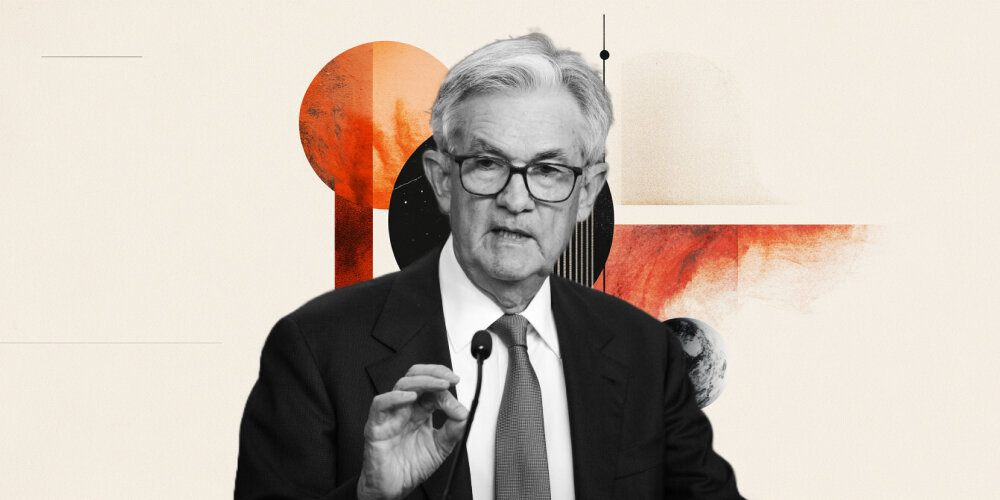

Powell strikes dovish note at Jackson Hole conference

In his prepared remarks ahead of his keynote address, Powell struck a decidedly dovish note. We see the key takeaways from his communications as the following. Firstly, he appeared more concerned about the labour market than investors had perhaps anticipated, warning that risks to employment were to the downside. Powell equally said that risks to inflation were to the upside, but he also noted that there was a reasonable base case that the inflation effects of tariffs would be short-lived.

These are two pretty pivotal threads of dialogue. On face value, Powell’s comment that the jobs market had worsened shouldn’t necessarily be a newsflash. Last month’s payrolls report was a huge disappointment, with the three-month moving average of job creation falling to its lowest level since the pandemic.

There is an argument, however, to suggest that this is largely a supply problem (partly due to mass immigration crackdowns), rather than one of demand, particularly as layoffs remain low, while job openings have been largely stable. Powell noted that labour supply had weakened, but he also said that this had softened in line with demand, suggesting that the Fed doesn’t see this as merely a supply problem.

As of yet, we’ve seen limited signs that the tariffs are acting to push up consumer inflation, but that’s not to say that price pressures don’t lie ahead. In part, this can be attributed to businesses stockpiling goods prior to the tariffs and absorbing much of the costs in an attempt to maintain market share (estimates suggest that consumers are bearing less than a quarter of the price hikes).

The July PPI figures are also a worrying prelude to rising consumer inflation. Yet, the Fed doesn’t seem overly concerned, and Powell actually talked down the inflation risk, partly due to expectations for a temporary passthrough of the tariffs, and the weakening in the jobs market, which should act to suppress demand-pull inflation.

A September rate cut now set in stone?

Arguably the key line in the communications was that the shifting balance of risks “may warrant adjusting [the Fed’s] policy stance”. We see this pivot in the language as a crystal clear signal that a September rate cut is almost certainly on the way.

Futures markets have reacted by assigning around a 90% chance of a rate reduction at next month’s FOMC meeting (up from 75%), with 55 basis points of cuts now priced in by year-end (from 49bps). We think that a September cut is now practically guaranteed, and we currently expect this to be followed up with another one in December.

The market reaction has been to send the dollar sharply lower across the board (EUR/USD leapt around 1% higher for the day by London close on Friday). Short-term Treasury yields also fell sharply (the 2-year dropped by 10 basis points), but the limited move in long-dated yields has led to a steepening in the curve, perhaps for fear that the Fed is prioritising the jobs market, while letting inflation run hot above the 2% target.

Rising fears surrounding Federal Reserve independence, and President Trump’s influence on monetary policy, are not exactly helping matters.

Author

Matthew Ryan, CFA

Ebury

Matthew is Global Head of Market Strategy at FX specialist Ebury, where he has been part of the strategy team since 2014. He provides fundamental FX analysis for a wide range of G10 and emerging market currencies.