Murrey math lines: Brent, S&P 500

Brent

Brent crude oil quotes and the RSI on H4 are in their respective overbought areas. In this situation, a downward breakout of 8/8 (93.75) is expected, followed by a decline to the support at 6/8 (90.62). The scenario can be cancelled by an upward breakout of +1/8 (95.31). In this case, the quotes could aim at the resistance at +2/8 (96.88).

On M15, the lower boundary of the VoltyChannel is too far from the current price, so the decline might only be supported by a downward breakout of 8/8 (93.75) on H4.

S&P 500

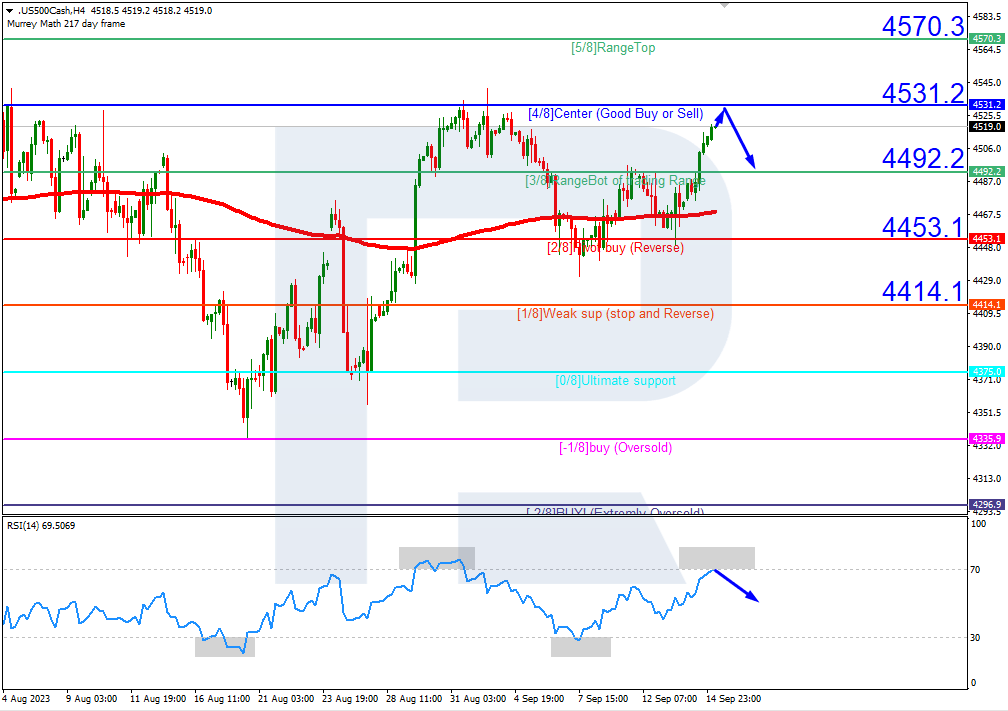

On H4, the S&P 500 index quotes are above the 200-day Moving Average, indicating the prevalence of an uptrend. However, the RSI has already reached the overbought area. As a result, in these circumstances, a test of 4/8 (4531.2) is expected, followed by a rebound from this level and a decline to the support at 3/8 (4492.2). The scenario can be cancelled by rising above the resistance level of 4/8 (4453.1). In this case, the S&P 500 could continue growing and reach 5/8 (4570.3).

On M15, the lower boundary of the VoltyChannel is too far from the current price, so the decline might only be supported by a rebound from 4/8 (4531.2) on H4.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.