Powell says low-income lending rules should apply to all firms

The reflation theme continues to dominate globally. Commodity prices are soaring. The ISM prices paid data point confirms the price pressures businesses are facing. Inventories are being drawn down and lead times are high as supply is failing to keep up with the resurgence in demand. US 10y yield is a tad higher. US equities ended the session on a positive note. The US Dollar retreated during the US session after US manufacturing data for April came in weaker than expected. US March trade balance, factory orders data is due today. The focus will also be on the RBA monetary policy after BoC tapered asset purchases in its policy.

Yesterday was a good day for INR assets overall. There have been some positive developments on the COVID front with certain states showing initial signs of cases peaking. Equities recouped losses from early in the session to end flat. The Nifty ended above the 14525 marks and therefore the upside momentum is still intact. Bonds rallied with the yield on the benchmark 10y ending the session 5bps lower at 6%. The focus will be on the SDL auction today.

The action in the forward market drove the spot. The Cash Tom points were as high as 4.5p, equivalent to a yield of 22%. Elevated cash Tom points reverberated across the curve. 1m forward yield rose to 8% and 1y rose above 5%. Forwards got paid heavily as the nationalized banks were apparently absent from taking the opposite of trade i.e. receiving forwards. Higher forward points make it expensive to short the Rupee against the Dollar. Spot USD/INR after opening higher, came off from highs around 74.30 to end at the low point of the day at 73.90.

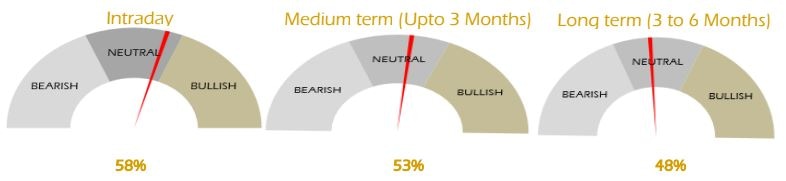

Strategy: Exporters are advised to cover a part of their near-term exposure on upticks towards 74.80-75.00. Importers are advised to cover through forwards on dips towards 73.80. The 3M range for USDINR is 73.50 – 76.00 and the 6M range is 73.00 – 76.50.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.