Key Thought of the Day: China Today is Like Japan in 1989

China is slowly and surely going down the path of Japan. It is aging rapidly as bad bank debts pile up.

‘Japanification’ Stalks the US, Europe, and China

The Financial Times comments ‘Japanification’ stalks the US and Europe

The FT did not include China in its discussion.

Let's take a look down that path.

Japanification of China Well Underway

A Fascinating Conversation With Renowned Short Seller Jim Chanos on Hedgeye TV got me thinking more about China.

I made 15 notes. Consider notes 4 and 6.

4: China is still the biggest real estate bubble in history.

6: Similarities between Japan in 1980's and China Today.

China’s Looming Crisis

Please consider China’s Looming Crisis: A Shrinking Population.

A decline in the birth rate and an increase in life expectancy means there will soon be too few workers able to support an enormous and aging population, the academy warned. The academy estimated the contraction would begin in 2027, though others believe it would come sooner or has already begun.

The government has recognized the worrisome demographic trend and in 2013 began easing enforcement of the “one child” policy in certain circumstances. It then raised the limit to two children for all families in 2016, in hopes of encouraging a baby boom. It did not work.

Dateline 2050 Projection

Replacement Level Fertility

One cannot lay all the blame for this on one child policy.

The US is also below replacement level fertility.

Please don't suggest the answer is immigration.

Europe is aging far faster than the US, and we saw what happened to Merkel's open arms invitation of refugees who could not speak German and had no skills at all.

China, like Japan in the 1990s, Will Be Dominated by Huge Zombie Banks

Please consider China, like Japan in the 1990s, Will Be Dominated by Huge Zombie Banks

Population Demographics

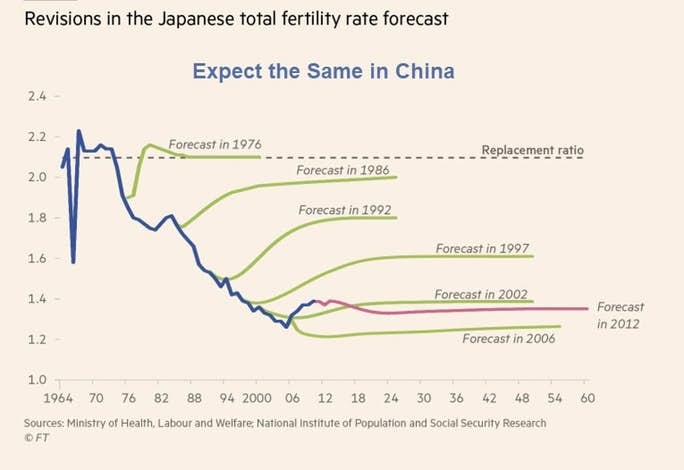

China resembles Japan in what is arguably the most important long-term factor affecting debt and prices: population demographics.

Japan’s paradigm shifted when it’s workforce began to shrink, which was ~15 years before its overall population began shrinking, and China is in a very similar position today.

$250 Trillion in Global Debt: How Can That Be Paid back?

In light of population demographics, increasing needs of healthcare of retirees, and massively underfunded pensions I again ask, $250 Trillion in Global Debt: How Can That Be Paid back?

Population demographics alone show the futility of central bank efforts to cram more debt into a global financial system choking on debt.

A currency crisis awaits, please click on the above link for further discussion.

Meanwhile, please ask, what the hell China is going to do with the massive number of vacant and unaffordable apartments it is building.

Addendum - Michael Pettis Chimes In

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc