Nonfarm Payrolls Preview: Four scenarios for a jobs report set to test US economic resilience

- Economists expect the US to report an increase of 170,000 jobs in August, extending the slowdown in job creation.

- A series of weak data points has downwardly revised market estimates, lowering the bar for an upside surprise.

- A weaker outcome may fully convince investors that the Federal Reserve is done hiking rates.

Is a winter recession coming? That has been the notion from a series of data misses from the US this week, yet the all-important Nonfarm Payrolls report has the last word. Yet after substantial falls for the US Dollar, a minor upside surprise could spark a rally for the Greenback.

Here is a preview of the US Nonfarm Payrolls (NFP) for August, due on Friday at 12:30 GMT.

Data leading to NFP shows rate hikes are biting

US Gross Domestic Product (GDP) figures for the second quarter were downgraded from 2.4% to 2.1%, but that quarter ended two months ago. The JOLTS Job Openings plunged below nine million, indicating reduced hiring intentions.

On their own, the JOLTS data for July or the backward-looking GDP data for 2Q would have had less impact. However, these two indicators were accompanied by more recent and more worrying data. The Conference Board's Consumer Confidence measure tumbled from 116 to 106 – and showed a discouraging increase in the "jobs hard to find" gauge.

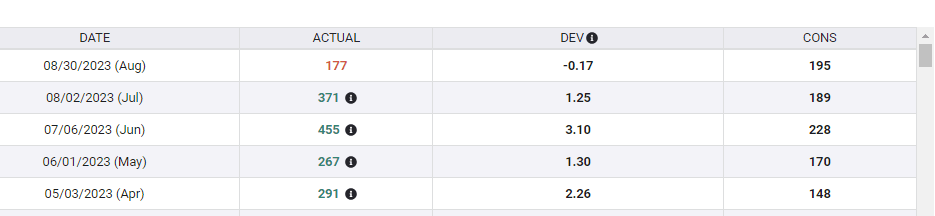

Arguably the most important release – at least the one most related to the Nonfarm Payrolls – came from ADP. America's largest payrolls provider reported an increase of only 177,000 jobs in August. While ADP revised its estimate for the previous month to the upside, the report seemed to point to a peak in July – and it may be all downhill from here.

While the ADP model has diverged considerably from the official Labor Department’s data, the latest report from the payroll provider showed some warning signs:

ADP jobs reports. Source: FXStreet

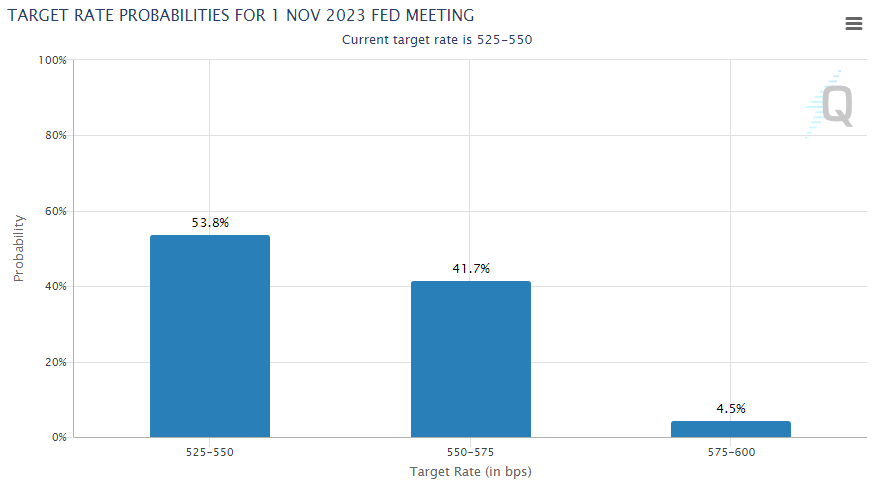

On this background, is the Federal Reserve (Fed) done raising rates? Investors are pricing out an increase in borrowing costs in November after already having cemented a no-change decision in the upcoming September meeting.

