Markets are sending different signals on recovery

When bond traders are questioning the strength of economy recovery, does this mean that USD/JPY tend to weaken?

Stocks and bonds traders now lay out the different outlooks on the upcoming recovery, setting the tone for the Forex market that prices could continue to range in coming weeks.

The US government bond yields reversed an early climb and closed lower last week, with investors weighing persistent worries about the economic outlook against a better-than-expected monthly jobs report.

The yield on the 10-year Treasury note, a key benchmark for borrowing costs on everything from mortgages to student loans, climbed above 0.71% in the wake of Thursday morning’s data, according to Tradeweb. But it then retraced the move, settling at 0.670%, compared with 0.682% on Wednesday. Bond yields rise as prices fall.

The Bond market shows that traders believe that a full economic recovery will take time. The 10-year yield tends to rise and fall with investors’ expectations for growth and inflation, and has traded within a relatively narrow range around 0.7% in recent weeks. This stalls many attributes to economic worries and aggressive monetary stimulus.

The 10-year yield initially climbed after data showed that the jobless rate fell to 11.1% in June and that the US added 4.8 million jobs, boosting hopes that the economy will avoid investors’ worst-case scenarios, but it reversed course later in the session, to snap a two-session streak of gains.

Among the worries dragging on bond yields is the concern that a recent resurgence in the pandemic will force new lockdowns. This could slow the recovery, prompting the central bank to keep interest rates low. It could also limit any pickup in inflation, increasing the appeal of government debt by preserving the purchasing power of its fixed-coupon payments.

However, stock traders are projecting calmer markets ahead. The CBOE Volatility Index, or VIX, edged down for the fourth consecutive session to 27.68 last week, continuing a week-long descent that sent it to its lowest close since June 10.

The gauge is based on options prices on the S&P 500 and tends to slip as stocks are rising.

Leveraged funds like hedge funds have increased bearish positions tied to the VIX. Bearish bets recently outweighed bullish ones by the most since February, before US stocks tumbled into a bear market and the volatility gauge hit its highest level on record, according to data from the Commodity Futures Trading Commission as of June 23.

A bearish position on the VIX is akin to a bullish one on stocks since the volatility gauge and its futures typically fall as stocks rise. Traders can tap VIX futures to make directional bets or hedge their portfolios.

Among the exceptions is the period around the US presidential election. Futures prices tied to the VIX indicate that traders are bracing for more volatility in October, ahead of the election. Analysts have already started forecasting the effects of presumptive Democratic nominee Joe Biden and President Trump’s potential policies on the stock market.

Options markets were bracing for big swings in share prices around the Iowa Democratic caucuses on 3rd February. Market volatility also picked up ahead of President Trump’s 2016 election, on news that the Federal Bureau of Investigation was reviewing evidence in connection with its investigation of Democratic presidential candidate Hillary Clinton’s email server.

Our Picks

EUR/USD – Slightly bullish

This pair may rise towards 1.1315 this week.

USD/JPY– Slightly bearish

This pair may fall towards 107.30.

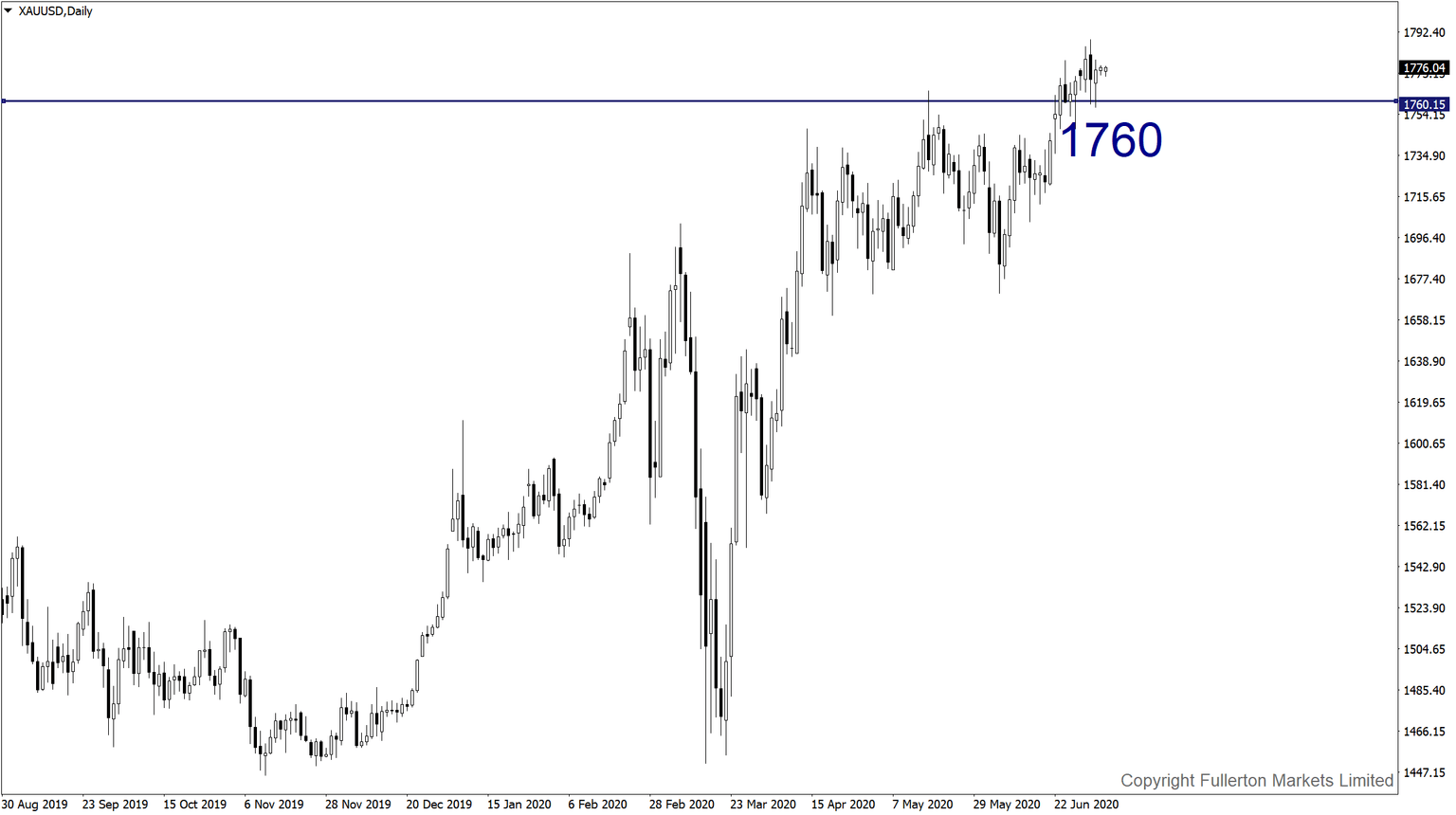

XAU/USD (Gold) – Slightly bearish

We expect price to drop towards 1760 this week.

H33HKD (HSI) – Slightly bullish

Index may rise towards 25660 this week.

Author

%20V2_XtraSmall.jpg)

Wayne Ko Heng Whye

Fullerton Markets Ltd

As Head of Research & Education in Fullerton Markets, Wayne provides thought-provoking analysis and trading ideas to thousands of clients worldwide.