Markets focus on closing out the month and quarter

The uneven vaccine roll out is leading to a very disjointed recovery, however today we will see traders focused on closing the month, quarter and in Japan the fiscal year. As today is the month end value date we can expect to see strong US corporate demand for USD.

The virus situation in Europe continues to deteriorate and Germany delaying the EU Recovery Fund will not help the zones economic position. The market is still long but the story of US outperformance on the back of a swift vaccine roll out while Europe lags behind is becoming stronger.

Angela Merkel has threatened to assert federal control to implement measures to stem the spread of the virus. This comes after she was forced to back track on an Easter lockdown that she had announced last week.

Hopes of EU fiscal union have taken a knock as Germany’s highest court blocks ratification of the EU Recovery Fund. This is unlikely to stop the fund going ahead but may delay it. The push back shows that that Germany is still against EU fiscal union. We are expecting EURUSD to remain under pressure and drift lower to 1.1600 support over the coming months. 1.1835-50 resistance.

There could be some volatility in US equity markets this week as a result of large block trades to cut positions of a large family office, Bill Hwang’s Archegos Capital Management. US NFP on Friday the main event of the week.

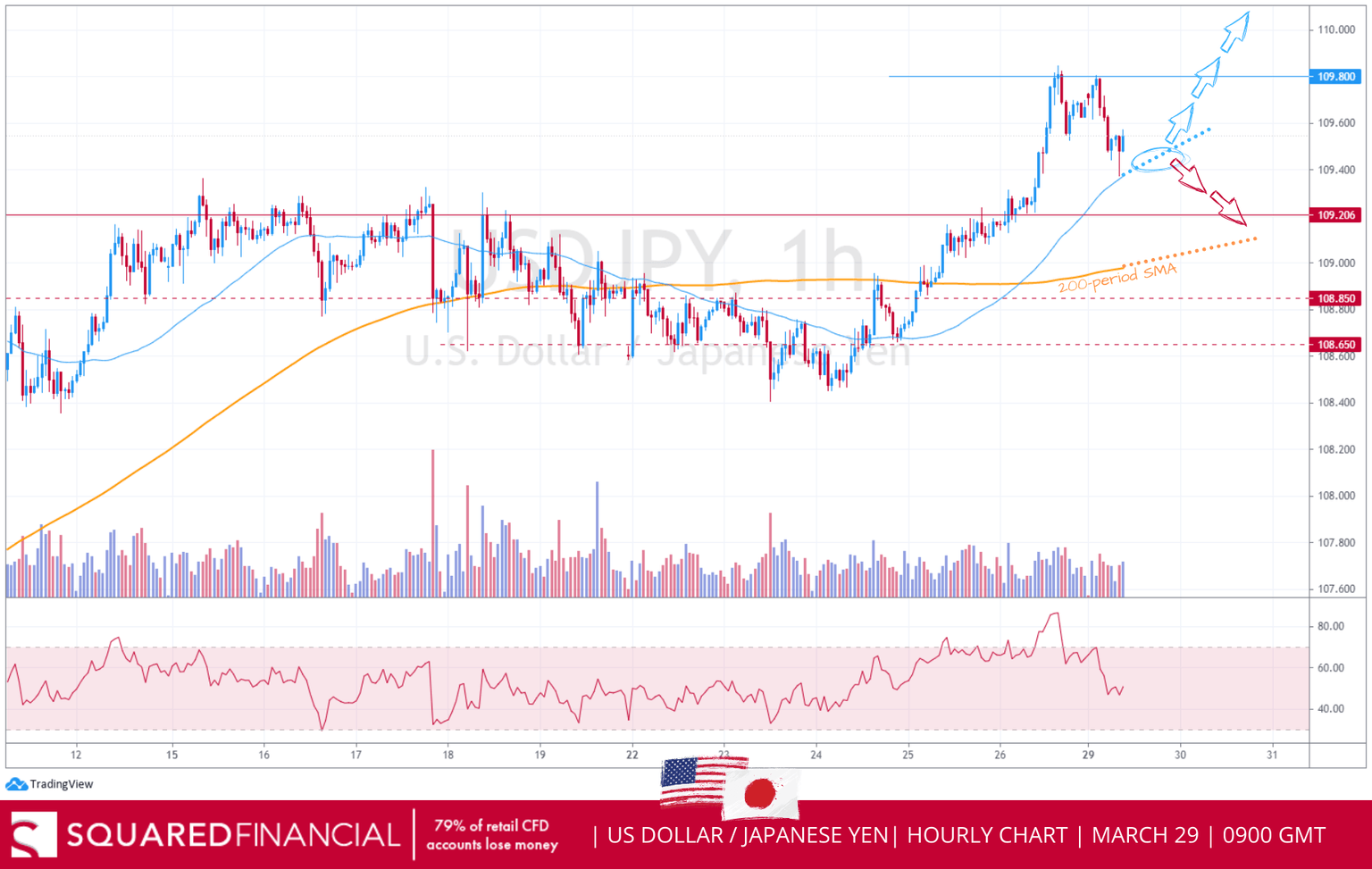

A strong rally back in crossJPY on Friday after some position reduction earlier in the week. USDJPY broke 109.36 previous high and gathered momentum to trade all the way up to 109.845, just ahead of the 109.85 high from June. 109.85 becomes resistance.

