Nonfarm Payrolls Preview: High expectations set deal the dollar a blow, create buying opportunity

- Economists expect the US to report an increase of 250,000 jobs in July, lower than 372,000 in June.

- Strong employment components in the ISM surveys and three consecutive beats raise expectations.

- An as-expected figure could push the dollar down on lower Fed expectations.

- Investors may quickly return to the greenback's safety ahead of the weekend.

Sell the whisper, buy the fact? Paraphrasing one of the most common market patterns, I believe that real expectations for Nonfarm Payroll are above what is seen on the calendar, raising the chances of a disappointment. Nevertheless, that could be only a knee-jerk reaction before a "There Is No Alternative” (TINA) mood returns, benefiting the dollar.

The economic calendar is pointing to an increase of 250,000 jobs in July, lower than the 372,000 recorded in June. The labor market is expected to cool down in response to higher inflation and the Federal Reserve's rapid tightening. The pre-pandemic average was around 200,000, so a return to similar levels seems reasonable.

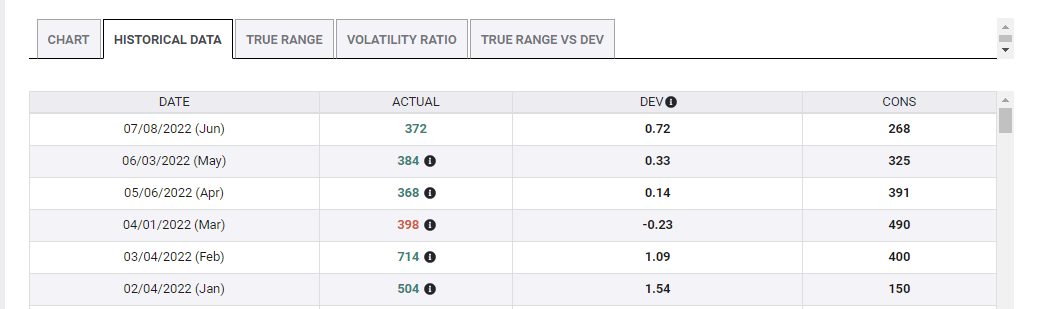

However, those same assumptions proved wrong in the past three releases, especially the last one:

Source: FXStreet

Moreover, the headline NFP beat estimates in five of the six releases so far this year. I think that will lead investors to project more than 250,000 job gains, casting doubts about predictions that have proved pessimistic.

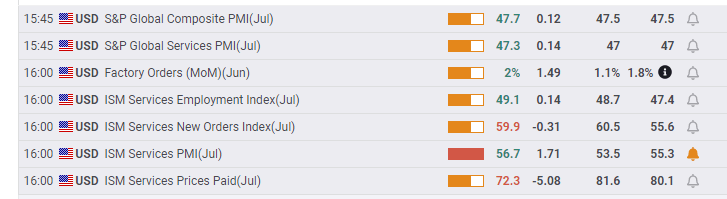

Another reason to expect a higher "whisper number" for the NFP comes from the ISM Purchasing Managers' Indexes. The focus in PMIs for both the manufacturing and services sector reports was on the Prices Paid component, reflecting inflation. Nevertheless, regarding Nonfarm Payrolls positioning, the Employment components matter more – and they both surprised to the upside.

In the Manufacturing PMI, the employment component rose from 47.3 to 49.9 points, beating estimates for 47.4. In the larger services sector, the gauge for the labor market rose from 47.4 to 49.1 points, exceeding 48.7 projected. While figures below 50 reflect contraction, the significant improvement shows that hiring remains robust. These figures are not lost on investors.

Data points on Wednesday were generally positive:

Therefore, I believe that real or "whisper" estimates for the NFP stand at around 300,000 or even 350,000. A higher bar means a greater chance for disappointment.

Nonfarm Payrolls initial reaction

What would happen if economists are right this time? What happens if those business surveys fail to reflect hiring trends? In case the headline Nonfarm Payrolls comes out under 300,000, I think the dollar will dive.

Any such outcome would show that the labor market is losing steam, leaving less room for the Fed to raise rates. If fewer than 200,000 positions were created last month, the blow to the dollar could be worse.

It would probably take another blockbuster report of 400,000 or more to trigger a positive dollar reaction, one that would show that efforts to cool the economy have fully failed and that higher rates now and in the future are needed.

What about wage growth? Pay rises have failed to keep up with inflation but are still rising at a rapid pace of 5.1% YoY, indicating price costs have become more entrenched, potentially leading to a spiral of higher prices leading to higher salaries, in turn pushing costs higher and so on.

Back in June, Average Hourly Earnings rose by 0.3% as expected, and a repeat of last month expected in July. Contrary to previous months, I think wages will likely have a smaller impact on the market reaction. The Fed wants to see a bigger economic cooldown – not only wage growth decelerating but also job growth reversing.

Similar to inflation, monthly earnings figures are becoming more important than yearly ones. If wage growth rises by 0.4% or more, it would support the dollar, while an outcome of 0.2% or lower would suppress the greenback. Nevertheless, the headline matters more.

Post-initial reaction

As I've detailed above, I think that real Nonfarm Payrolls expectations are high, potentially leading to a disappointment and a drop in the dollar. However, any retreat by the greenback will probably be followed by a bounce. Why?

First, the knee-jerk reaction to the NFP can often be the wrong one. Secondly, investors tend to rush to safety ahead of the weekend, and the dollar is the obvious choice.

Third and most importantly – There Is No Alternative (TINA). The Bank of England was not only the latest to raise rates by more than the standard 25 bps, but also to paint a picture of uncertainty, sending the currency down. The European Central Bank, Reserve Bank of Australia, and the Fed added to the uncertainty.

Nevertheless, Fed officials quickly came out against market expectations that rate cuts would come in 2023. Other central banks remain mum, worrying about a recession more than the central bankers in Washington. That gives the dollar – which is also a safe haven – an advantage.

I think that after an initial reaction to the data, investors will quickly zoom out and return to the safety of the dollar.

Final thoughts

Nonfarm Payrolls always have a considerable effect on markets, and fears of a slowdown give the upcoming July report extra impetus. While high "real" expectations may lead to disappointment and a dollar decline, the greenback has room to recover afterward.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.