Intraday market analysis: USD struggles to find bids

EUR/USD attempts reversal

The US dollar tumbled after Fed Chairman Jerome Powell said it is nowhere near a rate hike.

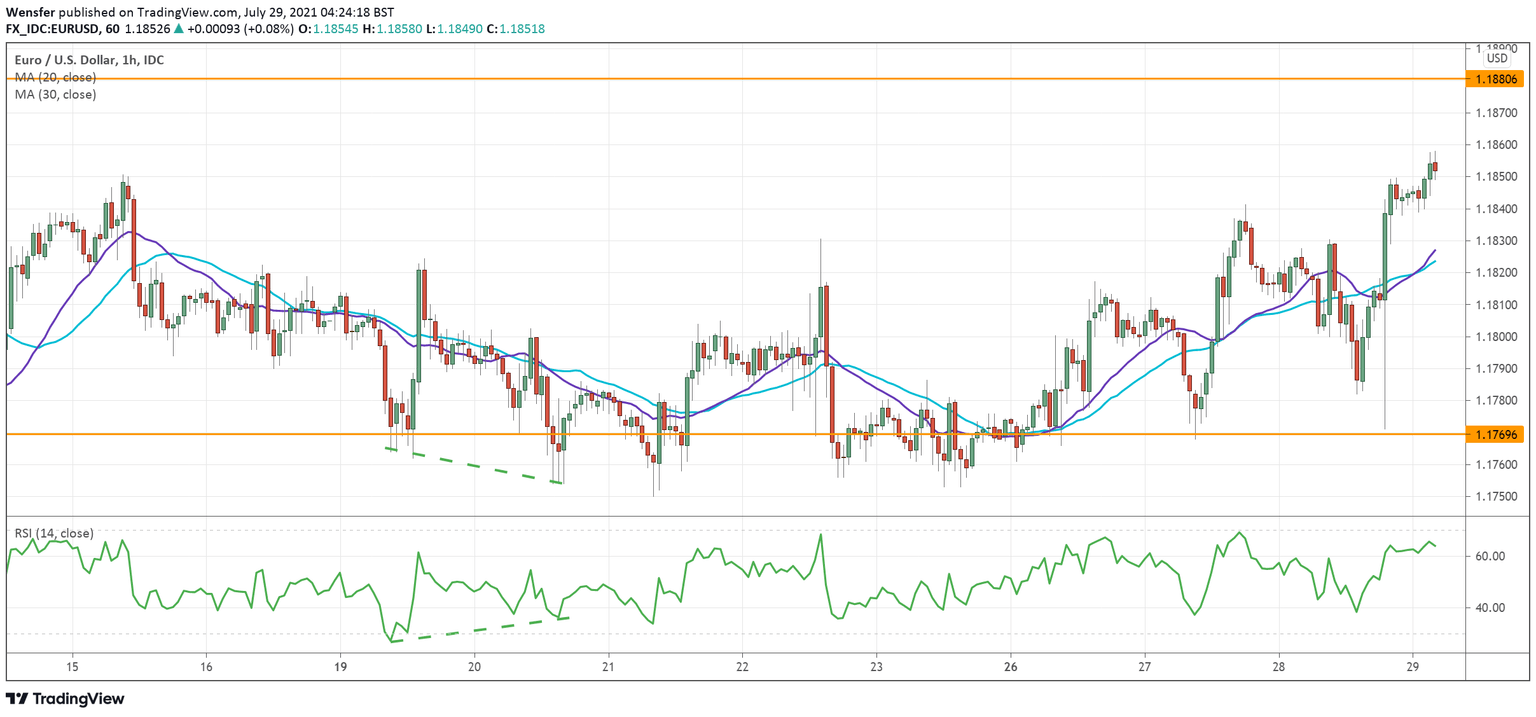

The RSI divergence was a giveaway that the sellers may have taken their feet off the pedals. The break above 1.1820 suggests that buyers were trying to get back into the game.

As the pair grinds its way up, a close above 1.1850 may foreshadow a U-turn in the coming days, prompting sellers to cover.

1.1880 could be the last hurdle and its clearance may trigger a runaway rally. 1.1770 is a fresh support in case of a pullback.

CAD/JPY tests psychological level

The Canadian dollar inched higher after a better-than-expected CPI in June.

The bulls are looking to extend the rebound from 85.50, a major support on the daily chart, in order to resume the fifteen-month long uptrend.

The break above the support-turned-resistance of 87.60 has put the bears under pressure. The psychological level of 88.00 has so far capped the loonie’s advance.

However, an oversold RSI may help gather more buying interest. 86.60 is the immediate support if the consolidation drags on.

NAS 100 recoups losses

The Nasdaq 100 recovers from profit-takings as investors continue to digest Q2 earnings.

The technical pullback has found bids on the 20-day moving average (14800). Buyers were quick to see the oversold RSI as a bargain indicator.

The bullish mood remains intact as long as the price is above the previous demand zone near 14550 from the daily chart.

Consolidation may run its course for a few more hours as short-term bulls rebuild their stakes. Those armed with patience may wait for a clean break above the peak at 15140.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.