PCE Inflation Preview: Price pressures set to fade in Fed favorite figures, US Dollar to follow suit

- PCE inflation figures for June are set to show another decline in underlying price pressures.

- The Employment Cost Index for the second quarter is projected to decelerate.

- The Federal Reserve watches these figures closely, and markets are set to react.

Two more nails in the hiking cycle's coffin – that is what markets hope to see from a pair of inflation-related figures. Two days after the Federal Reserve (Fed) raised interest rates and stressed its dependence on data, investors are watching two figures the bank watches closely. The lower they go, the better.

Here is a preview for the Core Personal Consumption Expenditure (Core PCE) and the Employment Cost Index (ECI), due out on Friday at 12:30 GMT.

Core PCE inflation drives Fed policy

PCE is the Fed's preferred gauge of inflation as it rapidly adjusts to consumers' changing preferences. If shoppers rush to buy Barbie dolls in response to the movie, their weight in calculations of price rises grows fast. The Consumer Price Index (CPI) gauge is released earlier – triggering the biggest market reactions – but it is less accurate as it is updated less frequently.

Core PCE excludes costs of volatile energy and food, which are set on global markets. Changes in interest rates have a greater effect on underlying inflation more than the broader headline inflation.

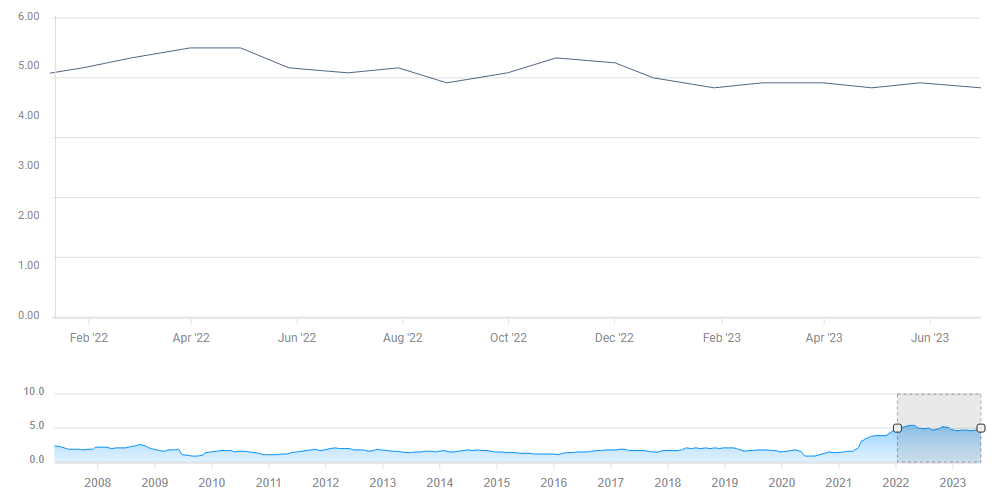

How has Core PCE recently developed? It has been gradually retreating from a peak of 5.4% YoY to 4.6% in May 2023, and a further slide to 4.2% is on the cards for June:

Core PCE YoY. Source: FXStreet

Markets are set to react to monthly changes, which better reflect the trend. Economists expect an increase of 0.2% in June after 0.3% in May. Every tenth of a percentage matters. A 0.3% rise would be positive for the US Dollar and adverse for stocks. A meager 0.1% increase would lift shares and grind the Greenback.

What about a 0.2% read? This is when another factor comes in.

Employment Cost Index (ECI) is a Powell favorite

The world's most powerful central bank is content with easing housing inflation – a result of its rate hikes – and also the costs of goods. Supply chains have unsnarled. However, the Fed remains worried about “non-shelter core services” inflation, which means growth in wages of hairdressers, accountants and of every employee in the labor-intensive services sector.

While the monthly wages component of the Nonfarm Payrolls provides an instant snapshot of such costs, the Fed also eyes the broader quarterly Employment Cost Index. Chair Jerome Powell mentioned the upcoming ECI report in his press conference on Wednesday, adding to evidence of its importance for policy makers.

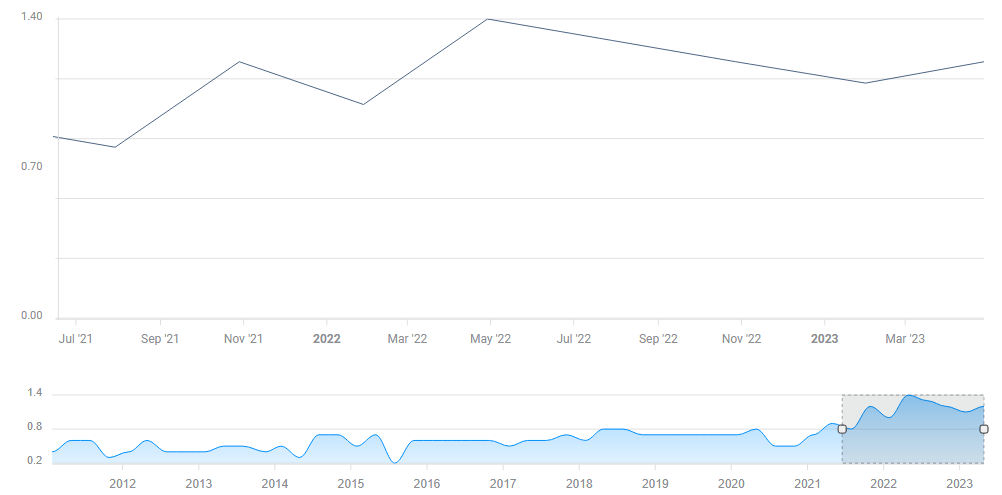

The ECI stood at 1.2% in the first quarter, down from a peak of 1.4%. A retreat to 1.1% is expected for the second quarter.

Employment Cost Index. Source: FXStreet

Once again, every tenth counts, especially if Core PCE meets expectations. A 1% read would support stocks and weigh on the US Dollar, while a 1.2% outcome would do the opposite.

Final thoughts

Both the Core PCE and ECI indexes are set to retreat, in line with other softening inflation indicators. I expect the figures to lean lower, perhaps missing estimates, thus adding to the market conviction that the Fed is done raising rates – prolonging the party in stock markets and extending the US Dollar's long march south.

The data is out on Friday, at the end of a busy week, and will likely trigger significant volatility.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.