With increasing global Covid cases and position liquidation in equities likely to bring some volatility this week the risk/reward of being short crossJPY at these levels looks attractive. Short AUDJPY due to the Brisbane lockdown – the city is entering a three day lockdown to steam an outbreak of virus cases – and CADJPY as any global movement restrictions are likely to weigh on oil could make sense.

Medium term the theme of increasing yields for growth currencies whilst JPY and EUR yields stay anchored lower still holds but given that positioning has now flipped to long crossJPY it makes sense to wait for another wash out to buy the dip.

Our overview and outlook of the key trading pairs and indices is as follows

EUR/USD – Rising coronavirus cases in France and Germany are weighing on the euro, despite the risk-on mood in equities. The US dollar dynamics remain in focus, weighing negatively on the pair. However, the prospects of a quicker economic recovery could revitalize the single currency and potentially break above 1.18 to head towards 1.1840.

GBP/USD – The Pound bulls shrugging off any Brexit concerns, pushing the pair to retest our 1.38 target. However, we think this could be the beginning of the rally, as Britain prepares for the reopening, lifting any lockdown restrictions. If 1.3750 support holds, we might see a rally towards 1.3850 soon.

USD/JPY – Fiscal stimulus combined with accelerated vaccine distribution in the US has triggered a US Dollar bull run, which in turn helped US Treasury yields outpace Japanese Government bond yields allowing the USDJPY to test the June 5th top at ¥109.80 twice on Friday although failed to break it. Technically though, the main trend is still up, and therefore a sustained move over the ¥109.80 level will trigger an acceleration to the upside with the ¥111 mark as our medium to long-term upside target.

FTSE100 – Stocks in London are set to start the week on a soft note following Friday’s strong close after UK’s FTSE flirted with our key resistance level around 6780 for the first time since March 18th. The British index strongly rose back above the 200-period SMA as investor sentiment improved on hopes for global economic recovery. FTSE100’s support is now the 50-period moving average around 6730/20, as the minor trend is currently up from a technical perspective, with 6780 as nearest upside target, however a trade through 6700 will change the minor trend from bullish back to bearish, as traders brace for heightened volatility during this holiday-shortened week.

DOWJONES – Wall Street ended the week strongly in the green, with the Dow Jones Industrial Average closing above 33000 as quarter end rebalancing leads to choppy trading on the last hour of trade last Friday. This morning however, stock indices on the futures market are seen opening on a soft note as oil prices plunge after the massive container ship MV Ever Given, that has been blocking the Suez Canal for almost a week now, started to finally move. The RSI was also overextended into extreme overbought which from a technical perspective suggests a short-term downside move is likely, with 32820, coinciding with the 50-period moving average as nearest downside target.

DAX30 – German DAX futures are lower in overnight trading Sunday after a late session surge on Friday helped it end the week with a strong performance with the index closing above 14800 amid optimism that fiscal stimulus and the rollout of COVID-19 vaccines will help boost growth, despite the European Commission's warning that the EU is at the start of a third wave of the coronavirus pandemic. Traders are bracing for heightened volatility during this holiday-shortened week with quarter-end rebalancing among pension and mutual funds, and a sustained move through the key 14800 resistance will trigger an acceleration to the upside with the 14970/15000 area as target.

GOLD – Gold continues to trade in a range between $1722 and $1740 support/resistance levels as ETF investors remain bearish on the yellow metal, recording the longest run of declines on record. US10Y yields holding above 1.60% is keeping the bulls at bay with technical indicators favouring lower prints in today’s session to be confirmed on an hourly close below $1722 with $1710 as the second support target in extension.

USOIL – WTI Crude hit our resistance target on Friday’s session, ending the week in the green to print below the $60 mark in early trade today after reports of progress on Suez Canal blockage with ship now fully re-floated. $60 mark now back as resistance level and to direct today’s session, as failure to breach $60 will confirm bearish momentum with $58.50 as closest support target on the downside.

Author

Rony Nehme

SquaredFinancial

Rony has over twenty years of experience in financial planning and professional proprietary trading in the equity and currency markets.