debates, CAD CPI and risk assets supported on trade scepticism

What was the result of the UK TV debate between Corbyn and PM Johnson last night?

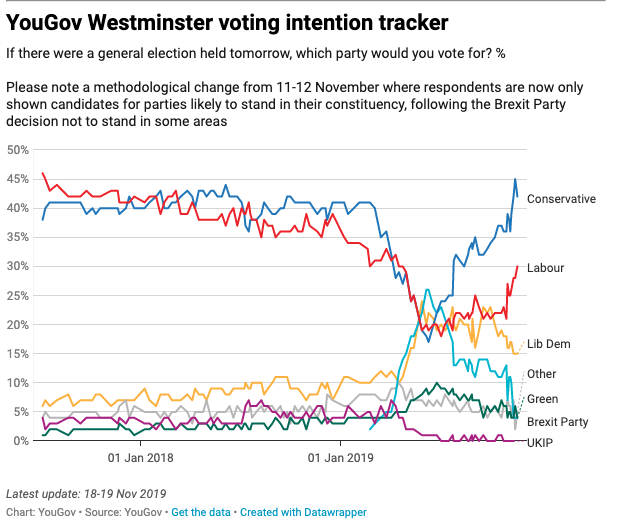

A UK poll conducted by YouGov / Sky News last night on who performed the best at the leader debate last night showed the results were nearly split exactly down the middle. From a total of 1600 people PM Johnson received 51% of the votes and Jeremy Corbyn 49%. The latest YouGov poll also out last night had Conservatives down with a 42% lead (-3%), Labour 30% (+2), Lib Dem 15% (unch) and Brexit Party 4% (unch). The GBPUSD has fallen away from the overhead 1.3000 resistance level (there is a large option level there today) as the Conservative party gives up some of their recent lead in the polls.

CAD CPI numbers at 13:30 GMT

The two main scheduled events today are the CAD CPI numbers and the FOMC minutes out later this evening. The BoC has taken a more dovish turn lately as the BoC have highlighted their concerns on the US-China trade war and its repercussions for the Canadian economy. The CPI data out today will be viewed carefully for any hints that the BoC will be coming off the sidelines with a rate cut in December. The data points are expected to be in line with the BoC's 2% inflation target. The BoC's preferred measure of inflation is in this order: the Common, Trim, and Median with the main focus on the Common. For a significant move on CAD look for a major miss on the CPI readings (sub 1.9%) and a corresponding risk off tone. This is the most anticipated event of the week in a quiet data week.

Increasing US-China tensions supports safe haven assets

The uncertainty over a coming trade deal between the US and China is continuing to weigh on risk sentiment this morning. Latest tensions seem to arise from the US Senate unanimously approving the Hong Kong Human Right Bills. China's foreign ministry has strongly condemned the Senate calling for the US to stop interfering in Hong Kong and China affairs. The hopes for a an extended ‘phase 2 deal' is greeted with broad scepticism. In this environment expect AUD, NZD and CAD weakness and JYP, CHF and USD strength.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.