Rates spark: Markets didn’t have high hopes for France anyway

The spreads on French government bonds widened on the news of another fallen prime minister, but remain below previous peaks. We see many paths to further widening as the political landscape is shrouded by uncertainty. Having said that, a sharp, sudden rise in French bond yields might incite a reaction from the European Central Bank.

Plenty of paths to wider spreads on French government bonds

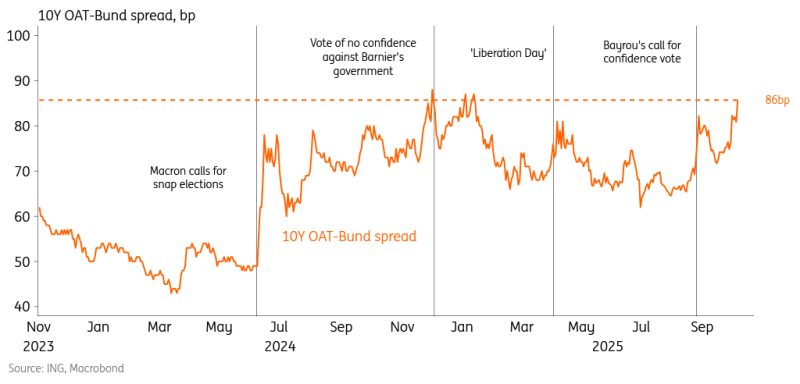

The spread of 10y French government bonds over German Bunds stood some 5bp wider at around 86bp by the end of Monday, following the news of Prime Minister Lecornu’s resignation.

During the collapse of the Barnier government in December 2024, we scraped levels closer to 90bp, and the relatively muted reaction reflects the markets' low expectations to begin with. The spillover into other eurozone bonds was also limited, with the Italian spread over Bunds widening by 1.5bp. And even here it was, in part, driven by Bunds outperforming versus swap rates as they received a small safe-haven bid. They are now a little more than 1bp above swaps – the old reflexes still work, even if less pronounced.

In a last-ditch effort, President Macron has given Lecornu until Wednesday evening to find a way out of the political stalemate. We can see French spreads experiencing more widening pressure as uncertainty lingers and new legislative elections loom, but also as the market is looking at increasing tail risks such as an early end to Macron’s presidency. If that latter fear gains more traction, we think the 10y spread could start to venture well beyond 90bp.

More fundamentally, there are rating reviews to look forward to again, with Moody’s scheduled to review its Aa3/Stable rating for France on 24 October and S&P with an AA/Negative to follow on 28 November. Fitch had downgraded France to single A in September. That said, France trading wider than Italy – still a BBB country – already reflects expectations of a further rating convergence.

The ultimate backstop to the spread dynamics remains the ECB and its Transmission Protection Instrument (TPI). It has strict conditionality on paper, but the European Central Bank has discretion on deploying this tool. Importantly, we think that as soon as monetary transmission is compromised, it will be activated. The issue here is not if, but rather how far policymakers are willing to let things escalate before intervening in French bonds – France is just too big and relevant to not do anything.

Markets will think along the same lines, and, for now, that is why the mere existence of TPI will help contain spreads. The question is whether there will be some developments that could prompt the market to test out the ECB’s pain thresholds. Here, it will be less about the magnitude, but rather the speed of any spread widening. The 10y spread gradually approaching 100bp will probably not see the ECB jumping into action.

Spreads still short of previous peaks

Source: Macrobond, ING Research

Read the original analysis: Rates spark: Markets didn’t have high hopes for France anyway

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.