ISM Manufacturing PMI Preview: Low bar for upside surprise could turn dollar-positive

- The ISM Manufacturing PMI is set to marginally edge higher in September.

- Expectations for a drop in employment open door to a beat.

- The dollar has room to gain ground – but for the wrong reasons.

Has the fiscal cliff sent the economy plunging? The expiry of several government programs in late July is probably hurting the economy – but it will probably take time to propagate to the manufacturing sector. The loss of the $600/week federal unemployment insurance top-up is slowing the bounce in retail sales, but it takes more time for weaker revenue at stores to hit factories – and especially hiring there.

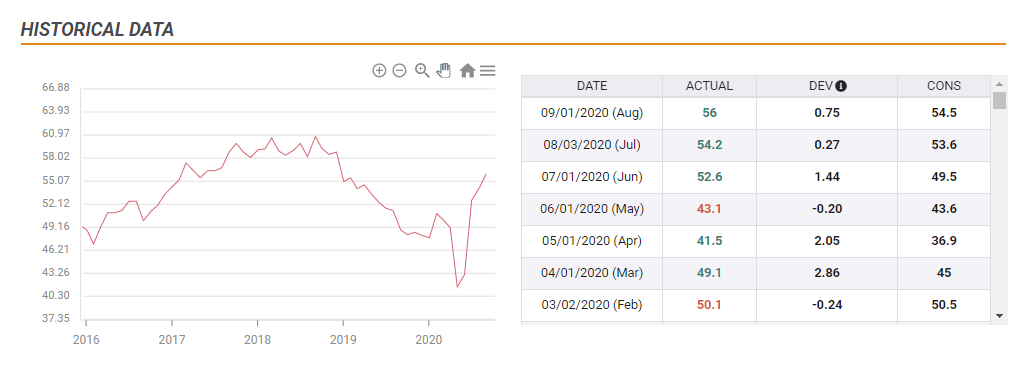

Economists expect a minor increase in the headline ISM Purchasing Managers' Index, from 56 in August to 56.3 in September. Any score above 50 represents expansion. It would still keep the indicator below the peak levels seen in 2018.

Source: FXStreet

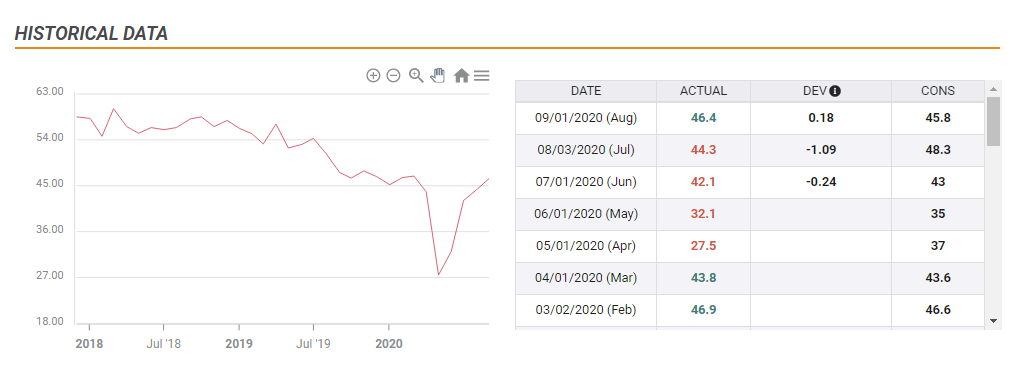

The more significant figure is the employment component, which serves as a hint toward Friday's jobs report. It is set to show a decline from 46.4 to 45.8, representing a deeper contraction in hiring. As mentioned earlier, that may happen, but probably not immediately.

Moreover, the figure has been on an upturned and even beat estimates in August. Even if the manufacturing labor market remains in contraction, a score closer to 50 is likely now.

Source: FXStreet

Potential market reaction

An upbeat ISM Manufacturing PMI employment component would compound robust ADP's private-sector jobs report and create an upbeat narrative toward Friday's Non-Farm Payrolls. ADP, America's largest payroll firm, reported an increase of 749,000 positions in September, better than expected.

In theory, better figures mean a stronger currency, thus a stronger dollar. The greenback indeed has room to rise – yet for the wrong reason. Another robust Non-Farm Payrolls report could discourage lawmakers from cutting a deal on the next fiscal relief package, thus boosting the dollar in its role as a safe-haven currency.

That has already happened with the last jobs report. Back in early September, Republicans reduced their offer to below $1 trillion after the US recorded around 1.4 million job gains in August. The ruling party later raised it above that round number when August's retail sales statistics fell short of estimates.

Democrats also have various calculations. Challenger Joe Biden is leading in the polls and he may prefer to wait to get into office and push for a different package once in office. However, a deteriorating economic situation may push them to act sooner.

Conclusion

Overall, an upbeat employment component is dollar positive and a disappointment is dollar negative – yet for the wrong reasons.

More: Presidential Debate: Stocks set to suffer on Trump's refusal to accept the results

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.