Pound falls to nine-week low, UK food inflation jumps

The British pound is down for a fourth straight day, as the US dollar is showing strength against most of the majors. The pound has declined 1.5% in the current slide.

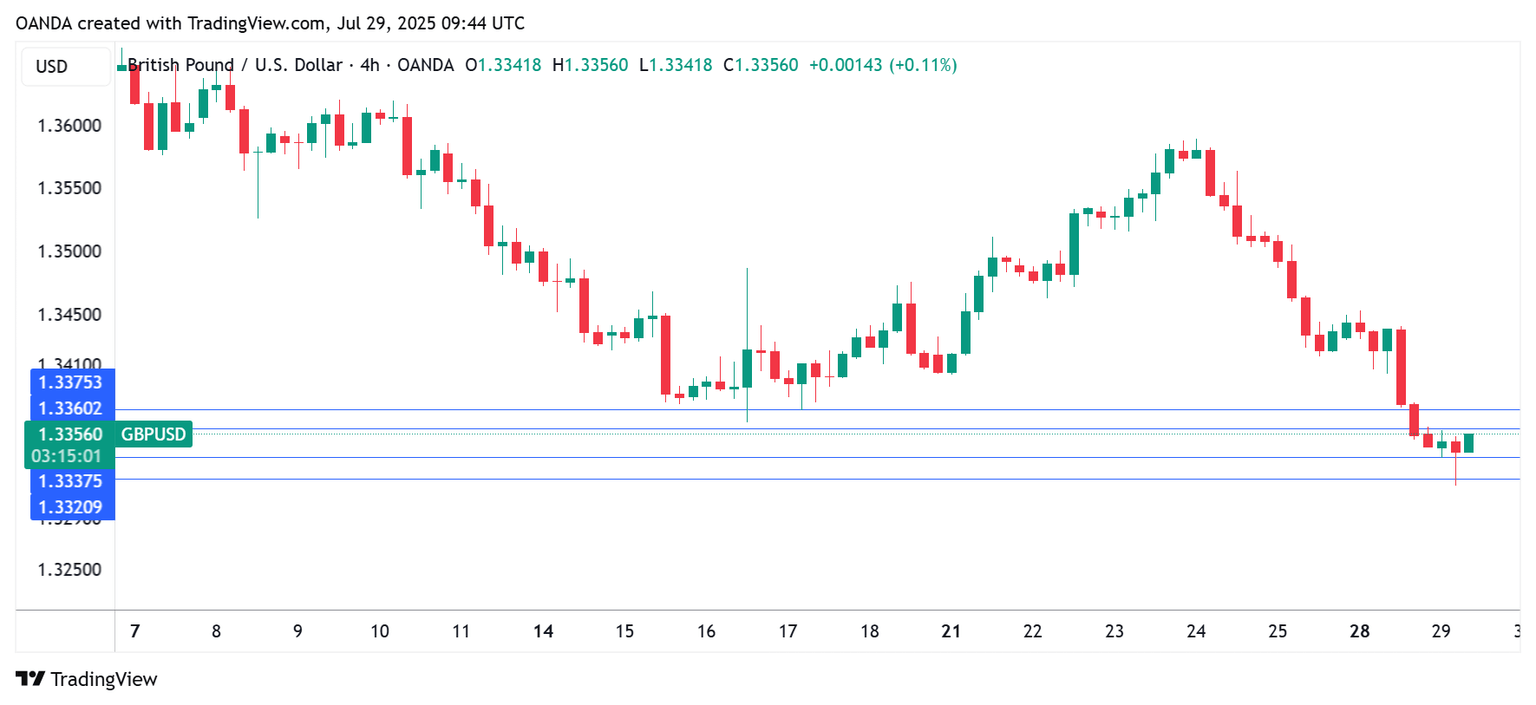

In the European session, GBP/USD is trading at 1.3338, down 0.10% on the day. The pound fell as low as 1.3315 earlier, its lowest level since May 19.

UK food inflation rises

UK inflation has been going up, so it was no surprise that the British Retail Consortium (BRC) Shop Price Index jumped 0.7% in July, up sharply from 0.4% in June and above the forecast of 0.2%.

Food inflation rose for a six consecutive month, rising 4.0% y/y in July, up from 3.7% in June. The driver of the increase was a rise in the cost of meat and tea. The increase in food prices helped boost UK inflation, which climbed to 3.6% y/y in June from 3.4% in May.

Consumers are being squeezed by rising inflation and high interest rates and are responding by holding tighter on the purse strings. The Confederation of British Industry (CBI) reported today that retail sales volumes continue to fall sharply, with a reading of -34 in July. This was an improvement from -46 in June but missed the forecast of -28.

Despite the fact that inflation is moving the wrong way, the markets expect that the Bank of England will lower interest rates next month. The central bank wants to trim the current cash rate of 4.25% and boost the economy, but the upward risk of inflation remains a headache for BoE policymakers who don't want to see inflation continue to move away from the Bank's 2% target.

GBP/USD technical

-

GBP/USD is putting pressure on support at 1.3337. This is followed by support at 1.3321.

-

There is resistance at 1.3359 and 1.3375.

GBPUSD 4-Hour Chart, July 29, 2025

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.