RBNZ to hike 25bps

FX daily: Low volatility sees carry trade in focus

FX markets seem rather non-plussed about the threat of a US debt default. Instead, traded levels of volatility are sinking back to pre-Ukraine invasion levels. Investors are expecting a quiet summer. Lower volatility is favouring the carry trade, where currencies in Latin America and Central and Eastern Europe offer the highest risk adjusted yields.

USD: Dollar does ok in a carry trade world

Ongoing discussions persist to prevent a potential US Treasury debt default. The recent talks between President Joe Biden and House Speaker Kevin McCarthy regarding the debt ceiling were deemed "productive." Presently, there appears to be minimal concern priced into the market for a possible "X" date (when the US Treasury runs out of funds) in June, apart from a slight anomaly in the one-month section of the USD/JPY volatility term structure.

Instead, what stands out is the decreased levels of traded foreign exchange (FX) volatility globally, encompassing both developed and emerging FX markets. Volatility has retreated to levels like those observed before the Ukraine invasion in early 2022. This decline in volatility is driven by investor apprehensions of a prolonged period of unchanged interest rates, questioning whether the Federal Reserve will increase, decrease, or maintain rates throughout the year.

Lower volatility levels correspond with a slightly more positive risk environment, as evidenced by the MSCI World equity index inching closer to its yearly highs. Investors seem inclined to allocate funds without clear indications of impending economic turbulence arising from tighter credit conditions.

Allocating funds within the FX market involves considering the carry trade strategy, which entails expectations of spot FX outperforming steep forward curves. For instance, selling USD/MXN three months ahead would yield a 2% return if spot USD/MXN remains around its current levels. Analysing volatility-adjusted returns globally, the currencies of Latin America (particularly the Mexican peso) and Central and Eastern Europe (particularly the Hungarian forint) offer the most favourable risk-adjusted returns. These currencies have performed well so far this year and are likely to continue unless US debt ceiling negotiations deteriorate.

With overnight rates surpassing 5.00%, the US dollar demonstrates favourable metrics for carry trade strategies. The current environment explains why the Japanese yen is underperforming despite perceived risks. Unless there are clearer indications of disinflation and a slowdown in US economic activity, which I believe will be more evident in the third quarter, the dollar is expected to remain slightly strong in this range-bound FX environment. The US Dollar Index (DXY) is anticipated to trade within a range of 102.80-103.60.

EUR: Positioning still seems quite long

Despite the correction observed in EUR/USD, with the exchange rate declining from nearly 1.11 to 1.08, the overall net speculative long positioning on the Euro remains quite extended. This presents a potential risk for EUR/USD to reach the 1.05 level if certain conditions arise. These conditions could include widespread speculation regarding additional rate hikes by the Federal Reserve (currently only 10 basis points of hikes are priced in) or a severe disruption in US money markets if the US Treasury comes close to an unprecedented default on its debt. However, neither of these scenarios aligns with my primary view, and I anticipate EUR/USD to hover around the 1.08 range for the time being. I expect the third quarter to be the period when clear indications of disinflation and weaker economic data in the US will drive a more pronounced bearish trend for the dollar.

After experiencing a monthly deficit as large as €36 billion last summer due to the surge in energy prices, the Eurozone's current account is now returning to more typical monthly surpluses in the range of €25-30 billion. This serves as a reminder that EUR/USD is likely still undervalued when considering medium-term factors.

GBP: Services PMI in focus

Historically, the release of services PMI data has had a significant influence on the value of the British pound, given the substantial presence of the services sector in the UK economy. Yesterday, another negative reading came in. However, it is unlikely that such an outcome would have a significant impact on the market's current expectation of an 84% probability of a 25-basis point hike by the Bank of England on 22 June. The focus of the ongoing debate will be the UK's April Consumer Price Index (CPI) data, which will be released today.

The EUR/GBP has been trading within a clear range of 0.8660-0.8735, and it is likely that today’s CPI figures will present the best opportunity for a potential breakout from this range.

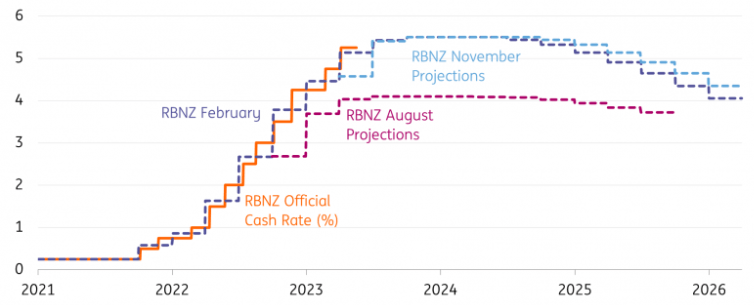

NZD: RBNZ to deliver hawkish 25bp hike

The Reserve Bank of New Zealand (RBNZ) is expected to implement a rate increase of 25 basis points to 5.50% in New Zealand. This aligns with my forecast and is also fully priced in by the markets, generating anticipation for the updated economic and rate forecasts. Initially, the RBNZ had indicated that rates would peak at 5.50%, and the economic data did not provide a compelling reason to revise the projected peak rate higher. Although the job market remained tight, inflation slowed more than anticipated in the first quarter.

The economic landscape underwent a notable change due to the government's budget announcement last week, which surpassed expectations with a fiscal boost and significantly revised growth forecasts that no longer indicate a recession this year. Additionally, consistently higher-than-expected inbound migration figures, which the RBNZ itself acknowledged as having inflationary effects, are likely to prompt the Reserve Bank to acknowledge fresh upward risks for prices and incorporate more tightening in the rate projections. While markets project a peak of 5.80%, I believe the RBNZ may raise the projected peak to 6.00%.

The movement of NZD/USD is primarily influenced by global factors and the performance of the US dollar. However, AUD/NZD has experienced increasing pressure due to the policy divergence between the Reserve Bank of Australia (RBA) and the RBNZ. If the RBNZ implements a hawkish 25 basis point hike today, it could provide support for NZD/USD even if the US dollar remains strong, while simultaneously exerting further pressure on AUD/NZD. This could potentially test the December lows of 1.0485 soon.

RBNZ rate projections

Source: ING & RBNZ

Author

ACY Securities Team

ACY Securities

ACY Securities is one of Australia's fastest growing multi-asset online trading providers, offering ultra-low-cost trading, rock-solid execution, technologically superior account management and premium market analysis. The key pi