New Zealand Dollar sinks after RBNZ cuts by 50 bps

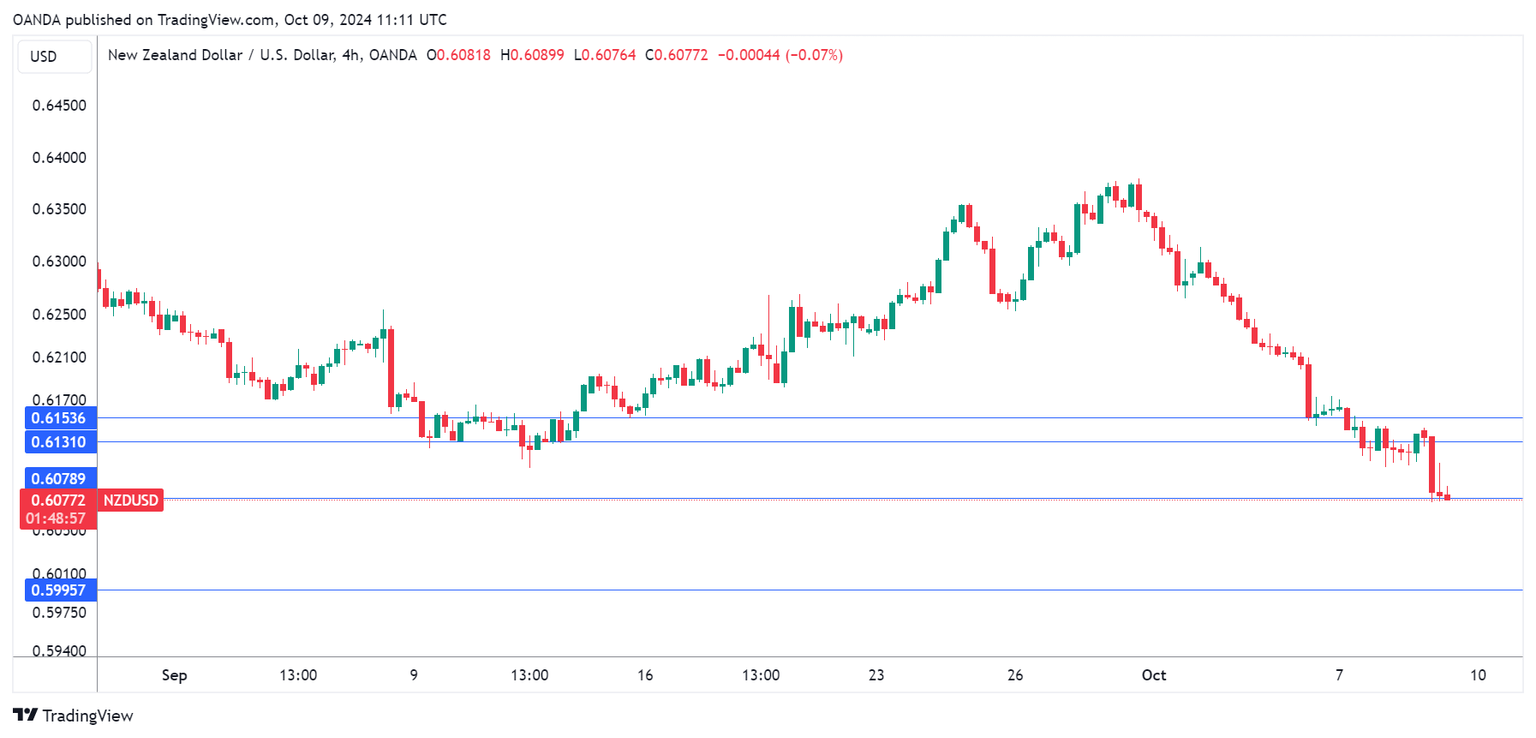

The New Zealand dollar is sharply lower on Wednesday. NZD/USD is trading at 0.6079 in the European session, down 0.96% on the day.

RBNZ slashes rates to 4.75%

The Reserve Bank of New Zealand lowered the cash rate by 50 basis points on Wednesday to 4.75%. The RBNZ cut rates by 25-bps in August, the first rate cut in over four years. The jumbo rate cut had been priced in by the markets but the dramatic move has sent the New Zealand dollar sharply lower.

The rate statement noted that inflation was within the target range and was “converging on the 2% midpoint”. This is a remarkable turnaround by the central bank, which only a few months ago was warning that inflation was too high and could force the Bank to raise rates. The RBNZ had projected that initial rate cut would not occur before mid-2025 but has moved up the timetable in dramatic fashion.

The decision to cut rates by 50 bps is not surprising, given that inflation has been falling and GDP contracted in the second quarter. New Zealand releases the quarterly inflation report next week and if inflation is within expectations, it could set up another rate cut at the November meeting.

The RBNZ would like to continue trimming rates but the sharp decline of the New Zealand dollar is a concern. The New Zealand dollar has plunged 4.25% in October and has slipped to a seven-week low. Today’s oversized cut sent the kiwi sharply lower and further cuts will add downward pressure on the currency.

NZD/USD technical

-

NZD/USD has pushed below several support levels and is testing support at 0.6079. Below, there is a monthly support level at 0.5995

-

There is resistance at 0.6131 and 0.6153

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.