Larger trade gap shows downside of robust domestic demand

Summary

The September trade report makes sense of the initial GDP estimate which revealed a drag from trade in Q3 when most anticipated a slight boost amid a trend narrowing in the trade gap. Exports grew in September, but imports grew even faster amid resilient domestic demand.

Bridging the gap wasn't going to be easy

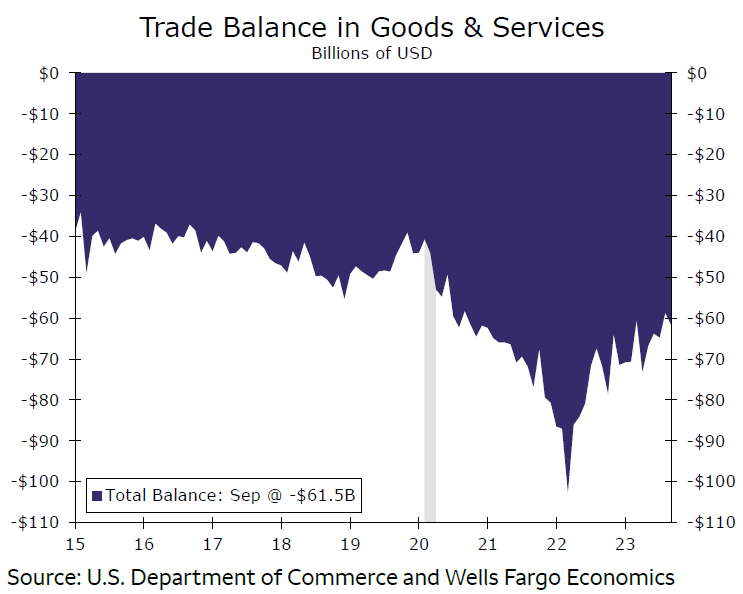

With a trend normalization toward pre-pandemic norms underway, it did not immediately make intuitive sense to see trade subtracting from third quarter growth in the first estimate of that quarter's GDP. It is a reminder that trade flows can be volatile on a month-to-month basis. The trade deficit widened to $61.5B in September, undoing about half of the trade gap's narrowing in the prior month (chart). Imports increased 2.7% outpacing exports which rose 2.2%. The outturn, along with a slight downward revision to August's balance, makes sense of the advance Q3 GDP report.

Still, over the past year, the trade deficit has narrowed back toward its pre-pandemic norm. Exports and imports have downshifted on trend, as global growth has plateaued and domestic demand has slowly moderated.

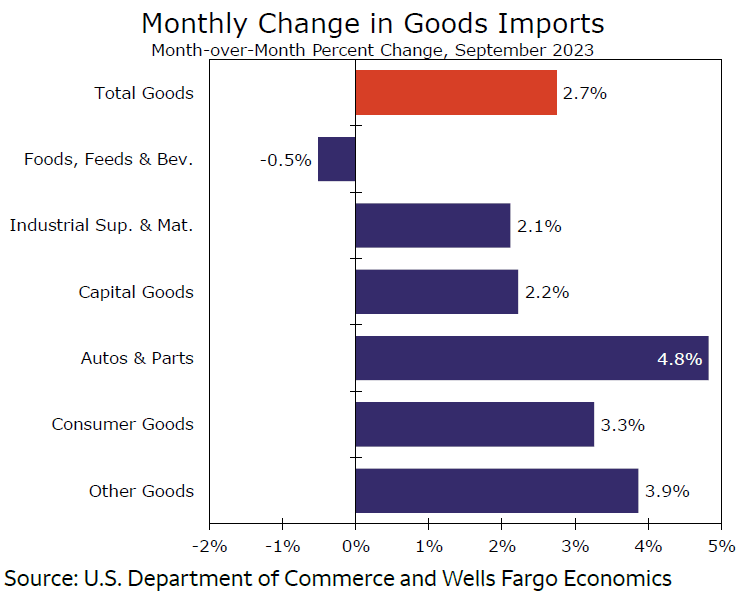

Sometimes strong domestic demand can result in a larger trade gap, especially if demand is less robust in other economies. A pickup in consumer goods and auto & parts imports contributed to the deficit widening in September (chart). That was certainly the case this month as consumer spending on durable goods was robust in September. The strength in durables spending was at odds with widespread expectations for a slowdown in durables spending amid elevated prices and borrowing costs. The consumer's underlying resilience has supported autos, where trade has been particularly bouncy as the industry is still recovering from pandemic-related disruptions and strike activity more recently.

Author

Wells Fargo Research Team

Wells Fargo