Nasdaq shorts at key resistance at 11650/700

Emini Dow Jones – Nasdaq

Emini Dow Jones December hit & held our buying opportunity at 27920/870 but there was no significant bounce to offer a decent profit. Eventually we collapsed another 600 ticks to the next target of 27650/600 & almost as far as strong support at 28200/150.

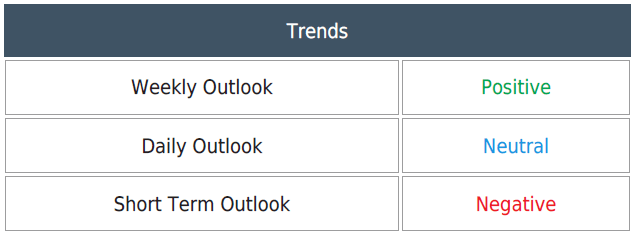

Nasdaq shorts at key resistance at 11650/700 worked perfectly. We topped exactly here & collapsed to support at 11430/400 for an easy 250 ticks profit. Although we broke lower, we unexpectedly bounced from 11343.

Daily Analysis

Emini Dow Jones bounced just 59 ticks from strong support at 28200/150. Holding above 27600/650 allows a further recovery to a selling opportunity at 27850/950 with stops above 28100.

Gains are likely to be limited but if we are able to short at 27850/950 look for 27650/600. Below 27550 risks a retest of important support at 27250/180. Longs need stops below 27140. A break lower is a sell signal initially targeting 27000 & 26800/750.

Nasdaq gains are likely to be limited with minor resistance at 11545/575 then key resistance at 11600/700. Try shorts with stops above 11750. A break higher is a buy signal initially targeting 11800 & 11860/880 with a break above last week's high at 11950 to target 12000/020 & 12150/170.

Hopefully we can get short to re-target 11430/400 & 113540/340. A break below here is an important medium term sell signal, initially targeting 11190/150 & very strong support at 11100/000.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk