RBNZ lowers rates by a quarter-point, New Zealand Dollar rises

The New Zealand dollar is in postive territory on Wednesday. In the European session, NZD/USD is trading at 0.5566, up 0.59% on the day.

The Reserve Bank of New Zealand lowered the official cash rate by 25 basis points to 3.5%. This is the lowest level since Oct. 2022 and follows a jumbo 50-basis point cut in February.

The RBNZ has been aggressive in its easing cycle and has slashed rates by 200 basis points since August 2024. Today's rate cut, the fourth in a row, was widely expected but the New Zealand dollar has posted strong gains.

The RBNZ rate statement note that inflation remains near the mid-point of the Bank's 1%-3% target band. Members stated that the tariff war had resulted in downside risks to New Zealand growth and inflation and that the central bank would continue to lower rates if necessary, based on the impact of the tariffs and the inflation outlook.

US-China trade war escalates

The trade war between the US and China is intensifying by the day. After China imposed 34% counter-tariffs on the US, President Trump has fired back with a 50% tariff, raising the tariff level on Chinese products to an astounding 104%. A trade war between the two largest economies in the world will dampen global growth and will hurt New Zealand's economy, as China is New Zealand's largest trading partner.

China releases the March inflation report on Thursday. CPI is expected to rebound to 0.1% y/y, after a 0.7% decline in February. Monthly, CPI is projected to remain unchanged at 0.2%. If the trade war with the US continues to escalate, China inflation's rate will likely climb higher.

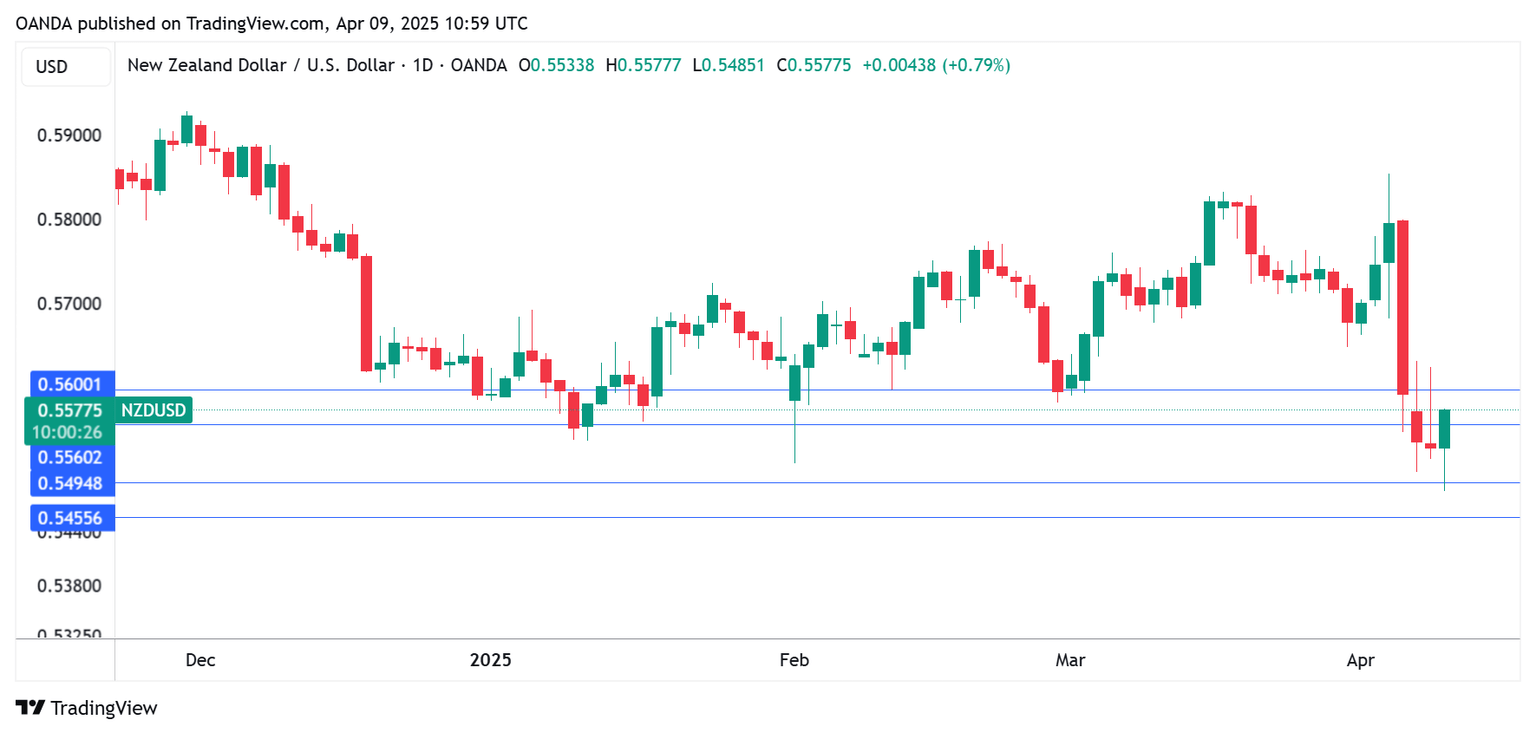

NZD/USD technical

-

NZD/USD is testing resistance at 0.5560. Above, there is resistance at 0.5600.

-

0.5495 and 0.5455 are the next support levels.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.