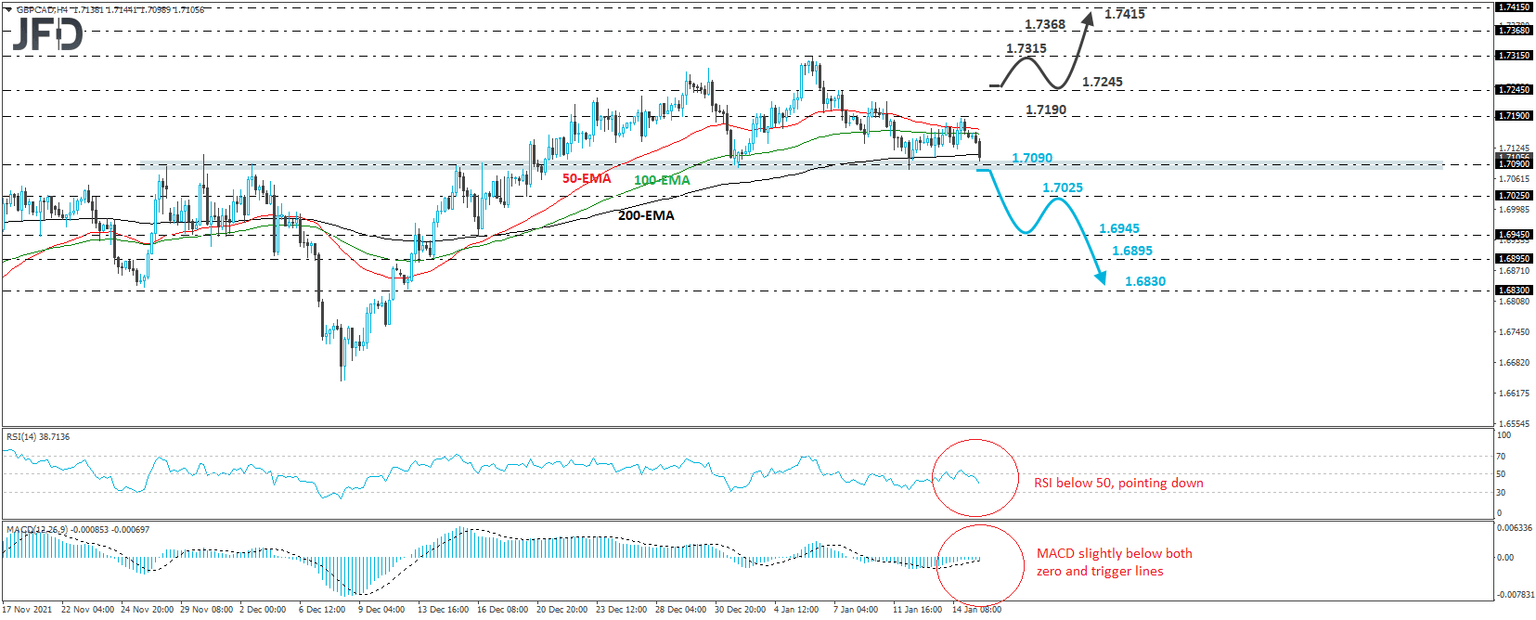

Is it time for a trend reversal in GBP/CAD?

GBP/CAD traded lower on Monday, after hitting resistance at 1.7190 on Friday. At the time of writing, the rate is flirting with the 1.7090 area, which seems to be the neckline of a potential head and shoulders formation that’s been forming since December 21st. A break lower could signal a bearish trend reversal, but up until that happens, we prefer to stay sidelined.

If indeed the pair falls clearly below 1.7090, this could add more bears into the equation and perhaps allow declines towards the low of December 20th, at 1.7025. If that barrier is not able to withstand the pressure and breaks, then we may see extensions towards the low of December 16th, at 1.6945, where another break could target the low of December 14th, at 1.6895. Should the bears overcome that obstacle as well, the next area to consider as a support may be the low of December 13th, at 1.6830.

Taking a look at our short-term oscillators, we see that the RSI turned down and fell back below its 50 lines, while the MACD lies slightly below both its zero and trigger lines. Both indicators detect downside speed and support the notion of this exchange rate to continue sliding. Nonetheless, we repeat that we prefer to wait for a dip below 1.7090 before we get confident on that front.

Now, in order to start examining the bullish case, we would like to see a clear break above the 1.7245 zone, which is the peak of January 7th. This could dismiss the head and shoulders formation and may initially target the peak of January 6th, at 1.7315. If the buyers are not willing to stop there, then we may see them targeting the 1.7368 level, marked by the high of September 27th, or the 1.7415 barriers, marked by the high of September 24th.

Author

JFD Team

JFD