NZD/JPY Elliott Wave forecasting the path: Zig zag pattern

In this article we’re going to take a quick look at the Elliott Wave charts of NZDJPY published in members area of the website. NZDJPY has given us recently ((x)) connector that unfolded as Elliott Wave Zig Zag pattern. Pull back completed right at the extreme zone as we expected. In the further text we are going to explain the Elliott Wave Forecast.

NZD/JPY Elliott Wave 1 hour chart 04.20.2023

We are calling cycle from the 83.90 still in progress. We got 5 waves decline from the mentioned peak which suggests we ended only first leg of the correction. Wave (b) was deep recovery, however as far as the price stays below 83.72 high, we still expect to see another wave down which should also unfold as 5 waves. More precisely we are now in wave iii of (c) of ((x)). The pair is targeting 81.95-81.52 area. As our members know we target get by Fibonacci extension tool. Mentioned zone is equal legs area from the 83.90 peak.

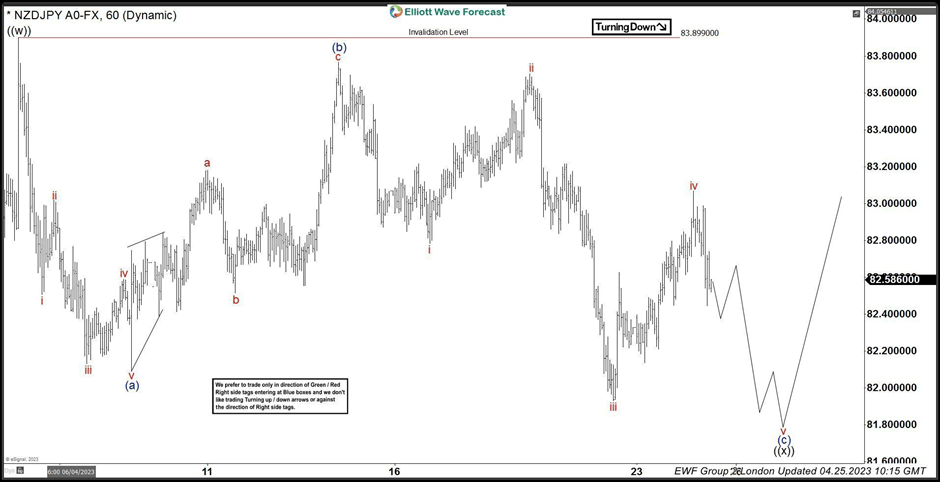

NZD/JPY Elliott Wave 1 Hour chart 04.25.2023

The pairs has given us decline toward proposed area. However at this moment (c) leg shows incomplete sequences. The pair is missing another wave down so we can count clear 5 waves in (c) blue wave. While below 83.05 high, we assume iv red is competed there and wave v is in progress. More precise target zone for wave v red would be inverse 1.236-1.618 fib ext of wave iv that comes at 81.69-81.27 area.

NZD/JPY Elliott Wave 1 hour chart 04.28.2023

NZDJPY made another leg down as proposed toward 81.69-81.27 area . Wave ((x)) connector completed at 81.54 low. The pair has found buyers and made very good reaction higher as we expected. As far as 81.5 pivot holds, more upside can be seen in the pair.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com