No major surprises in December trade report

Summary

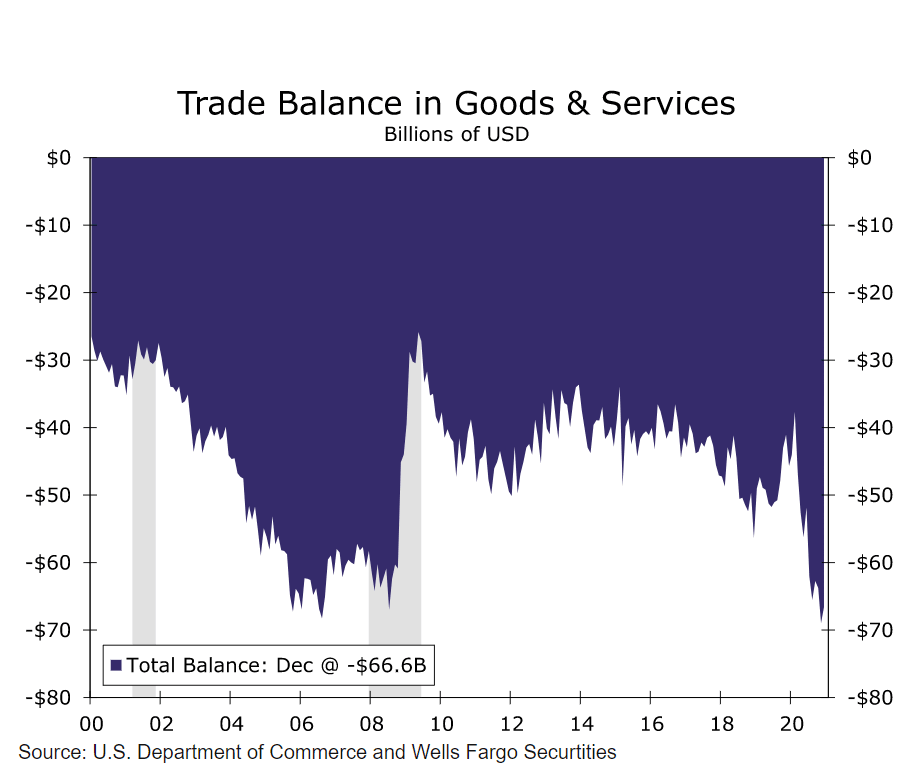

The December international trade report came in largely as the Q4 GDP report last week suggested. Exports outpaced imports resulting in the U.S. trade balance narrowing by $3.4 billion to a deficit of $66.6 billion.

U.S. Trade balance Narrowed in December

Trade flows continued to recover in December. But, as exports outpaced imports, the overall U.S. trade balance narrowed by $3.4 billion to a deficit of $66.6 billion.

The underlying details of the report came in largely as expected. Exports were particularly strong to end the quarter, but imports also held their ground. December's report confirms what we already know from last week's Q4 GDP data; net exports subtracted roughly 1.5 percentage points from overall GDP growth in the quarter. Today's report suggests net exports will likely be a neutral force in the first quarter and may even provide a modest boost to GDP growth.

Strength in Exports Should Continue in January

Total exports advanced 3.4% in December to $190.0 billion. Most of the growth was on the merchandise or goods side (+4.7%), while services (+0.5%) continue to struggle amid restrictions associated with the virus. The gain in merchandise exports was broad based with every major category advancing. The pick-up in industrial supplies (+4.3%) and automotives and parts (+6.9%) was particularly strong and consistent with recent U.S. manufacturing data.

Even with the sizable gain in December, exports remain constrained. Total exports remain roughly 9% below their pre-virus February 2020 level as global growth has been slower to recover amid renewed COVID restrictions and outbreaks. Still, the strong end to the quarter positions a robust first quarter for export growth, as do recent data for purchasing manager indices in foreign economies that indicate activity has held up in January.

Something we will be paying close attention to in coming trade releases is the civilian aircraft export component. Boeing resumed deliveries of its 737 MAX aircraft in December. Data from Boeing showed two 737 MAX aircraft were delivered internationally during the month, which is reflected in the $1.2 billion in civilian aircraft exports. But in 2018, prior to the grounding of 737 MAX, nearly three-quarters of the aircraft were exported overseas, while the remaining were purchased by U.S. airlines. This suggests as deliveries of the aircraft ramp back up, exports will also move higher.

Will the Air Pocket in Good Spending Hit Imports?

Imports also advanced a strong 1.5% to $256.6 billion in December. Growth in imports were more evenly balanced, as services imports (+1.8%) modestly outpacing goods (+1.5%). Still, services imports remain bogged down by restrictions on activity and it is unlikely we see a full recovery in this component until vaccines are widely administered. Service imports remain nearly 20% off their pre-virus February 2020 level.

Merchandise imports, however, have been the quickest to recover and are nearly 4% ahead of where they were in February of last year. Strength in merchandise imports mirrored exports, with industrial supplies (+6.8%) and automotives and parts (+6.3%) notching the strongest gains.

Particularly noteworthy, was a -3.1% decline in consumer goods imports in December. This category has been particularly strong since lockdowns were lifted last spring and posted two back-to-back gains in the months prior likely reflecting holiday sales. But, U.S. consumer spending on goods stumbled at the end of the year, and we look for an air pocket in goods spending this year as services spending begins to ramp up. Decreased consumer demand may weigh on consumer goods imports, but still-lean inventories suggest that imports of consumer goods shouldn't crater.

Author

Wells Fargo Research Team

Wells Fargo