Japan: Strong wage growth supports Bank of Japan rate hikes

Labour cash earnings rose more than expected in December and the November figures were all revised upwards. If Shunto results are as strong as last year's, we expect the Bank of Japan to hike by 25 basis points as early as May.

Labour cash earnings rose more than expected in December with upward revisions to November

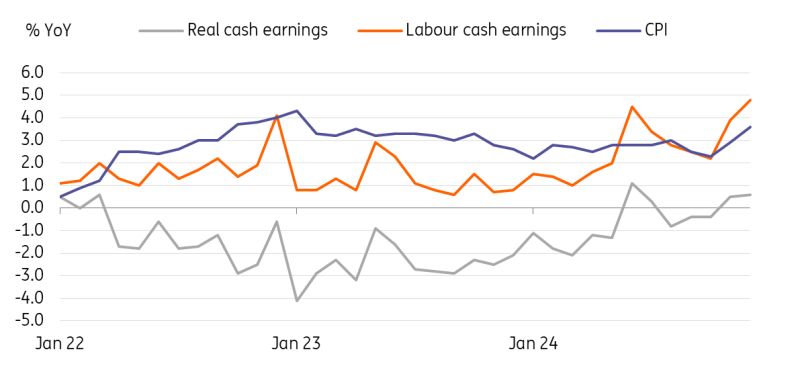

Labour cash earnings growth (4.8% year-on-year) were stronger than expected mostly due to strong bonuses and an increase in the minimum wage, but base earnings rose steadily by 2.5% for a second month. Real cash earnings rose 0.6%, following a 0.5% gain in November despite the recent pick-up in inflation. We believe that real cash earnings are likely to stay positive in the coming months, which will eventually lead to consumption growth. More importantly, the same sample base earnings, which is the preferred measure of the BoJ, rose even stronger to 5.2% (vs a revised 3.7% in November, 3.6% market consensus). Base earings have risen around 2.9% for the past three months, which is quite close to the BoJ's view on sustainable wage growth of 3%.

Labour cash earnings rose stronger than expected in December

Source: CEIC

Services PMI rose 53.0 (vs 52.7 in flash, 50 in December)

The strong services PMI continued in January, reaching its highest level since September 2024 and remaining in expansionary territory for three consecutive months. Among the sub-indexes, employment and prices charged rose in January, pointing to healthy labour conditions and sustainable inflation in the near future.

Bank of Japan outlook

Strong wage growth and an expansionary services PMI are supportive of the BoJ's policy normalisation, as strong wage growth is likely to lead to consumption growth and keep inflation above 2%. The market is currently pricing in another hike in July given the BoJ's cautious approach, but we believe that an earlier hike in May is possible. We will be watching this year's Shunto results to see if they are as strong as last year's. However, as the BoJ considers US trade policy as a risk factor, it should communicate carefully with the markets to reduce market volatility if any measures are announced. We have also raised the BoJ's terminal rate from 1.0% to 1.25% based on recent data outcomes and the BoJ's latest quarterly outlook revision, and we expect two more hikes in 2025 (May and October), and a 25bp hike in 2026.

Read the original analysis: Japan: Strong wage growth supports Bank of Japan rate hikes

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.