Odds of a November hike have slipped under 50%, according to data from the CME Group FedWatch Tool:

Chances of the Fed hike. Source: CME Group

Nonfarm Payrolls expectations and potential reaction

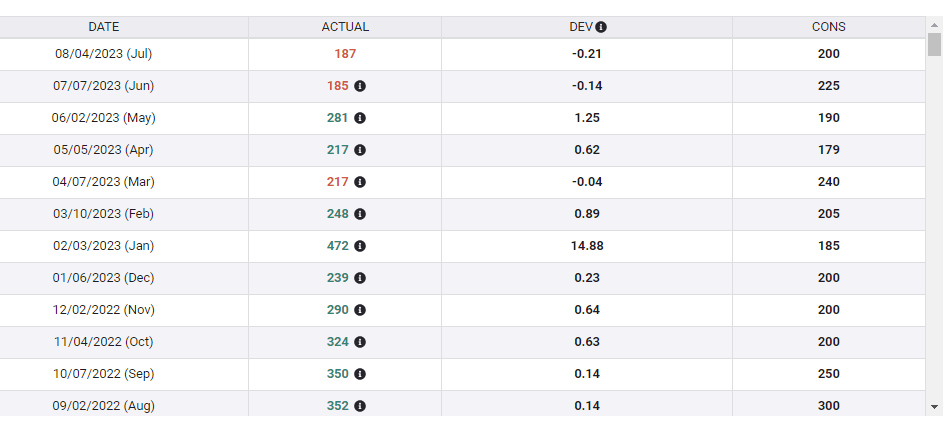

A weak Nonfarm Payrolls report is needed to celebrate the end of the hiking cycle and begin pricing cuts more aggressively. The market expects an increase of 170,000 jobs, marginally below the pre-pandemic pace of roughly 200,000 per month.

More beats than misses in the Nonfarm Payrolls reports:

NFP developments. Source: FXStreet

Here are four scenarios for the upcoming employment report:

1) Market scenario: Goldilocks comes to support stocks

Given the darkening background, real estimates are closer to 150,000. An increase of 100,000 would maintain the pressure on the US Dollar, while keeping Gold and stocks bid. It would serve as the "Goldilocks" scenario of a soft landing, indicating no more hikes, but no imminent recession either.

2) My scenario: small upside surprise and a US Dollar upside correction

My baseline scenario is somewhat more optimistic, of an increase closer to 200,000. The jobs report surprised to the upside in almost all reports since early 2022, and another beat cannot be ruled out. Moreover, merely an increase of 170,000 would counter the gloomy picture painted by other data figures.

The US Dollar would stage a much-needed upside correction, while Gold and stocks would suffer some profit-taking.

3) Depressing scenario: winter is coming

The two scenarios above are the most likely ones, but there are two additional ones to consider. If data leading to the NFP were only the appetizer for a devastating report, Goldilocks would fail to show up.

An increase of fewer than 100,000 would raise recession alarms, sending safe-haven flows toward the US Dollar, while stocks would sink on fears of falling corporate profits. Gold would probably edge higher, taking advantage of falling yields.

4) Upbeat scenario: Strong hiring continues, and could hikes

Another extreme scenario is of a substantial upside surprise, of over 200,000 jobs gained, or potentially surpassing 250,000. In such a case, a November hike would return to the table, with the Greenback gaining ground, shares shivering, and Gold melting. Until two weeks ago, US data mostly exceeded estimates.

Final thoughts

Markets have become ever-sensitive to data, and Nonfarm Payrolls have an even more important impact due to growing uncertainty and also the upcoming long weekend in the US. Investors might prefer closing more positions than usual before Labor Day.

My baseline scenario is a small beat of market estimates, triggering an upside correction for the US Dollar. Still, the three other scenarios described above should be considered.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.