Murrey math lines: USD/CHF, XAU/USD

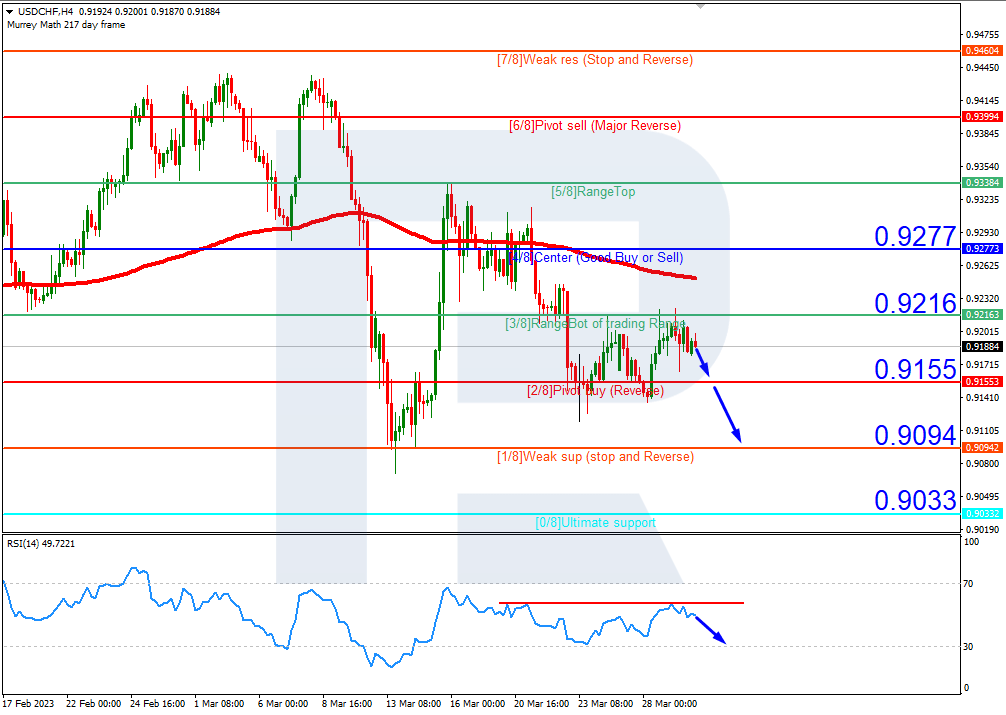

USD/CHF, “US Dollar vs Swiss Franc”

On H4, USDCHF are under the 200-day Moving Average, which indicates the prevalence of a downtrend. The RSI have rebounded from the resistance line. In this situation, we should expect the price to test the level of 2/8 (0.9155), break it, and fall to the support at 1/8 (0.9094). The scenario can be canceled if the price rises above the resistance at 3/8 (0.9216). In this case, the pair could grow to 4/8 (0.9277).

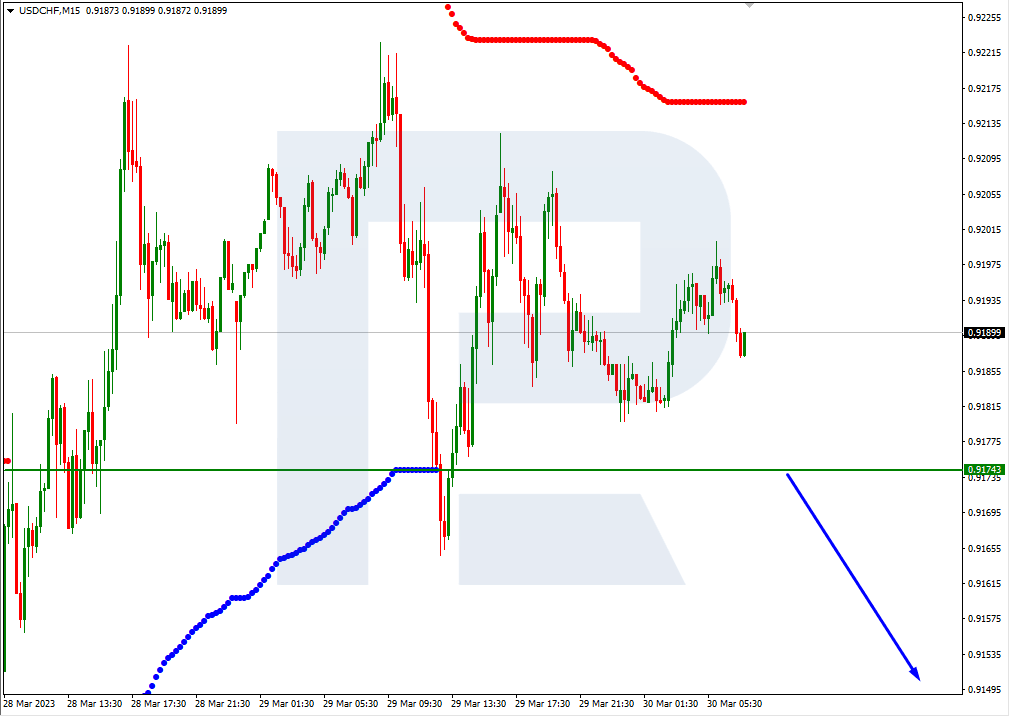

On M15, price falling can be additionally supported by breaking the lower line of the VoltyChannel indicator.

