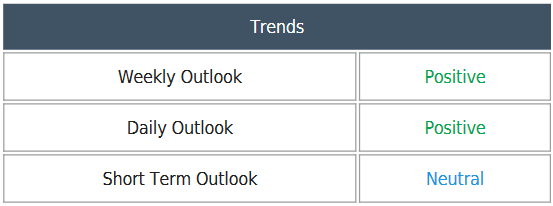

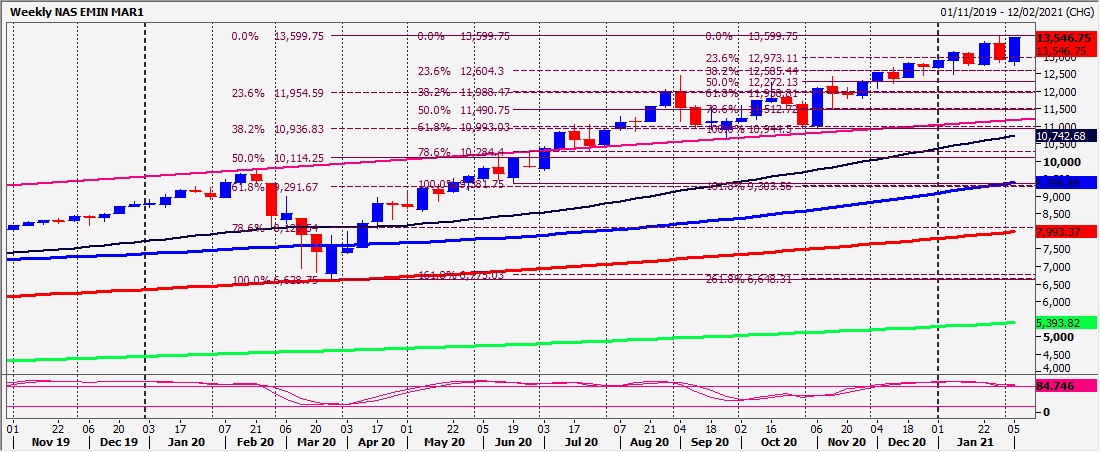

Nasdaq retests all-time high at 13550/600

Emini SP 500 – Nasdaq

Emini S&P March beat strong resistance at 3780/90 with shorts stopped above 3800for a buy signal targeting 3818/23 & 3840/43 today.

Nasdaq March higher again through 13400 opening the door to a retest of the alltime high at 13550/600. We are there as I write.

Daily Analysis

Emini S&P break above 3800 was our buy signal targeting 3818/23 & 3840/43. Thistarget has been hit as I write. Further gains certainly not out of the question for aretest of the all time high at 3857/62. Obviously a break higher is another buy signalinitially targeting 3871/74 & 3880, perhaps as far as 3895/99.

First support at 3800/3795 but longs need stops below 3785. A break lower meetssupport at 3765/60.

Nasdaq retests the all time high at 13550/600. A break higher is a buy signaltargeting 13640/650, 13680/690 & above 13710 we look for 13750/770.

Failure to beat resistance at the all time high at 13600 risks a double top sell signal.This sends prices back to 13450/400, perhaps as far as support at 13200/150.Unlikely at this stage but further losses meet strong support at 1300/12950. Longsneed stops below 12900.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk