Intraday market analysis: Bullish extension

AUD/USD gains momentum as rally extends

Markets bid up the Australian dollar after the country’s unemployment rate dropped from 5.8% to 5.6% in March.

A brief pullback overnight near the 30-hour moving average (0.7700) was met with strong buying interest. The RSI’s easing from the overbought zone suggests that there could be more room on the upside.

The latest rally above 0.7750 may attract more momentum players into the bidding war. This might open the path to 0.7850, a key resistance on the daily chart.

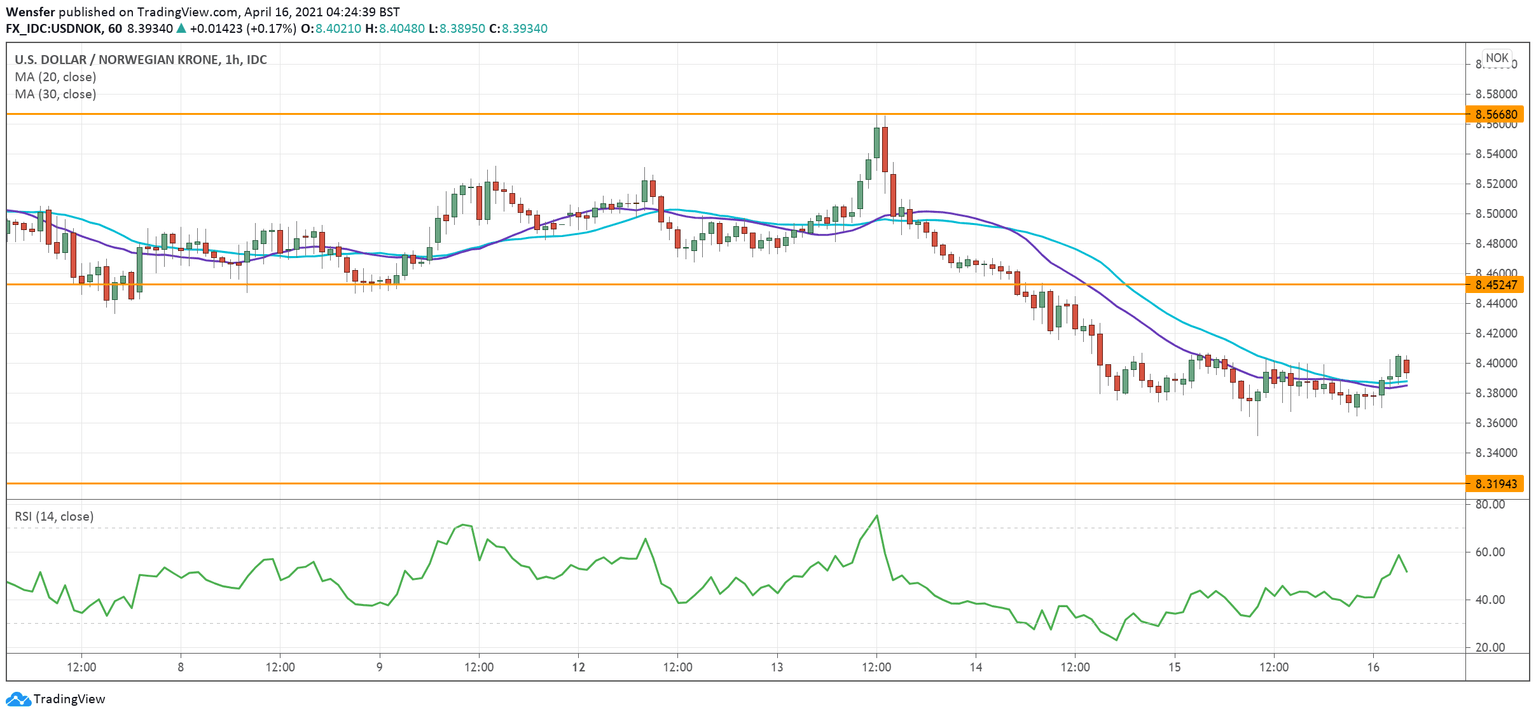

USD/NOK tests lower band of the consolidation range

Surging oil prices have put the commodity-sensitive Norwegian krone on the launchpad against a soft US dollar.

Successive breakouts below 0.8470 then 0.8390 were a strong sign that the bias remains bearish.

The US dollar may carry on its downtrend following a three-month-long consolidation between 8.3200 and 8.7200. There is a chance of a temporary rebound as the RSI rises back from the oversold area.

8.3200 would be the next target while 8.4500 is the immediate resistance in case of a retracement.

UK 100 lifts January’s resistance

The FTSE 100 climbs higher as value stocks gain momentum amid the UK’s reopening.

The bullish close above January’s high at 6963 indicates that the bulls are still in charge of the price action despite recent profit-takings.

The next round of rally could set the pre-pandemic level above 7400 as the target in the weeks to come.

In the short term, the index will need to lift the psychological level of 7000. An overbought RSI may cause a temporary pullback, and 6920 would be the closest support in that case.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.