Murrey math lines: EUR/USD, GBP/USD

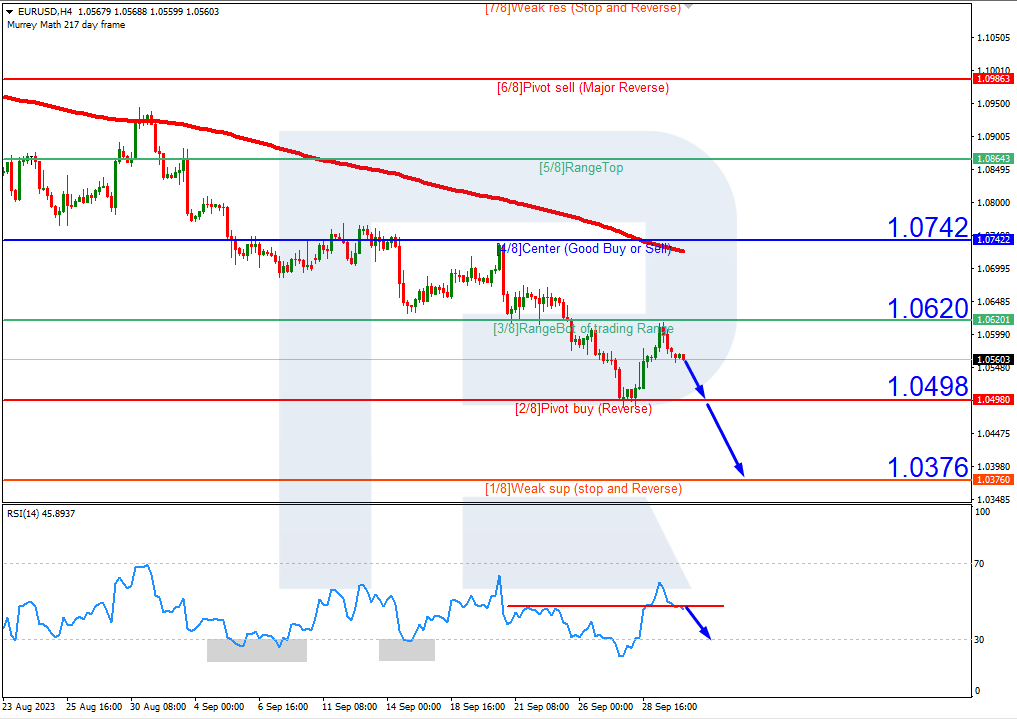

EUR/USD, “Euro vs US Dollar”

EUR/USD are under the 200-day Moving Average on H4, revealing the prevalence of a downtrend. The RSI is testing the support line. In this situation, a downward breakout of 2/8 (1.0498) is expected, followed by a decline to the support at 1/8 (1.0376). The scenario can be cancelled by the price rising above the resistance at 3/8 (1.0620), which might provoke the price to grow to 4/8 (1.0742).

On M15, a breakout of the lower boundary of the VoltyChannel could become an additional signal confirming the price drop.

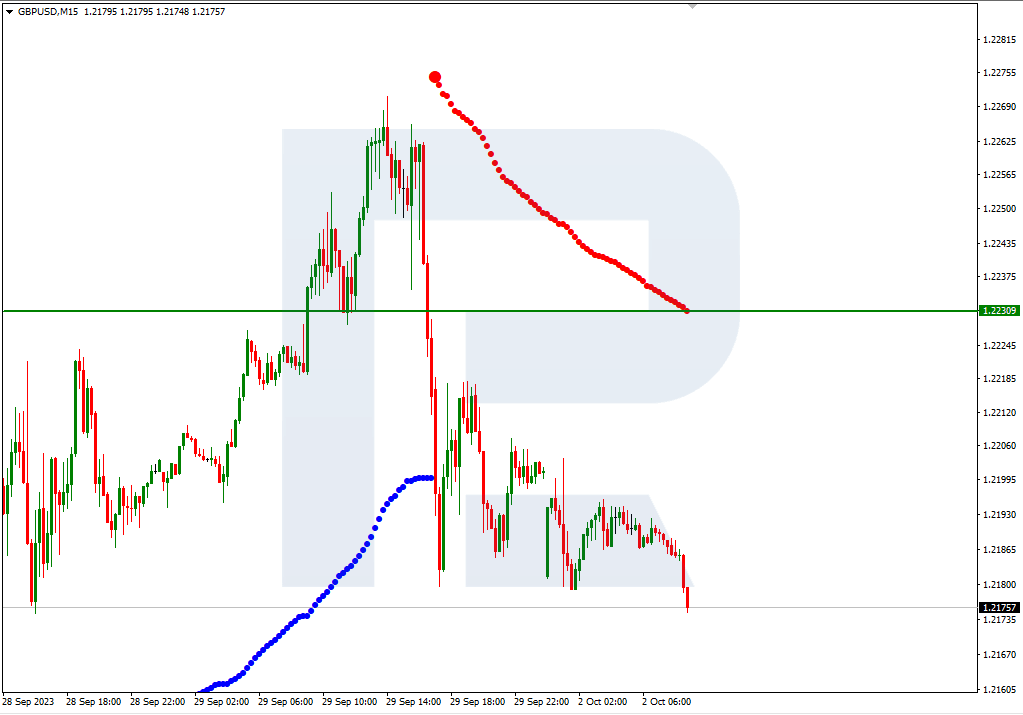

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD are in the oversold area on H4. The RSI is nearing the support line. In this situation, a test of -1/8 (1.2146) is expected, followed by a rebound from it and a price rise to the resistance at 2/8 (1.2329). The scenario can be cancelled by a downward breakout of the -1/8 (1.2146) level. In this situation, the pair could continue falling and reach the support at -2/8 (1.2085).

On M15, the upper boundary of the VoltyChannel is too far from the current price, which means the growth of the quotes can only be supported by a rebound from the -1/8 (1.2146) level on H4.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.