Reserve Bank of Australia Preview: AUD/USD set to suffer on a dovish outlook

- The Reserve Bank of Australia is set to deliver another 25 bps rate hike in March.

- Slowing wage growth, economic activity could prompt the RBA to deliver a dovish outlook.

- AUD/USD could yield a downside break below key daily support at around 0.6690.

The Reserve Bank of Australia (RBA) is set to announce another 25 basis points (bps) hike on March 7, lifting the Official Cash Rate (OCR) from 3.35% to 3.60%. The policy decision will be announced on Tuesday at 03:30 GMT.

RBA's take on wages and rate hikes eyed

In the February monetary policy statement, the Australian central bank said that “the board expects further increases in interest rates.” Since then, there are evident signs of economic activity slowing, with household consumption growing only modestly. Australia's economy grew 0.5% in the final three months of 2022, falling well short of market expectations of 0.80% while skirting a contraction. “The household saving ratio continued to decline in the December quarter, to the lowest level since September 2017,” Australia’s Bureau of Statistics (ABS) National Accounts head, Katherine Keenan, said.

Meanwhile, the country’s Consumer Price Index (CPI) for January eased sharply to 7.40%, compared with December’s 8.40%, suggesting a declining trend in inflation is underway. Additionally, Australia’s Wage Price Index (WPI) for the final quarter of 2022 came in at 3.30%, an increase on the 3.10% pace in the September quarter and the highest since the end of 2012. But it fell below the 3.50% consensus forecast. Slower-than-expected increase in wage growth amid the elevated inflation level implied a 4.50% decrease in real wages.

Therefore, the focus will be on the March statement for any changes in the central bank’s language, with regard to the wage and rate hike outlook. Recall that the board noted last month, “wages growth is continuing to pick up from the low rates of recent years and a further pick-up is expected due to the tight labor market and higher inflation.”

These economic indicators suggest the Reserve Bank of Australia (RBA) could shift gears to a dovish stance, potentially hinting at the end of its tightening cycle earlier than expected. According to economists surveyed by Reuters, the RBA is expected to lift rates to 3.85% in the April-June quarter, a level not seen since April 2012 and hold them for the rest of the year.

AUD/USD probable scenarios

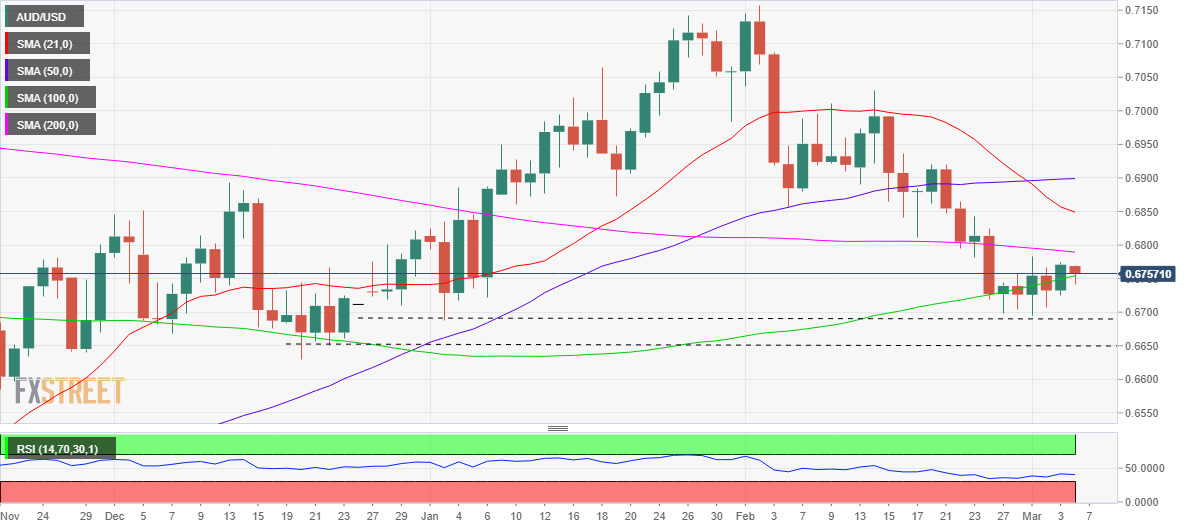

That said, a 50 bps rate hike is out of the books, leaving no scope for a surprise on the size of the rate increment. The central bank could, however, maintain that more rate hikes are expected if they disregard the benign wage growth amid elevated inflation levels. The AUD/USD pair could then recapture the mildly bearish 200-Daily Moving Average (DMA) at 0.6790 on its way to the 0.6850 price zone.

At the moment, the currency pair is holding its steady recovery mode while clinging to the critical 100 DMA at 0.6750. An acknowledgment of slowing wage growth combined with a dovish interest rate outlook by the RBA could trigger a fresh downside break, reopening floors for a test of the powerful static support at around 0.6690. Further south, the 0.6650 demand area could be breached decisively should the RBA signal a pause in its tightening cycle.

The AUD/USD price action could be limited in reaction to the RBA policy announcements, as traders will look forward to Federal Reserve (Fed) Chair Jerome Powell’s testimony on Tuesday and RBA Governor Philip Lowe’s speech at the AFR Business Summit on Wednesday for fresh hints on the future policy path.

AUD/USD: Daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.