Jackson Hole Preview: Powell poised to keep markets on edge, three scenarios for the US Dollar

- Federal Reserve Chair Jerome Powell is set to leave all options open at a highly anticipated speech.

- The robust US economy implies an even more hawkish tone, signaling rates will need to stay high for longer than expected.

- Only acknowledging the Fed's achievements in battling inflation would soothe markets.

"We're not in Kansas anymore" – this phrase from The Wizard of Oz reverberates across markets, which fear hawkish comments from the world's most powerful central banker. The Federal Reserve Bank of Kansas City holds its closely-watched annual symposium at Jackson Hole, Wyoming, and market expectations are far from what they were only a few weeks ago. There will be no summer vacation for volatility.

Here are three scenarios for Fed Chair Jerome Powell's speech at Jackson Hole, on Friday at 14:05 GMT.

Federal Reserve at the crossroads as the US economy booms, inflation slides

Has the Federal Reserve engineered a soft landing? The term refers to a gradual cooling of the economy which implies a return to lower inflation without massive unemployment or a recession. That seemed to be the notion in markets when the Fed seemed to be done raising rates. Things have since changed.

While headline inflation decreased from 9.1% YoY in June 2022 to 3% in June 2023, it edged up to 3.2% in July. Some fear higher energy prices might creep into core inflation, which is at 4.7% YoY.

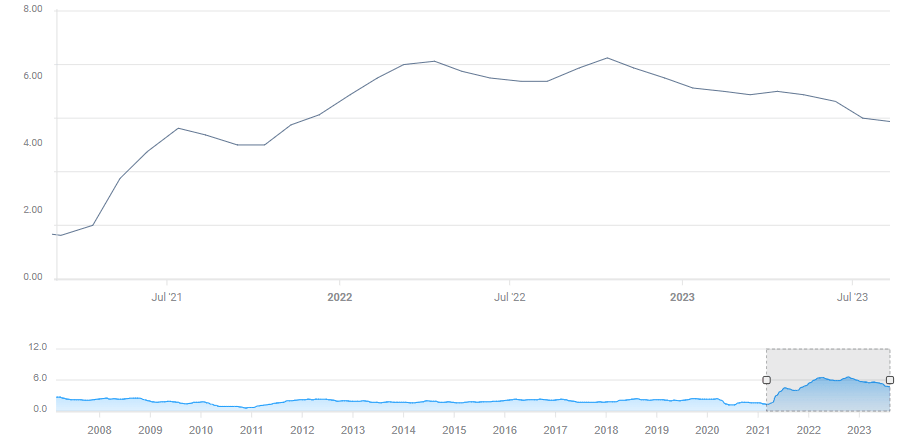

Core inflation is down but not out:

Consumer Price Index ex Food & Energy (YoY). Source: FXStreet

Bigger worries about more interest-rate hikes stem from the strength of the economy. Retail Sales data show Americans are out and about – far from burning excess money saved during the pandemic years. Higher rates would encourage saving.

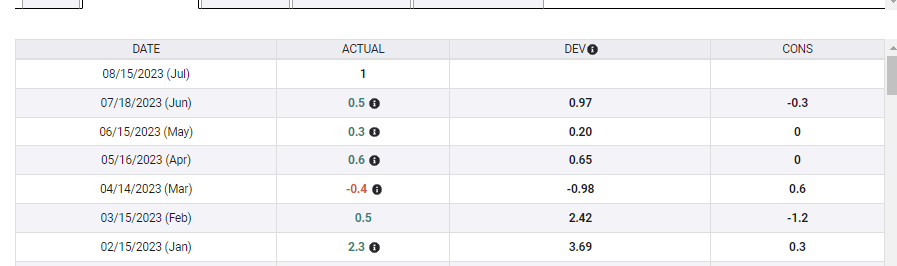

The Control Group of Retail Sales, also known as "core of the core", has been rising in six out of seven months this year, exceeding estimates.

Retail Sales Control Group. Source: FXStreet

The housing sector – arguably the most sensitive to higher rates – shows signs of bottoming out. Both prices and sales have stabilized even though 30-year mortgage rates topped 7%.

The most outstanding figure comes from the Atlanta Fed, whose "NowCast" model shows an annualized growth rate of 5.8% for the current quarter. Too much? Probably, but a rapid expansion means there is further room for rate hikes.

Concerns about rates have weighed on sentiment, sending the US Dollar up in August. While the Jackson Hole Symposium is not the last event of this hot month, it carries substantial weight as Fed Chairs traditionally have used it to signal policy shifts. Will it happen again?

Three scenarios for Powell's pivotal speech

1) Data dependent: The scenario with the highest probability is one where Powell stresses the high level of uncertainty and only acknowledges recent developments. Investors will likely react with worry by refusing to comment on future policy – and sticking to the mantra that the data will decide.

The US Dollar is set to advance in such a case, while stocks and Gold will likely suffer. A risk-off reaction would align with the broad trend but is unlikely to be devastating.

The focus will likely shift to next week's data, which include Personal Consumption Expenditure (PCE) Price Index – the Fed's preferred gauge of inflation – and Nonfarm Payrolls (NFP).

2) Higher for longer: A hawkish outcome would be one in which Powell highlights the recent strength of the economy and shrugs off the recent improvement in inflation – seeing the glass half empty. I see this scenario as having a medium probability.

The Fed Chair would further drive a tough message home by saying that rates will probably have to stay higher than previously thought. By refraining from committing to the next moves, Powell would leave room for data dependency. Nevertheless, his message would further align market expectations about the path of rates in 2024 – fewer rate cuts than officials had previously thought.

Telling investors that things will get worse will delight stock bears and trigger a sell-off. The US Dollar would rally, while Gold would tumble.

3) Victory lap: The dovish scenario is one in which the Fed Chair celebrates the drop in inflation and the upcoming decline in underlying price pressures. Unless prices of homes, used vehicles and other non-energy and non-food items surge, Core PCE is set to decline in the autumn. Why? The fall of 2022 saw big jumps in these prices, and they will drop out of the calculation in the next few months.

By celebrating the bank's achievements and playing down the economy's strength, Powell would signal that the Fed is done raising interest rates.

In such a scenario, which has a low probability, the US Dollar would plunge while Gold and stocks would party.

Final thoughts

I expect Powell to remain cautious and to refrain from declaring victory. The Fed’s Chair knows that inflation can return with another wave, and by merely sounding tough or leaving room for speculation, investors and consumers would be more cautious.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.