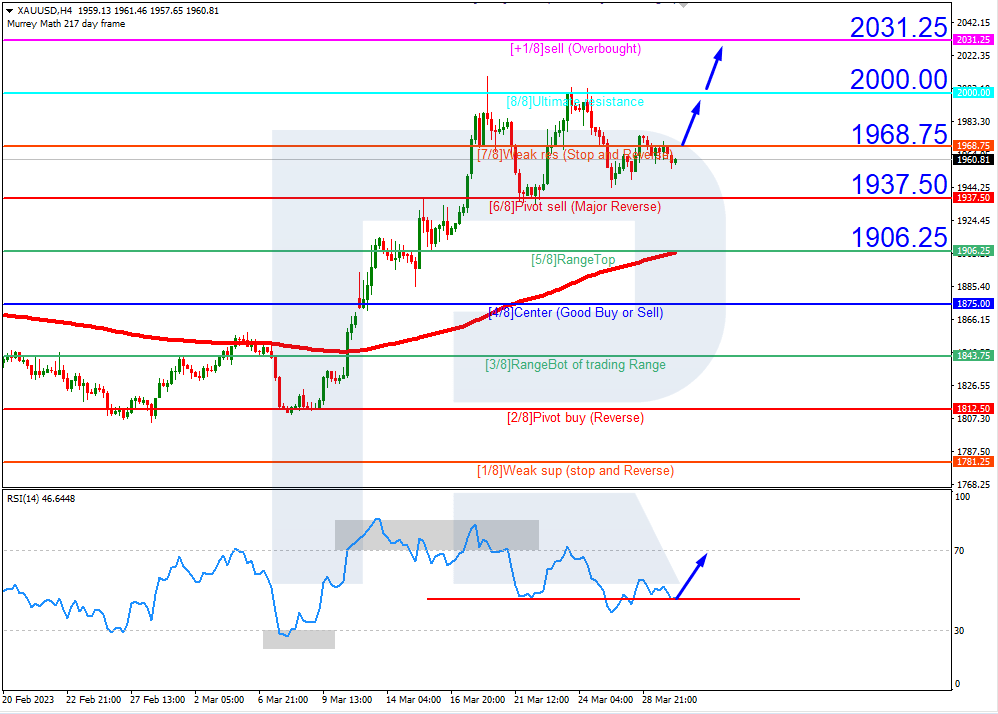

XAU/USD, “Gold vs US Dollar”

On H4, the quotes are above the 200-day Moving Average, which indicates the prevalence of an uptrend. The RSI is testing the support line. As a result, in such circumstances we expect the price to break the level of 7/8 (1968.75) upwards and then grow to the resistance level of +1/8 (2031.25). The scenario can be canceled by a downwards breakaway of the support at 6/8 (1937.50). In this case, gold quotes could correct to 5/8 (1906.25).

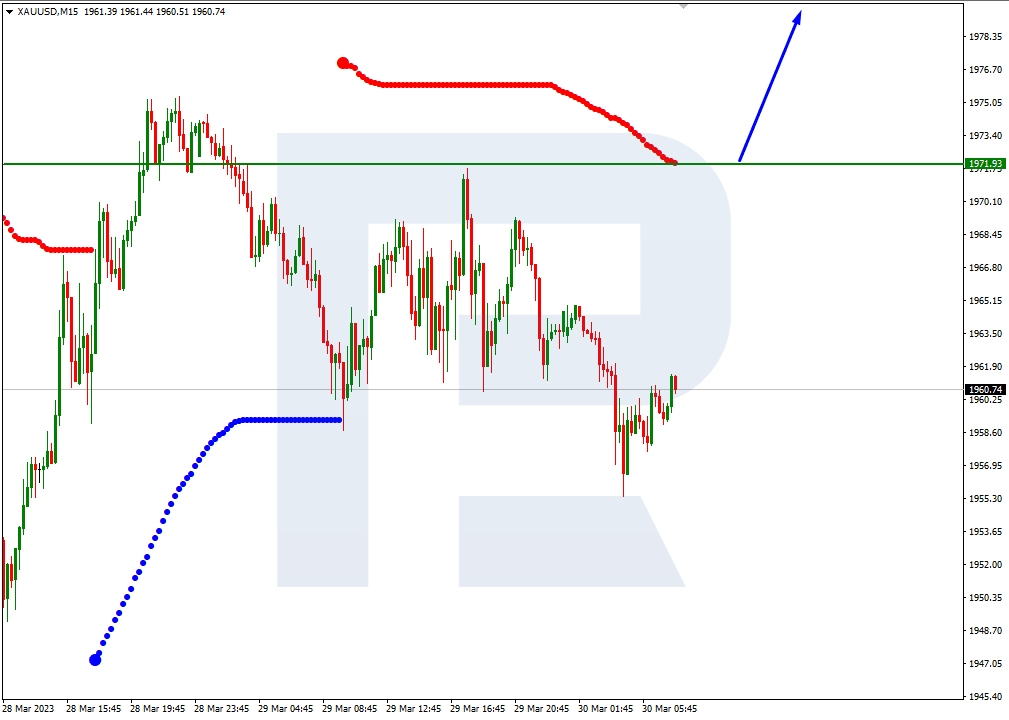

On M15, a breakaway of the upper border of VoltyChannel will increase the probability of further growth of the price.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.