Markets choose liquidity over political mayhem

The year did not open with calm. It opened with a geopolitical thunderclap. Venezuela loses its strongman. Iran simmers with street level pressure under an American spotlight. Cuba and Colombia find themselves suddenly name checked from Washington. Taiwan hangs in the background like a stress fracture in the global security framework. Even Denmark is staring at a map, wondering how Greenland became a strategic asset once again. It was one of those weekends when the market report reads as if a volatility trader with a dark sense of humour wrote it.

And yet when the opening bell rang on the first real trading day of the year, the market shrugged. Not because it is complacent but because it is conditioned. This is a market that votes not on headlines but on probabilities. It asks one question only. Is the worst case becoming more likely or less likely? The answer on Monday was clear enough to trigger a broad-based risk response. Everything that trades on liquidity caught a bid. Equities, commodities, crypto, and bonds all moved in the same direction while the dollar quietly stepped aside.

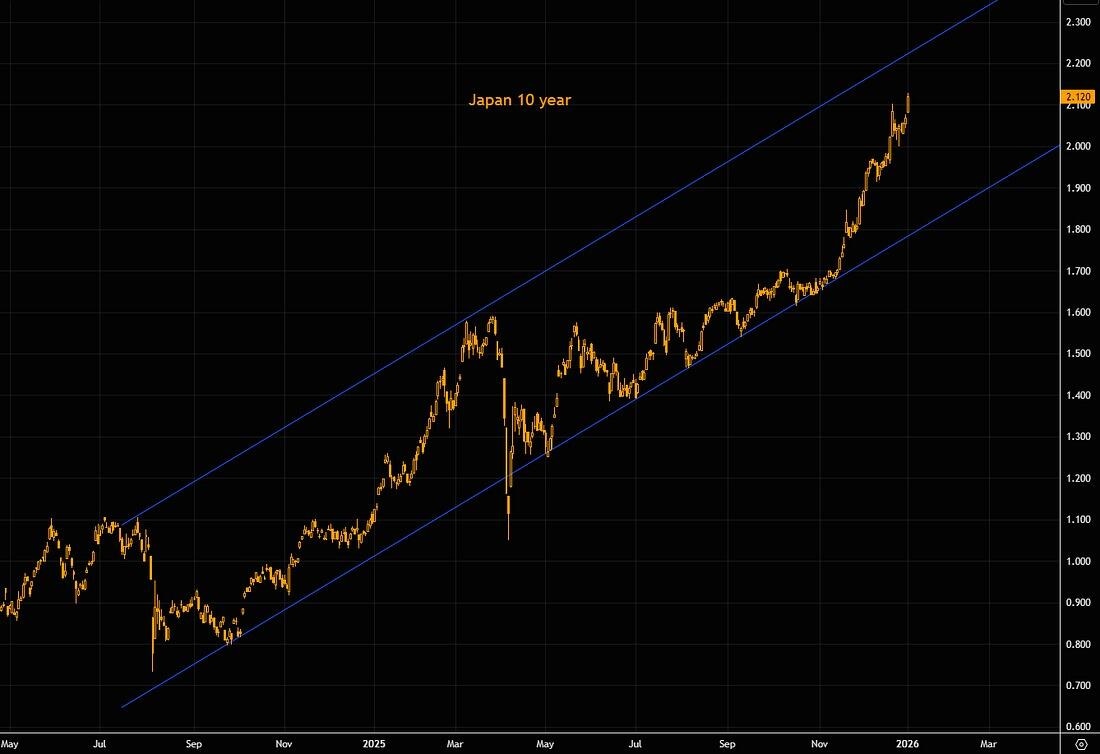

Gold led the charge not as a panic asset but as a barometer of policy drift. After a record-setting year, it continues to behave less like a fear hedge and more like a macro lie detector. Gold is reading the global rates complex with precision, particularly in Japan, where long-end yields have been creeping higher with intent. That correlation has not been accidental.

The market ear

Japanese and German yields have been moving while US ten-year yields have stayed oddly restrained, compressing spreads to levels that rarely hold. Bond volatility has been calm, but it feels borrowed, not earned. If Japan's export rate pressure the volatility complex will not remain this polite for long.

Equities moved with the body language of a market that understands where the marginal buyer lives. US indices were higher across the board with leadership from the Dow and small caps. The Dow briefly printed above 49000 before gravity reasserted itself but still closed at a record. The S&P flirted with flat for the Santa Claus window before slipping back but the message was clear. This was not retail euphoria. This was positioning repair.

Flows told the story. Hedge funds entered the year defensively positioned, having aggressively cut risk into year-end by shorting macro products and ETFs. That caution became fuel. Small caps ripped higher on another violent squeeze with some names up more than eight percent in two sessions. Mega cap tech followed a familiar script, opening strong, then leaking into the close, yet still finishing green. Leadership between the most prominent names and the rest of the market remained aligned until Europe closed, after which divergence set in. Energy and financials led while defensives lagged.

