Oil At 13 Month Low, More Downside To Come?

Aggressive selling continues in oil as fears deepen that the rapid spread of coronavirus will lead to a global pandemic and potentially to a global recession.

US Crude oil is trending lower for its fourth straight session with few signs that the bulls will take back control anytime soon. The global demand picture is weakening by the day as coronavirus spreads across the globe.

Whilst traders had been pricing in reduced demand from China in the last two weeks of January, comments from US Federal health authorities have added to anxieties. The US CDC warning over the expected spread of coronavirus in the US has meant that reduced demand from the largest oil consumer in the world is now also starting to be priced in.

API data

API reported a smaller than forecast inventory build of 1.3 million barrels, versus expectations of a 3-million-barrel increase. Today’s EIA weekly inventories report is expected to show a build of 2.3 million barrels.

As coronavirus panic takes over, traders are become increasing more concerned with how global oil demand will be hit and less interested in weekly inventory data. There seems to be little interest in the steep decline in Libyan output or whether the OPEC+ group decides to trim production again.

OPEC

It is doubtful that OPEC+ will announce further output cuts right now, without having further information on loss of demand. There is a good chance that they will wait for fresh economic data to assess the impact of coronavirus first. Even if OPEC did announce additional production cuts, we are more likely to see some short covering now rather than a change of trend.

Levels to watch

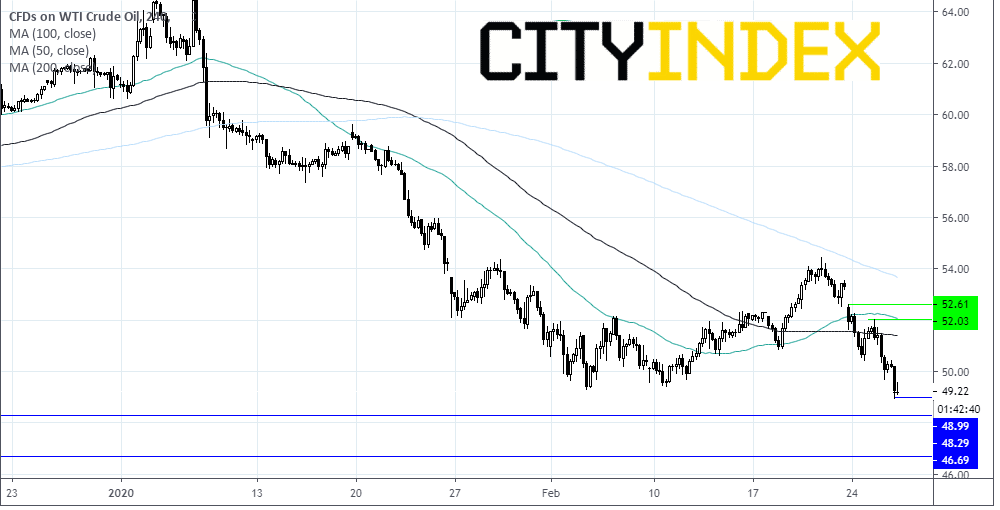

Crude is down 1.7% today and almost 8% so far this week. Crude trades at a 13-month low and below its 50, 100 and 200 moving average, with a bearish outlook.

Immediate support can be seen at $49 (today’s low), a break through here could open the door to $48.30 (8th Jan ‘19 low) prior to $46.70 (4th Jan’19 low).

Resistance csan be seen at $50.42 (today’s high). This could lead towards resistance at $52. (yesterday’s high), a breakthrough there could negate the current bearish trend.

Author

Fiona Cincotta

CityIndex