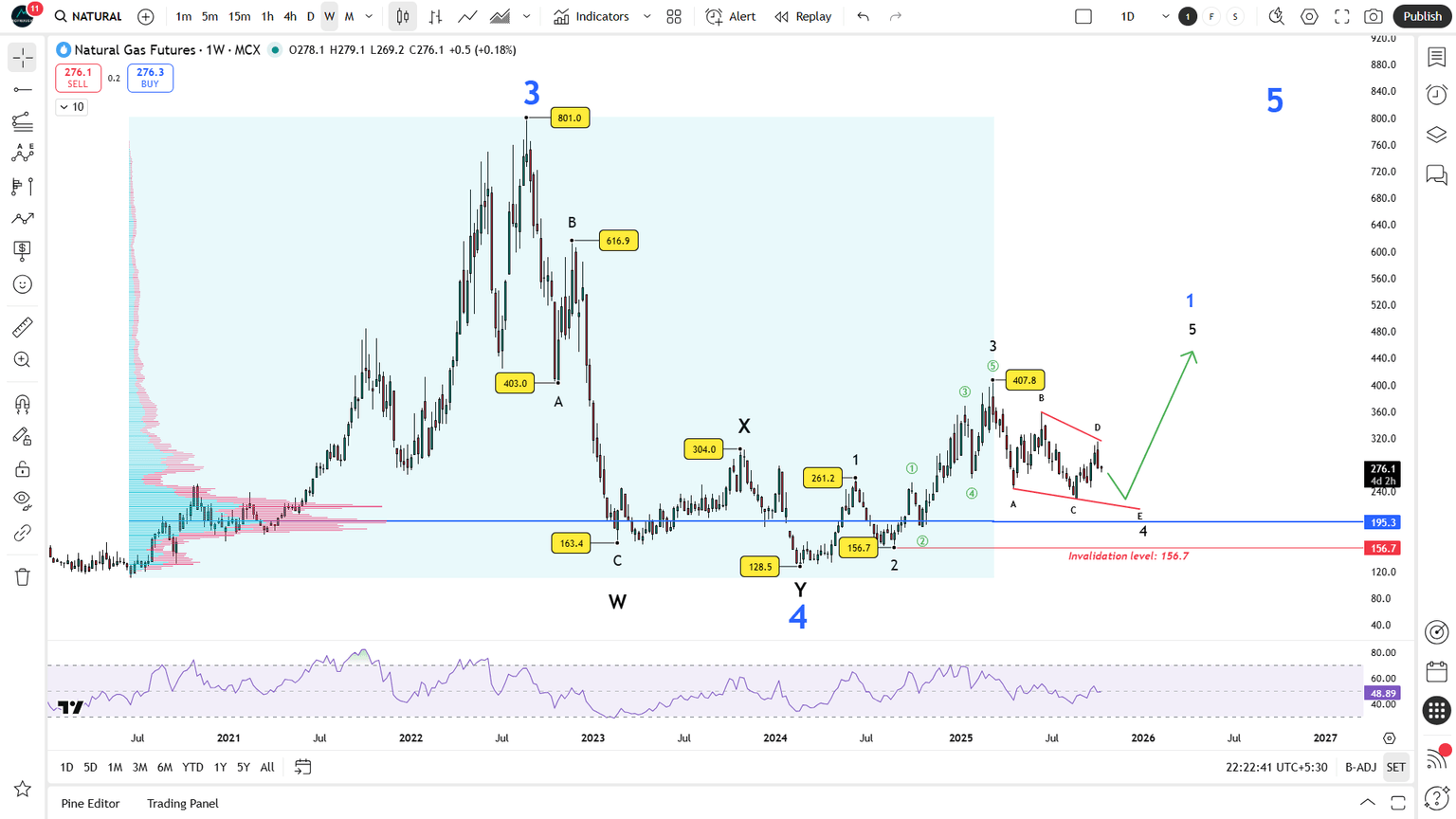

Natural Gas futures: Wave 4 triangle in play

Natural Gas Futures continues to consolidate within a contracting Wave 4 triangle, showing signs of coiling momentum before the next directional move.

The decline into ₹128.5 in early 2024 likely completed a W–X–Y complex correction, marking the end of Wave 4 of a higher degree. From that low, price advanced impulsively to ₹407.8, which fits as Wave 3 of the ongoing minor sequence.

Currently, the market seems to be consolidating inside a contracting Wave 4 triangle (A–B–C–D–E) — a textbook Elliott pattern showing diminishing volatility and balanced sentiment before the next leg up.

Key Technical View:

-

The E-wave could test the ₹195–205 region before a breakout attempt.

-

A decisive move above ₹280–285 would confirm the end of the triangle and the start of Wave 5, with potential targets near ₹440–480.

-

The invalidation level stays firm at ₹156.7 — any breach below would negate the triangle structure.

-

RSI near mid-range (≈48) supports a coiling setup, consistent with late-stage consolidation.

If the triangle plays out, the next bullish impulse could be a strong Wave 5 toward new intermediate highs.

Author

Veerappa Kaujageri

Independent Analyst

Veerappa Kaujageri is an independent market analyst and writer based in Sweden. He specializes in Elliott Wave theory, blending wave counts with RSI, Fibonacci, channels, and volume analysis to present structured and educational insights for traders.