Under the hood, systematic money is still re-engaging. Trend followers have fresh equity demand to deploy and corporate buybacks are quietly operating through preset programs even as blackout windows limit discretion. The mechanical bid is real. So is the risk. Option positioning shows a market perched above a key pivot where positive gamma can magnetize prices higher toward round numbers. But below that level support thins quickly. With implied volatility cheap and the calendar heavy with data this is the kind of tape that can melt higher while feeling increasingly unstable beneath the surface.

The macro data itself offered no comfort. Manufacturing surveys confirmed that soft data continue to deteriorate, and Treasuries responded accordingly, with the belly outperforming as the market leans into the idea that policy easing remains the path of least resistance. Labour data later this week will matter more than geopolitics for rates traders. The market is already priced for further cuts. What matters now is whether the data supports or challenges that conviction.

Commodities reflected a more nuanced read of the geopolitical noise. Oil initially slipped, then rebounded as traders weighed near-term disruption against longer-term supply narratives. Venezuela is the perfect case study in why markets fade headlines. The idea that hundreds of billions of barrels are about to flood the market ignores chemistry, physics, and economics. What sits in the Orinoco is extra-heavy sour crude loaded with metals that punish refineries and demand expensive processing. Volume is vanity. Viscosity is sanity. The reality is that recoverable supply is far smaller and far slower to monetize. That has not stopped energy equities from catching a bid as investors position for capital waves rather than geopolitical mayhem, even if it means extra barrels in years rather than weeks.

Copper pushed higher for different reasons. Tariff anxiety is pulling metal into the US just as supply risks in Chile resurface. This is stockpiling behaviour layered on top of a risk-on tape. Growth-linked metals thrive in that environment, even when the demand outlook is debated. Platinum joined the party alongside gold and silver, which printed eye-catching gains that spoke less to fear and more to currency dilution and real asset scarcity.

Crypto behaved exactly as it should in a liquidity-driven regime. Bitcoin reclaimed levels near 95,000 and held its trend support, while Ethereum pushed back toward the top of its recent range. These are not speculative blow offs. They are expressions of excess liquidity searching for duration.

Asia opened calmly. Japanese equities led while the region largely ignored the Latin American drama. This is a market three years into a bull run, driven by technology, artificial intelligence, and earnings growth. Rate-cut and capital-spending narratives still dominate. Geopolitics matters only if it threatens that engine. For now it does not.

The dollar was the outlier. After catching a brief overnight safety bid, it reversed and closed lower. That tells you everything you need to know about the market mood. Safety is sourced through tangible assets rather than currencies. Liquidity is the trade.

Zooming out the framework for the year ahead is becoming clearer. Policy is easing across fiscal, monetary, and regulatory channels, creating a pro-cyclical backdrop. Earnings growth is expected to do the heavy lifting while market leadership broadens beyond the narrow cohort that defined the last phase. Credit markets are becoming more active in refinancing and deal flow. Options markets are positioned for upside rather than protection. This is a market that wants to go higher but knows the path will be noisy.

That is the paradox. The melt can continue, but the ride will not be smooth. Intraday whipsaws, deeper pullbacks, and sharp squeezes are part of the terrain, especially with short-dated options dominating flow. The map indicates that higher levels are achievable over the year if earnings are delivered. But the compass says volatility will eventually reassert itself.

The market has made its opening statement. It has chosen liquidity over headlines. It has priced out the apocalypse and priced in the continuation. Whether that confidence is rewarded will depend less on who gets captured or threatened next and more on whether growth and policy stay aligned. For now, the tape is telling you exactly where the gravity is.

Gold and JGB yields

Gold moving higher at the same time as Japanese bond yields looks odd only if you still think of gold as simply an inverse yield trade. In this cycle, gold is responding to something more profound, not to the dollar or to its usual inverse correlation with rising yields. It is responding to confidence, or more precisely, to where confidence is starting to fray.

Japan matters because it has been the anchor of the global bond market for a generation. For years, Japanese yields were pinned down so tightly that they became the quiet funding base for the rest of the world. When those yields start to creep higher, the market does not see healthy normalization. It sees a system being nudged out of a very long-standing comfort zone. Gold tends to wake up when that happens.

The market ear

The rise in Japanese yields is not being read as a victory over inflation. It is being read as pressure. Pressure on the Bank of Japan, pressure on policy credibility, and pressure on a framework that has kept volatility suppressed for years. When yields rise for those reasons, gold does not flinch. It leans in.

There is also a currency angle. Higher Japanese yields hint at a possible shift in the yen regime. But regime shifts are rarely smooth. They come with uncertainty, false starts, and the risk of disorderly moves. In that kind of environment, gold becomes the asset that does not have to make a bet on any single currency getting it right.

Another tell is what is happening globally. Japanese and German yields have been moving while US yields have lagged. That kind of divergence almost never lasts. Markets know it. Gold knows it too. It starts pricing the return of bond market volatility before the volatility indices even stir.

Most importantly, gold is no longer being traded like a tactical hedge against rates. It is being held as balance sheet insurance. Central banks and long-term allocators are not asking whether yields are up or down this week. They are asking whether debt, geopolitics, and policy credibility are becoming more fragile. Rising Japanese yields tick all those boxes at once.

Gold is not rallying despite higher Japanese yields. It is rallying because of what they signal.

When the most controlled bond market in the world begins to move less on growth and more on the term premium, gold responds early.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.