Reserve Bank of Australia Preview: How aggressive can it be?

- The RBA will likely increase the cash rate by 50 basis points.

- Australian inflation continues to rise in the second quarter of the year.

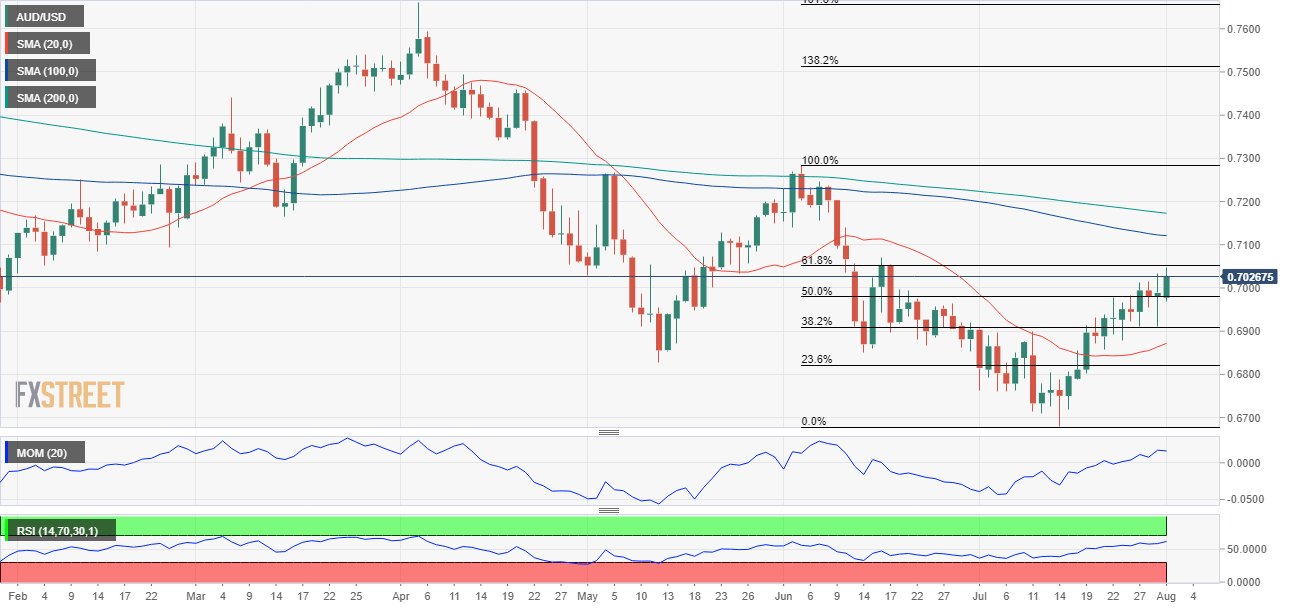

- AUD/USD is technically bullish and near a critical Fibonacci resistance level.

The Reserve Bank of Australia will announce its monetary policy decision on Tuesday, August 2. Market participants anticipate another 50 bps cash rate hike. The central bank has accelerated the pace of tightening in June and has already hiked 125 bps this year, bringing the key rate to the current 1.35%.

Australian policymakers noted in their July statement that the cash rate’s current level is “well below” what they consider a neutral one, which should be “at least” 2.5%. Nevertheless – and along with many other central banks – the RBA is juggling to contain inflation without restricting economic growth. The annual inflation rate rose by 6.1% in the second quarter of the year from 5.1% in Q1. It was slightly below-expected but still on the rise.

It seems unlikely that the central bank will hike by 75 bps, but there are some chances of a 25 bps movement. Policymakers could turn cautious considering the impact higher rates may have on household spending, slowing further economic activity.

AUD/USD possible scenarios

A smaller-than-anticipated hike should have a negative impact on the Australian dollar, sending AUD/USD sharply lower, particularly if the market sentiment deteriorates ahead of the announcement. A 75 bps hike, on the other hand, could fuel gains towards the 0.7100 figure. Whether gains will be sustainable or if the rally will be seen as a selling opportunity will depend on investors’ perception of risk.

From a technical perspective, AUD/USD heads into the release with a bullish bias. The pair has neared the 61.8% retracement of its latest daily slide between 0.7282 and 0.6680 at 0.7050, the immediate resistance level ahead of the 0.7100 figure. A break through the latter will require a quite hawkish RBA hinting at an aggressive path ahead.

A move below 0.6990, on the other hand, will open the door for a slide towards 0.6910, the 38.2% retracement of the aforementioned decline.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.